- Friend.tech’s on-chain metrics sink to new lows.

- The peak-to-trough fall in daily transactions is down significantly.

- Web2 social platforms continue to boom.

As the digital landscape evolves from Web2 to Web3, a groundbreaking model known as Social Finance (SoFi) is gaining prominence. Touted as a potential successor to today’s ad-driven social platforms, SoFi introduces a fresh paradigm for online community building.

Leading the SoFi charge is friend.tech, which enables influencers to monetize their followers. However, recent on-chain metrics, specifically the daily transaction count, reveal that friend.tech’s initial surge of excitement and activity has now dwindled to a crawl

Friend.tech Metrics Falter

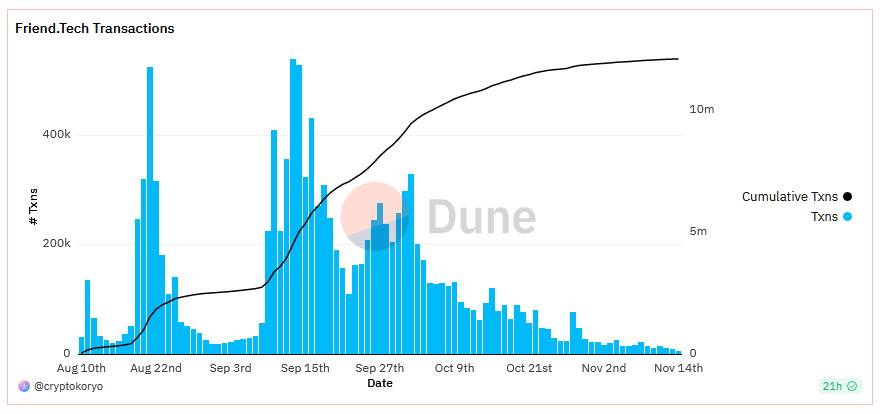

According to data tracked by Dune Analytics, friend.tech’s daily transactions have plunged to just 5,160 as of November 14th, representing a new low for the platform. This is in stark contrast to friend.tech’s peak on September 13, when the daily transaction count posted an all-time high of 539,810, equating to a peak-to-trough drawdown of 99%.

Sponsored

After its launch in early August, friend.tech experienced exponential growth in daily transactions, prompting many to dub it the next big thing. However, the initial hype waned by August 21. Yet, a resurgence of interest ensued, reaching its peak around September 13. Since that peak, the daily transaction count has failed to recapture the initial frenzy, showing a steeper decline moving into November.

Other key metrics also show waning activity in line with expectations around dwindling daily transaction count. Daily protocol fees have sunk to 17.7 ETH, representing a 97% decrease from the September 13 top of 578.8 ETH.

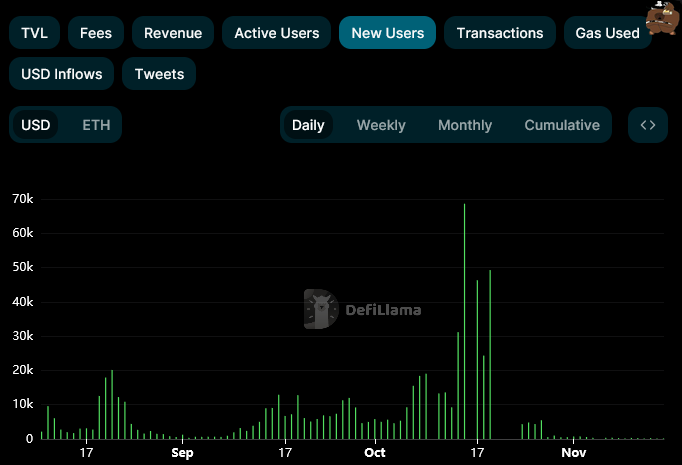

Similarly, the daily count of new users has dwindled to a mere 170 as of November 14, according to DeFiLlama. In contrast, during the peak of new user sign-ups on October 15, the SoFi platform attracted an impressive 68,640 new users.

Protocol Improvements

While the initial hype and on-chain activity may have subsided, friend.tech has been diligently working on several enhancements to fortify the protocol and enhance the user experience. Just last month, the team introduced two-factor authentication to combat the rising incidence of SIM-swap attacks targeting users. Additionally, they rolled out customizable bios to infuse user profiles with more personality and depth.

Sponsored

On the technical front, friend.tech recently initiated a bug bounty program, encouraging the disclosure of vulnerabilities to bolster community safety. Furthermore, the team has also fine-tuned data loading speeds for a smoother user experience.

On the Flipside

- friend.tech is still in the early stages of development and current on-chain metrics may not reflect longer-term outcomes.

- The wider crypto market uptick over the past month did not trickle down to boosting friend.tech activity.

- Stats for Web2 social media platforms, such as 𝕏, continue to boom, suggesting the Web3 revolution is premature.

Why This Matters

The decline in on-chain metrics on friend.tech underscores the sustainability challenges encountered by many “next big things” in the web3 space. While novel concepts can indeed ignite early excitement, enduring platforms demand more than mere hype-driven speculation.

Learn more friend.tech’s bid to beef up security following a spate of exploits here:

Friend.tech Bolsters Security Against SIM Swap Exploits

Find out about the fraudulent BlackRock XRP ETF filing incident here:

BlackRock Denies XRP ETF Filing, But Community Holds Hope