When entering the crypto ecosystem, investors have a few available methods of buying crypto. Bitcoin ATMs have established themselves as a convenient and swift system for entering the crypto market, and their popularity ensures that their functionalities will not be easily replaced.

However, as the Bitcoin ATM operators are looking for ways to expand operations, operating and upgrading the infrastructure remains a long-term objective to engage customers and offer benefits that other methods fall short of. Supporting the less tech-savvy newcomers provides a gateway to wider crypto adoption and shapes the future Bitcoin landscape.

Can they be enhanced, resist the challenges, and keep up with the competition?

Table of Contents

- What Are Bitcoin ATMs and How Do They Work?

- The Rise Of Bitcoin ATMs: Market Trends and Statistics

- Benefits Of Using Bitcoin ATMs: A Comparison with Traditional Crypto Exchanges

- A Few Important Points to Remember When Using a Bitcoin ATM

- The Future of Bitcoin ATMs: Trends and Innovations to Watch

- Conclusion

What Are Bitcoin ATMs and How Do They Work?

Bitcoin ATMs have been instrumental in making smaller transactions more accessible and feasible. These devices provide a beginner-friendly and easy access point to digital assets, much like traditional cash ATMs. They allow users to buy or sell cryptocurrencies with cash or credit cards, and their interface is similar to conventional ATMs, providing clear and concise navigation instructions, often in more than one language.

Sponsored

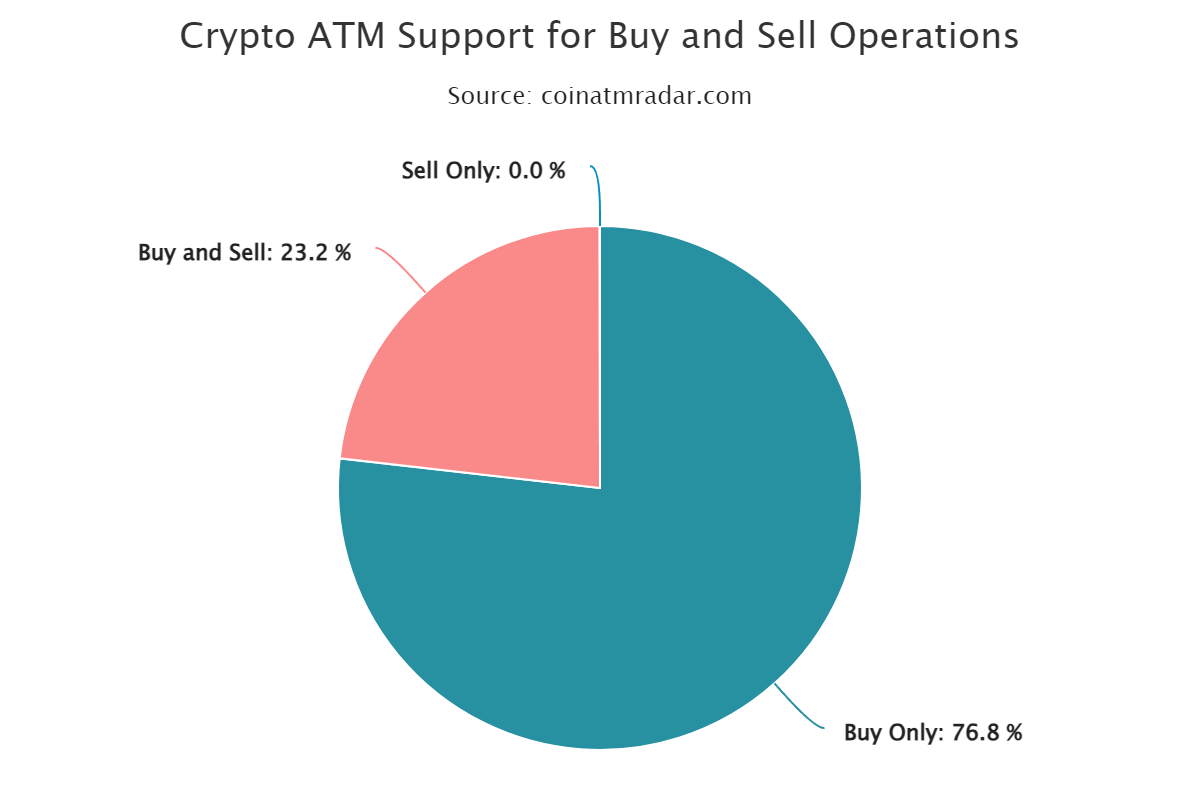

Currently, there are two types of Bitcoin ATMs: unidirectional, which supports either buying or selling the cryptocurrency, and bidirectional, which supports both options. Users can easily buy their cryptocurrency or sell it for cash within seconds, making them a convenient method for getting instant cash.

