- Ethereum is the leading smart contract network for developing and deploying decentralized projects.

- The network is going to switch from Proof of Work (PoW) to Proof of Stake (PoS) protocol this year.

- Fundamental factors and technical analysis predict ETH price growth in the long-term.

- The ETH price predictions for 2020 are bullish and vary from around $300 to $1.400.

- The Ethereum price forecast for 2025 varies from $1.000 to $1.500.

The first part of 2020 was not easy neither for the cryptocurrency market nor for any other market. However, the upcoming half-year is expected to be more optimistic for the world’s second-biggest digital asset Ethereum.

Despite the fact of the hard fork and the growing competition, Ethereum is still the second biggest network by market capitalization. Furthermore, it is the leading smart contract network, used to build and run the other decentralized programs and applications (dApps). In the time when the whole sector of dApps is growing, the solid part of decentralized finance (DeFi) sector transactions are made on the Ethereum network. With this and with the upcoming network’s transition to Proof-of-Stake (PoS) in mind, this Ethereum price prediction article will review the historical price movements, the current situation, and the future prognosis for ETH.

What is Ethereum?

Ethereum is the second-largest cryptocurrency platform by market capitalization after Bitcoin. Although it is built on blockchain technology like the world-leading crypto, Ethereum has much wider capabilities and works more as a whole network that supports its own programming language (Solidity) and payment system.

This means that Ethereum is a programmable blockchain. A decentralized open-source blockchain protocol offers the functionality of smart contracts and enables users to build and run decentralized applications (dApps) on its network.

Sponsored

Back in 2014 Ethereum was created by Russian programmer Vitaly “Vitalik” Buterin, who first had an idea to improve the network of Bitcoin and expand it beyond the concept of payment method. However, after his attempts to change Bitcoin failed, Buterin created a new platform – Ethereum – with a more general programming language for application development. The project got crowdfunded by 72 million pre-minted coins.

However, a few years later the network split into two separate blockchains. The hard fork remained the current Ethereum network with a native Ether (ETH) cryptocurrency. Meanwhile, the original version of the pre-forked blockchain changed the name to Ethereum Classic and currently supports its native ETC currency. The Ethereum Classic remains operating on the Proof of Work (PoW) concept.

What is Ether?

In the meantime, Ether (ETH) is the native cryptocurrency of the Ethereum network, which is the second-largest cryptocurrency after Bitcoin. Decentralized digital currency is generated by Ethereum miners and can be used to make payments or stored as an investment.

Although ETH has many of the same features with Bitcoin, the primary purpose of it is to monetize the operations on the Ethereum network, which allows users to create and run decentralized applications.

The second-biggest cryptocurrency at the time of writing has the market capitalization of $27.2 billion. Meanwhile, the circulating supply of Ether is limitless, there currently are more than 111 million Ether in circulation.

What is Ethereum used for?

Since ETH cryptocurrency might be used for trading or investing, the ultimate goal of Ethereum is to allow building and running decentralized applications (dApps) on its network. The market of dApps is booming currently, generating nearly $8 billion in transactions within the past year.

Moreover, Ethereum blockchain can be used to create Decentralized Autonomous Organizations (DAO), that are designed to exclude the centralized or personalized governance and control of the organization. The DAOs thus run on the blockchain as the computer programs and provide total transparency and independence of any intervention.

Besides that, Ethereum is the biggest and most accessible blockchain network on which the majority of stablecoins are built. And while the emerging DeFi market has a strong need for pegged coins that are operating on the same chain, the role of the Ethereum network is growing as well. With all these factors in mind, it would be right to say that Ethereum price prediction is largely based on the fundamentals.

Historic moves of the ETH price

Before investing in Ethereum it is always helpful to have a broader view of its previous price movements as well.

Since the Ethereum network was launched in 2015, the value of its native coin Ether was floating at around $1 for some time. The price spurt started at the end of January 2016 until it reached its peak of over $20 six months later. The following downtrend then continued until March 2017, when the whole crypto industry started the historical route to the impressive heights.

Since March 2017, when ETH price sat at a level of $10, the currency has run a long uptrend, that continued until January 2018. Within the period of 10 months, ETH has increased over 1000% and reached an all-time high of $1.396.

