- Wealth consultants Henley & Partners publish their first crypto-related report.

- Singapore scores highly on policy factors but low on infrastructure adoption.

- The report considers the USA more regulatory friendly than Hong Kong.

Cryptocurrency adoption continues to go from strength to strength. Amid this growing embrace, Henley & Partners’ inaugural Crypto Adoption Index (CAI) ranked countries by crypto adoption, revealing an unexpected country as the overall global leader.

Crypto Adoption Ranked Best in Singapore

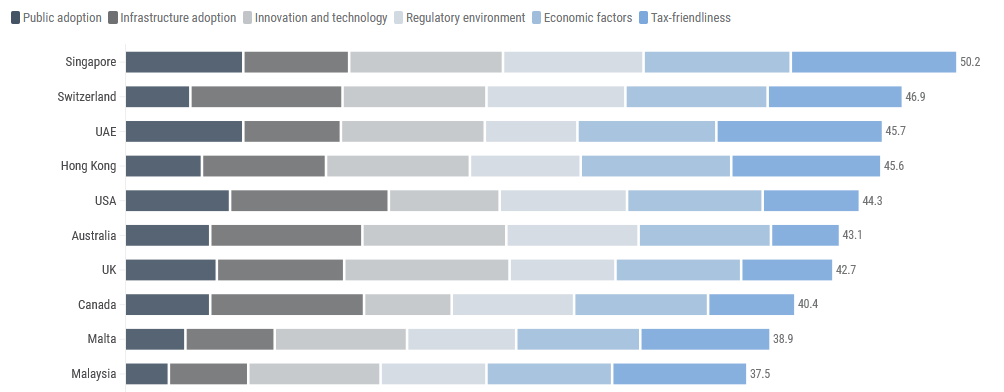

The CAI ranked Singapore first out of twenty-six countries with a score of 50.2, beating out expected top dogs Switzerland and the UAE, which rang in at 46.9 and 45.7, respectively. Straggling at the bottom were Turkey, Montenegro, and Namibia, who scored 27.5, 25.6, and 24.8, respectively.

This should be no surprise considering the stance adopted by the financial regulator, summarized by a recent comment from the Monetary Authority of Singapore’s Deputy Managing Director, Ho Hern Shin, expressing openness toward industry cooperation to balance innovation with responsible oversight.

Sponsored

Regarding other contenders, it was noted that Hong Kong placed above the USA overall, thanks to higher innovation and technology and tax friendliness category scores. Nonetheless, the USA scored higher than Hong Kong in the regulatory environment category, at 7.7 versus 6.7.

The environment score ruffled some feathers, as the USA has fostered a reputation for regulatory hostility in recent years. This is partly attributed to the Securities Exchange Commission’s (SEC) crackdown on crypto firms, including enforcement actions against Binance and Coinbase. By contrast, Hong Kong authorities have enacted friendly legal frameworks aimed at incubating the industry and becoming a hub for the nascent technology.

Considering this, it would appear that the systems for evaluation still require some fine-tuning.

Crypto Adoption Index Methodology

According to Henley & Partners, the CAI was compiled using 750 data points within the above six parameters. The parameters, in turn, comprised 19 sub-parameters and 29 indicators.

Sponsored

The wealth consultancy firm normalized raw statistical data on a 0-1 scale to create analytically useful metrics. The metrics, collected from August-September 2023 from public databases were grouped into equally weighted sub-parameters by theme.

In the case of the regulatory environment parameter, the sub-parameters consisted of data related to:

- The adoption of Initial Coin Offerings (ICOs) and the number of ICOs operated.

- Anti-money laundering/combating the financing of terrorism (AML/CFT) regulations.

- The legal status of cryptocurrency.

- Clarity of regulations.

- The development status of central-bank-backed digital currencies.

- Licensing requirements for crypto businesses.

Therefore, considering the depth of sub-parameters that determine the regulatory environment score, it is somewhat one-dimensional to assess the USA as regulatory-hostile based on SEC enforcement actions alone.

On the Flipside

- The methodology used gives priority to policy rather than actual grassroots adoption.

- A study by Hedgewithcrypto named Australia, the USA, and Brazil the top three “most crypto-ready” countries.

- Data from Statista highlights a general uptrend in crypto ownership or usage between 2019 and 2023.

Why This Matters

The CAI has cemented Singapore’s reputation as a crypto-friendly jurisdiction, vindicating pro-crypto efforts in the region and motivating rival nations worldwide to intensify their efforts.

Discover how Circle is working to remove barriers to mass adoption here:

How Circle’s Wallet Service Plans to Bolster Blockchain Adoption

Read more about Lory Kehoe’s take on spot Bitcoin ETF approval here:

Former Coinbase Director Dampens Hopes for BTC ETF Approval