The Rise Of Bitcoin ATMs: Market Trends and Statistics

The trend of Bitcoin ATMs started in 2013 when the first ever bidirectional crypto kiosk was manufactured by Robocoin and installed in Vancouver, Canada. After a quick palm security scan test, it allowed its customers to exchange Canadian dollars for digital currency and vice versa.

Sponsored

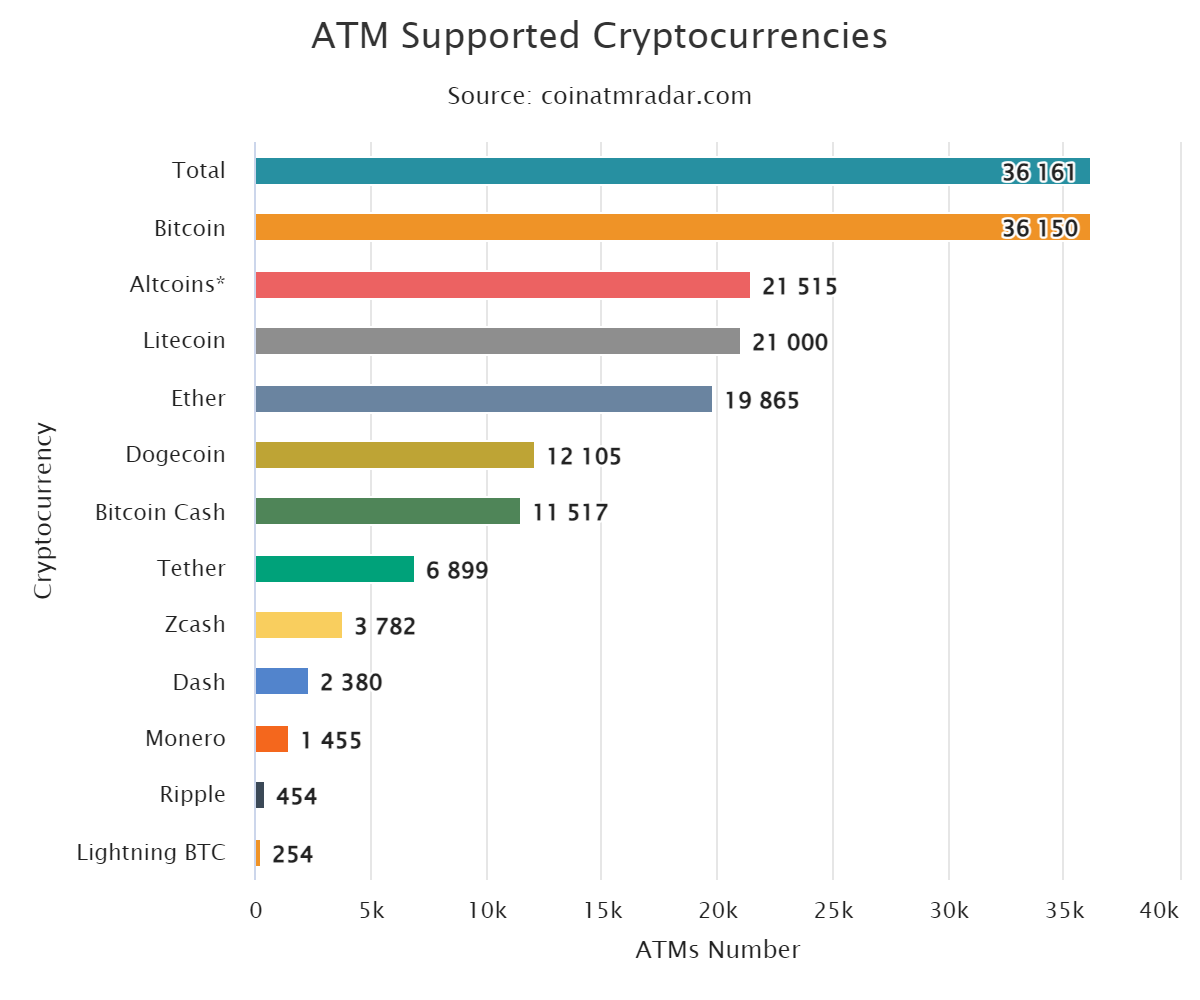

This event marked a milestone in Bitcoin adoption, and since then, the number of these machines has grown rapidly. According to coinatmradar.com data, there are currently 36.156 Bitcoin ATMs worldwide.

The United States ranks top globally with 30.621 Bitcoin ATMs, accounting for 84.7% of the global market.

Canada, the home of the first ever Bitcoin ATM, now only accounts for 7.5% of the total ATMs globally.

However, the Bitcoin ATM market has been affected by the crypto winter of 2022/23, with over 3,000 machines going offline in March 2023, representing a negative change of – 6.6%. During the crypto winter, the market experiences chaos and unexpected fluctuations that can wipe out billions of dollars in investor value. To survive, most crypto companies aggressively cut costs and jobs. Although the number of Bitcoin ATMs globally has decreased, the net change has always remained positive, showing continuous growth. However, since February 2023, the number of closed ATMs exceeded new installations, resulting in a negative net growth of -2.6%, which continued throughout March. April, May, and June witnessed a revival as the ATM industry experienced a return to positive growth, ranging from 1% to 2%.

The decline in the number of open Bitcoin ATMs in spring was mainly attributed to the arrest of the management of Bitcoin of America, which operated roughly 2,500 locations across the US. Bitcoin of America’s CEO now faces multiple charges for money laundering, conspiracy, and receiving stolen property. Although the charges against the company were only in Ohio for operating without proper licenses, reports from users suggest that locations across the country were also affected and closed, as reflected in the current statistics.

