Around this time last year, the DailyCoin team put their heads together and crafted a list of ten things to be excited about in 2023. With 2024 just around the corner, there’s no better time to reflect on our previous predictions.

Did our expectations for 2023 match reality?

Table of Contents

10 Things We Were Excited About For 2023

1. A Fast and Mild Recession

January 2023 heralded woe and misery in financial markets across the planet. Analysts were forecasting a recession on the horizon, and the recent collapse of Sam Bankman-Fried’s FTX crypto exchange had left the crypto market in a fragile state.

Sponsored

Despite this, our reporter shared a view held by JP Morgan and anticipated a fast and mild recession that would encourage investors and traders to take risks on positions. He theorized that we might even see a new bull run forming in the year’s second half.

Reality?

Now that the dust has settled and we can look at the facts, most analysts believe 2023’s doom and gloom was exaggerated. Top financial analysts from Bloomberg claim we avoided a recession in 2023, although others might call it a soft landing.

In any case, the second half of 2023 was certainly a euphoric time in the crypto space. A meteoric Q4 put cryptocurrency firmly back in the minds of the general public, with BTC surging to over $40,000 USD and altcoins like Solana (SOL) posting 1,000% YTD gains.

2. Interest Rate Cuts

In a bid to stave off inflation, our reporter expected that the U.S. Federal Reserve would continue to cut interest rates. Cutting interest rates would theoretically help curb inflation in the United States.

Sponsored

Ultimately, a lower-rate environment would be bullish for the crypto market, providing greater liquidity and funding opportunities for crypto startups.

Reality?

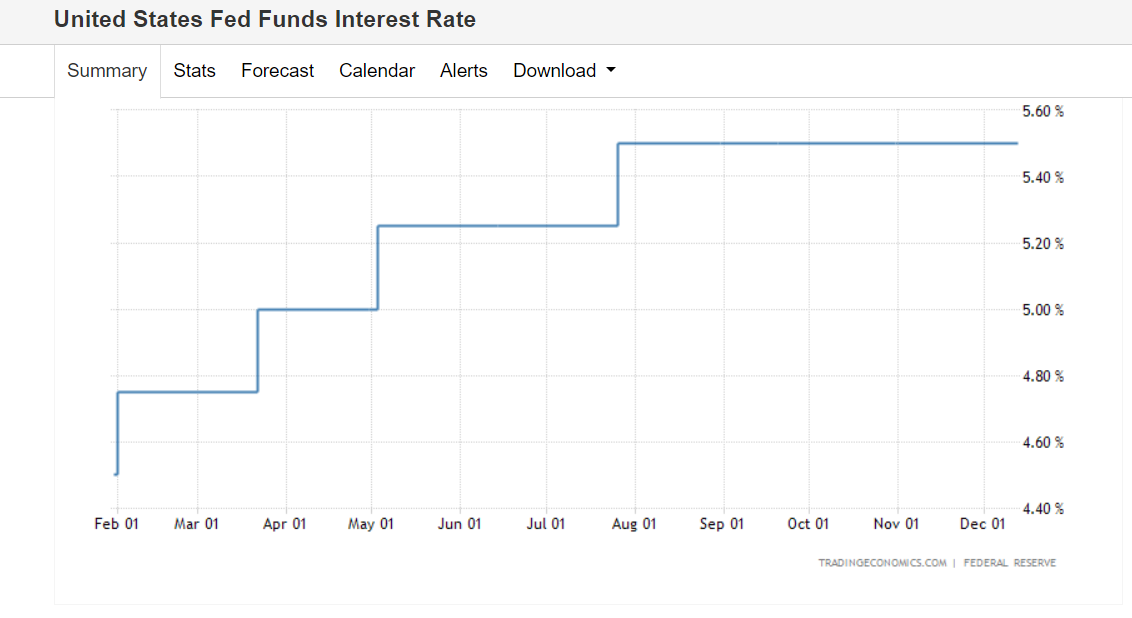

Admittedly, our reporter was a bit wide of the mark there. In fact, not only did the economy improve, but funding rates consistently rose throughout 2023, stabilizing at 5.5% in August and staying there until the end of the year.

However, this didn’t discourage crypto investors from piling into the market. The second half of 2023 witnessed dramatic capital inflows into the space, no doubt spurred by anticipation of a Spot Bitcoin ETF.

3. Regulations

2023 was a huge year for crypto regulations, although many would argue that that wasn’t always good. While some would say that regulations bring greater clarity and safety to the crypto market, others argue they stifle innovation.

Our reporter highlighted the European MiCA regulations as one of the largest regulatory events in 2023’s crypto calendar. What else has passed in crypto courtrooms across the world?

Reality?

Indeed, crypto regulations were at the front and center of the blockchain industry throughout 2023. While the European MiCA rulings were undoubtedly a significant milestone, most of the drama unfolded in the United States.

In a landmark moment, Ripple Labs and XRP gained a serious advantage over the Securities and Exchanges Commission. Striking a blow against Gary Gensler and the SEC, Judge Analisa Torres declared that XRP was not security, undermining one of the key foundations of the lawsuit.

But that wasn’t the end of the drama. Towards the end of the year, the U.S. Department of Justice fined Binance, the world’s largest crypto exchange, over $4B USD on anti-money laundering and sanctions charges.

4. Decentralized Social Media

Elon Musk’s Twitter takeover and ‘𝕏’ rebranding dominated headlines in 2023, but it was otherwise a relatively quiet year for social media.

Our reporter predicted decentralized social media platforms would see an influx of users, led by networks like Lens.

Reality?

As a whole, decentralized social media didn’t attract droves of new users. However, 2023 still provided us with a new DeSo protocol that turned many heads and made its mark in the crypto market.