Despite the global short-term decline in installations, there was some positive news from Australia on the Bitcoin ATM front. Roy Morgan’s Research Institute reports that over 1 million Australians own cryptocurrency. In contrast to other regions, such as Europe and the United States, Australia has been steadily increasing the number of Bitcoin ATMs, surpassing Asia with 549 machines in July 2023.

Though there are challenges, the rise of Bitcoin ATMs globally shows a continued growth in adoption and a growing interest in cryptocurrency.

Benefits Of Using Bitcoin ATMs: A Comparison with Traditional Crypto Exchanges

According to a recent study by TripleA, a company acting as a crypto payment gateway, 82% of U.S. cryptocurrency owners are aged between 18-44, with only 7% being 55 or older. This indicates that younger Americans largely own cryptocurrencies. The cryptocurrency demographics also appear to be very similar for other continents and countries.

This is likely due to younger people being more tech-savvy and more comfortable with the early adoption of new technologies, such as cryptocurrencies. Older generations may be more comfortable investing in traditional asset classes like stocks, bonds, and real estate, which have been around for much longer and are more established.

Bitcoin ATMs can provide an easy on-ramp for less tech-savvy and more mature customers by simplifying the buying process and increasing accessibility. Some of the benefits are:

Firstly, they represent the only physical access point for digital assets. Older and more traditional generations may be uncomfortable using complex technology like cryptocurrency exchanges. Bitcoin ATMs provide a familiar and accessible interface similar to traditional ATMs, acting as a bridge between physical FIAT money and Bitcoin. Often installed and located in public places, these machines are more accessible to older customers who might not be familiar with centralized exchanges. The Coin ATM Radar website provides a convenient way to find Bitcoin ATMs located nearby through geolocation detection.

These generations are also more likely to prefer cash payments in their everyday transactions; providing them with an option of directly exchanging cash for cryptocurrency could simplify the process of accessing the cryptocurrency market.

New users, beginners, and the less tech-savvy will presumably start with smaller transactions as they enter the new and unknown industry with caution. Bitcoin ATMs provide a convenient method for making smaller transactions, offering valuable insights and experience needed to gain more confidence in the cryptocurrency in the future. These smaller transactions are often processed instantly with little to no registration requirements or limitations. Many of these machines also offer the option to scan a customer’s wallet for instant transfers or will generate a new wallet for a customer if they do not currently own one. This facilitates the transaction process and ensures a smooth experience. As users gain more experience and confidence in the cryptocurrency market, they can gradually start making larger investments to diversify their portfolios. Unlike traditional crypto exchanges, Bitcoin ATMs offer a simple and accessible way to enter the market and make smaller transactions, including buying Bitcoin.

Aside from being secure and regulated, these services offer beginner-friendly support through 24/7 customer service and step-by-step instructions and guidance on setting up a Bitcoin wallet, scanning the QR code, or answering any questions or concerns that might arise from the process of obtaining the cryptocurrency.

Banking the unbanked is often hailed as one of many benefits of Bitcoin. Bitcoin ATMs contribute to this principle by allowing users without a bank account to access cryptocurrency. It certainly provides financial freedom for many individuals who live in areas without proper bank access or who do not have the requirements to open and possess a bank account. It benefits those who, for various reasons, avoid banks and prefer staying off the grid.

Many users avoid centralized exchanges due to their reputation for being custodial and their complex account setup process. To comply with regulatory requirements, the majority of these exchanges require KYC documentation – Know Your Customer policy, where users are asked to scan and provide their personal documents as a way of identity verification. Unfortunately, these institutions are a single point of failure and have been frequent targets for hackers and theft. Many privacy-concerned experts warn of the risks of providing sensitive personal documentation to third parties. Mt. Gox, Equifax data breach, and KuCoin are just a few of the hacks that happened, resulting in thousands of bitcoins stolen and the personal data of millions exposed. A great deal of Bitcoin ATMs will not require registration up to a certain amount, and no account is necessary.

Finally, smaller transactions done via Bitcoin ATMs carry a smaller risk for investors than larger transactions. During volatile and unfavorable market conditions, investors may be hesitant to invest large sums of money into Bitcoin but are also more willing to invest small amounts. Market analysis data shows that smaller bitcoin wallets, so-called shrimps, continued trading and remained very active during the worst days of crypto winter in December 2022.

A Few Important Points to Remember When Using a Bitcoin ATM

Bitcoin ATMs are generally secure, using encrypted protocols to protect users’ transactions and personal information. Most Bitcoin ATM operators comply with strict regulations and security measures.

- However, much like handling cash and using traditional ATMs, users should take precautionary measures to ensure their safety. Avoid using them in poorly lit or isolated areas and using ATMs by unfamiliar operators. Also, always be aware of your surroundings.

- If a Bitcoin ATM is used to create a paper wallet, it will provide a customer with a private key needed to access the Bitcoin on the blockchain. Private keys must be stored in a safe and secure place, as anyone with access to a private key can access the Bitcoin in a wallet. Maintaining the same level of caution as with a debit card PIN when handling crypto wallet private keys is crucial. Leaving the Bitcoin in the paper wallet provided by the Bitcoin ATM is not recommended. Using a secure wallet and transferring the funds to that wallet is a much safer and recommended practice.

- When choosing a wallet, make sure it is a noncustodial open-source wallet that supports Bitcoin.

- Bitcoin is a blockchain, and transactions on a blockchain are immutable. Unlike wire transfers, where erroneous and mistaken payments can be canceled, BTC transactions cannot be canceled or reversed. Therefore, checking the transaction details is vital. If the incorrect BTC address is entered, there will be no option to reverse the transaction.

- Transaction fees on Bitcoin ATMs can vary from country to country, with the most frequent being between 10% and 15%. Additionally, there are different fees for buying and selling crypto on Bitcoin ATMs, so check the commission rates before trading. You can find a comprehensive list of all Bitcoin ATM locations with fees included for most of them at the Coin ATM radar website.

- Some Bitcoin machine operators also charge a fixed fee on top of their commission fee. All notifications should be displayed on the Bitcoin ATM before making a transaction. Remember that transaction fees are often higher than those charged by central exchanges, as users also pay for convenience and additional costs related to operating a Bitcoin ATM.