Built on Coinbase’s Base Chain, friend.tech became an overnight sensation by allowing users to trade 𝕏 accounts like shares. These ‘Keys’ gave users direct access to private chat rooms hosted by some of the largest crypto 𝕏 accounts in the space.

friend.tech proved exceptionally popular at launch but has since struggled to retain users.

5. Ethereum Sharding

It seems Ethereum always has a crucial event coming up in its calendar. After successfully transitioning to becoming a Proof-of-Stake network, our reporter speculated that the Shanghai Hard Fork and Proto-Danksharding would catapult Ethereum scalability into the future and help prepare the network for mass adoption.

Reality?

Fortunately, the Shanghai Hard Fork went off without a hitch and became a boon for the liquid stakes derivative markets. LSD tokens responded well to the network upgrade, although decentralization proponents argued that LSD providers like Lido now have excessive control and influence over the network.

Proto-Danksharding (EIP-4844), on the other hand, is still a work in progress. The Ethereum community is working on the proposal, but no timeline has been given for its implementation.

6. Zero-Knowledge Ethereum Virtual Machine

In late 2022, our DailyCoin reporter suggested that zero-knowledge technology would play a big role in the crypto market in 2023.

Essentially used as an Ethereum scaling solution, zk-tech allows separate parties to confirm whether or not something is true without revealing the data itself.

Reality?

Zero-knowledge technology was all the rage in 2023, with a handful of zkEVMs and zk-rollups launching over the year.

Considered one of the most secure Ethereum scaling solutions, the zk-tech niche is fiercely competitive. At the head of the race, zkSync, Starknet, and the Polygon zkEVM have attracted the highest number of users and TVL (Total Value Locked).

7. Web3 Gaming

Web3 gaming has long been touted as the Trojan Horse of blockchain technology. As a result, crypto enthusiasts have been eagerly awaiting the day a blockchain-based game goes mainstream and brings thousands of new players into the crypto world.

Last year, our reporter speculated that blockchain gaming would be a force to be reckoned with in 2023. With AAA games like Illuvium leading the charge, blockchain gaming would finally begin its golden era.

Reality

Despite the palpable hype and excitement in the crypto gaming niche, we’re yet to see a new game reach Axie Infinity-level adoption. Illuvium continues its march to the top as one of the leading blockchain games but hasn’t been fully released to the public.

Crypto gaming infrastructure coins like Immutable X (IMX) and Render (RNDR) enjoyed significant growth in 2023. Still, the blockchain gaming niche has yet to deliver the widespread adoption it has been promising for so long.

8. Final Washout

When the FTX exchange collapsed in November 2022, many analysts saw this as the beginning of the next big contagion event. It was widely believed that several other companies would be badly affected by the FTX disaster, causing cascading liquidations across the board.

Was FTX the first shoe to drop, or was the bottom already in?

Reality?

The FTX collapse had devastating consequences for several real-world financial institutions. Crypto-friendly companies and investment firms like Silvergate and Silicon Valley Bank suffered from over-exposure, eventually collapsing in early 2023.

However, crypto prices remained relatively unaffected after the first round of FTX damage was done. FTX’s bankruptcy marks the lowest BTC price since around November 2020. Ultimately, no final washout took the crypto market to new lows.

9. Account Abstraction

Heading into Ethereum’s deeper and darker realms, our reporter suggested that account abstraction could be one of crypto’s big stories in 2023.

Account abstraction deals with the architecture of Ethereum accounts and changes how certain contracts and tokens interact. For example, one of the key benefits of account abstraction is that users can pay their gas fees using any cryptocurrency they hold instead of spending ETH.

Reality?

Alas, account abstraction remains a particularly challenging aspect of Ethereum development that still eludes Buterin and other Ethereum developers. At the annual EthCC event in July, Buterin admitted that significant challenges still needed to be overcome before account abstraction became a reality.

10. The Flippening

The Ethereum maxi’s pipedream, The Flippening, refers to when ETH finally surpasses BTC’s market capitalization and becomes the largest cryptocurrency in the industry.

In a flash of tongue and cheek, our reporter playfully speculated on the possibility of Ethereum leapfrogging Bitcoin in 2023.

Reality?

Sure enough, Ethereum didn’t even come close to reaching Bitcoin’s titanic market position in 2023. Regarding market capitalization, BTC still hovers around 4 times the size of Ethereum, making the Flippening a distant goal.

How’d We Do?

If anything, looking back over these theories and speculations shows us just how diverse and nuanced the crypto space truly is. So many different narratives are at play, and the puzzle pieces are constantly in motion, meaning that some beliefs are proven to be both true and false simultaneously.

Take decentralized social media as an example. DeSo didn’t have a particularly large year, but friend.tech still came out of nowhere and has become the hottest topic in crypto for a short period.

The crypto market always provides exciting new narratives and protocols to learn about and explore. While most of our reporters’ theories did come true, the crypto space always seems to find new ways to surprise us.

We wouldn’t have it any other way.

On the Flipside

- The blockchain industry is unpredictable. As we’ve seen repeatedly, even the experts and analysts can be wrong. It’s important to always think critically about what’s going on in the market and make informed, independent decisions.

Why This Matters

The start of a new year always provides a good opportunity to reflect on the year that was. Take this time to reflect on your predictions for 2023 and see where you might have gone wrong.

Who knows, it might help you make more accurate predictions for 2024.

FAQs

The best way to find an answer to this question is to do your own research. Search for cryptocurrencies with upcoming catalysts that positively contribute to the Web 3 world.

Historically, the Bitcoin halving indicates a surge in BTC price as miner selling pressure is reduced. However, it’s worth noting that there are no guarantees in the crypto space.