- Do not panic if the Bitcoin you bought does not show in your wallet hours after you complete a purchase at the Bitcoin ATM. The transaction will appear for some wallets the moment a purchase is made or within a minute a transaction is broadcast, but it will be marked as “pending” until there has been at least one network confirmation. This is how the blockchain works; each new block will also confirm a previous one. When a transaction is confirmed, it is included in a block by a miner. The time it takes a transaction to be confirmed depends on the fee used by the sender and the overall network traffic. Sometimes this can take up to two or three hours, but there is no reason for panic. Most wallets are integrated with blockchain explorer, so pending transactions can be tracked in real-time.

- Additionally, each Bitcoin ATM will issue a ticket containing transaction details, including a transaction ID (TX ID), which you can use to contact a customer service center.

Overall, using a Bitcoin ATM can be a convenient way to buy or sell Bitcoin, but it is important to be aware of the potential risks and take appropriate precautions.

The Future of Bitcoin ATMs: Trends and Innovations to Watch

The cryptocurrency industry is constantly evolving, and the Bitcoin ATM industry is no exception. Flexibility and adaptability are essential to keep up with the rapid pace of change. Taking into account the latest turn of events, especially the last two months, it is clear that several trends and innovations should be on the horizon:

Regulatory certainty is crucial to increasing customer trust in the crypto industry as a whole, as well as the Bitcoin ATM industry in particular. Recent charges against the company, Bitcoin of America, have negatively affected Bitcoin ATM industry statistics. Clear regulations would increase customer security and enhance the overall safety of Bitcoin users.

There is a need for improvements in Bitcoin ATM operations. Currently, only 23.2% of all worldwide Bitcoin ATMs are bidirectional, allowing both buying and selling crypto. A staggering 27.768 machines are still buy-only, making up 76.8% of the overall Bitcoin ATMs available. As the crypto market is becoming more dynamic and one of its main advantages is its transaction speed, unidirectional ATMs decrease cryptocurrency utility, speed, convenience, and profitability. Subsequently, they result in more time-consuming processes, cause financial losses, and fail to attract more customers to the crypto ecosystem.

Integration of new cryptocurrencies is also an important trend to watch. Many Bitcoin ATMs now support other cryptocurrencies, such as Ethereum and Litecoin, and this trend should continue.

Another key trend to keep in mind is support for the Bitcoin Lightning Network. Currently, only 254 Bitcoin ATMs support transactions on the Lightning Network, which is around 0.7% of all available Bitcoin ATMs at the moment. Given the fact that the Lightning Network is designed specifically for smaller transactions, reducing the cost and increasing the transaction speed, there is a lot of room for improvement here. Bitcoin adoption could benefit greatly from the Bitcoin Lightning Network, yet many newcomers are confused about how to transfer BTC to Bitcoin Lightning Network wallets. Incorporating the option to change cash to the Lightning Bitcoin immediately on a Bitcoin ATM would facilitate the process of getting familiar with both layer networks. This improvement would benefit the senior generation and younger crypto enthusiasts who are still apprehensive about using the Lightning Network.

Conclusion

Bitcoin ATMs have revolutionized the way people invest in cryptocurrencies. They offer a convenient and accessible way for users to buy and sell Bitcoin and other cryptocurrencies, providing greater privacy and security than traditional exchanges. They also promote inclusion and reduce the age gap, making new and revolutionary technology such as Bitcoin available to the traditional retail customer.

Bitcoin ATMs can contribute to and promote the widespread adoption of Bitcoin and provide and facilitate on-ramp access. Aside from that, they provide a great place for investors looking to get involved in cryptocurrencies as they familiarize themselves and gradually start making bolder decisions.

It’s worth noting, however, that there is a growing trend toward mobile apps and online platforms that allow users to buy and sell cryptocurrencies directly from their smartphones. While this is convenient, it still poses risks and obstacles for cash users and older generations who may lack information on debit cards and in-app purchases.

Europe is lagging behind America in the number of installed Bitcoin machines (with only 1,465 machines), and no European operators are in the top 10 list of Bitcoin ATM operators. However, with the adoption of the MICAR regulation and more regulatory clarity, Europe is expected to become a more competitive player in the Bitcoin ATM market.

Certain modifications and adjustments will be necessary. Rapid growth and development of the crypto industry will bring challenges and obstacles, which, to thrive further, must be overcome with innovations and valid responses. The Lightning Network adoption and a wider choice of assets are a good starting point for unlocking the full potential of Bitcoin ATMs.