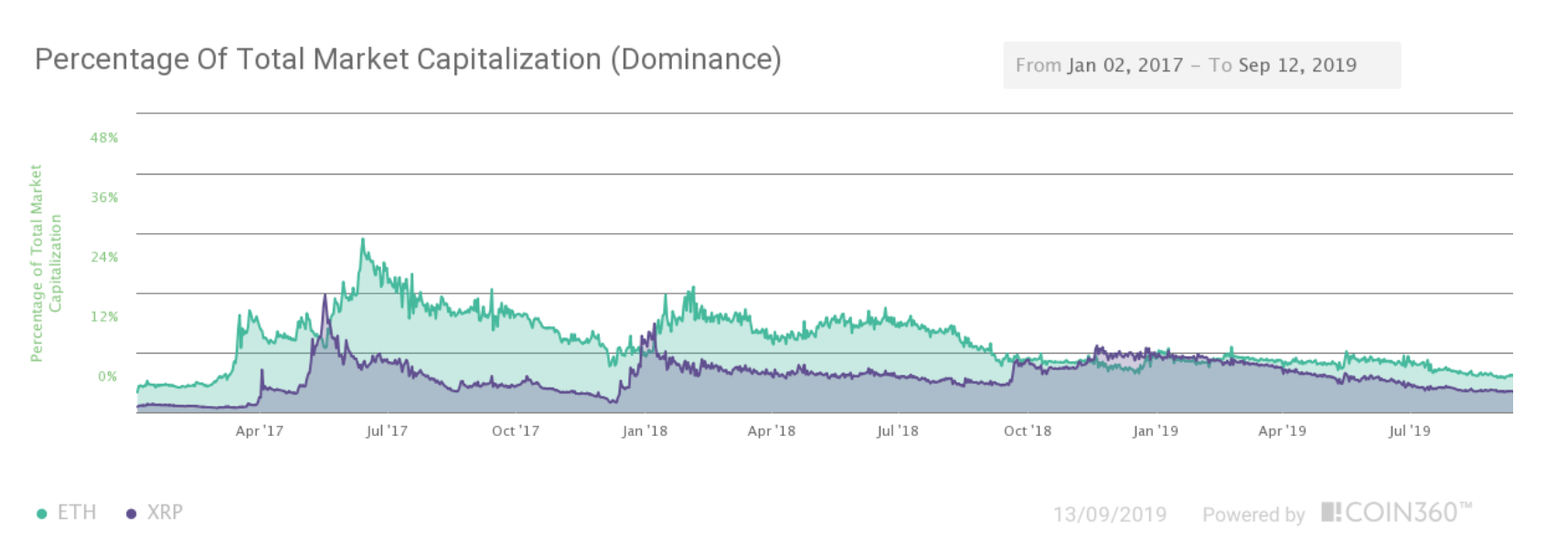

However, since January 2018, the cryptocurrency asset fell into a long-term downtrend. As the crypto winter came for a lot of coins that were incredibly booming before, the upcoming months were difficult for Ethereum. The ETH has even lost the title of second-biggest cryptocurrency by market capitalization and was overtaken by Ripple (XRP) back in January of 2019. The price of the Ether dropped to the lows of under $85 at a time.

Following the moderate market uptrend in 2019, the price of Ethereum climbed to the top of $334.6 at the end of June 2019. However, since then, the ETH price has not risen higher and currently fluctuates at around $245 at the time of writing.

Ethereum price prediction for 2020

Before starting forecasts of the possible Ethereum price, it is worth reviewing both external and internal factors that might be affecting the ETH price movements for the upcoming years.

The most important aspects though are related to the long-awaited Ethereum’s transition to Proof of Stake (PoS) protocol and the boom of decentralized application and especially – decentralized finance (DeFi) sector. Considering these fundamental factors, the Ethereum price prediction looks positive for the upcoming 2020 and further 2025.

Factor of transition to Proof of Stake

Ethereum, which is currently the leading platform of the smart-contracts, should be going through the major upgrade to its platform. The upgrade called Ethereum 2.0 will shift Ethereum from Proof of Work (PoW) towards Proof of Stake (PoS) protocol and is planned to happen this summer.

The adoption of PoS brings the staking ability to the network. The revolutionary change means that block mining will not be based on nodes’ competition to solve mathematical puzzles to validate the new block. Instead, the blocks will be confirmed by the users, who have the biggest value of assets in their cryptocurrency wallets. The transition is expected to spark the demand of Ethereum and thus inspire the bull run for its price.

Factor of DeFi growth

With the list of competitors growing, Ethereum still remains the most popular platform for the decentralized application (dApps) developers that build and deploy their projects on its network. According to the statistics, the constantly growing industry of dApps has generated nearly $8 billion in total transaction volume during the last year.

Furthermore, the Ethereum-based decentralized finance (DeFi) sector has also recorded an incredible nearly 800% growth during the past year. Moreover, the total market capitalization of the sector increased by $1 billion within two months and has exceeded $2 billion within the first days of summer.

Factor of the Bitcoin

Since Bitcoin is the dominant cryptocurrency, altcoins especially Ethereum show positive correlations with it. This means that both assets tend to move in the same direction when the leading one is in the uptrend or downtrend. And since both fundamentals and technical factors indicate that Bitcoin is entering the bullish uptrend this year, the same expectations apply to Ethereum.

Furthermore, Bitcoin is maturing, according to market analytics, since more and more institutional investors are turning towards it and accepting it as a trusted form of securities. Simultaneously, the large financial investors are showing an increasing interest in Ethereum as they diversify their portfolios. Nearly 38% of institutional clients of Grayscale, which is one of the biggest crypto management companies, are currently holding more than one cryptocurrency. Furthermore, they have purchased nearly $110 million worth ETH during the past year.

Furthermore, Ethereum became the second cryptocurrency that entered the derivatives market as Ethereum futures contracts became available on derivatives exchanges. The futures contracts allow buying Ethereum at a predetermined price at a specific time in the future. They are also considered an important factor that helps to establish the decentralized digital asset as a more stable investment, meaning that the price fluctuations become less sharp.

Price forecast for 2020

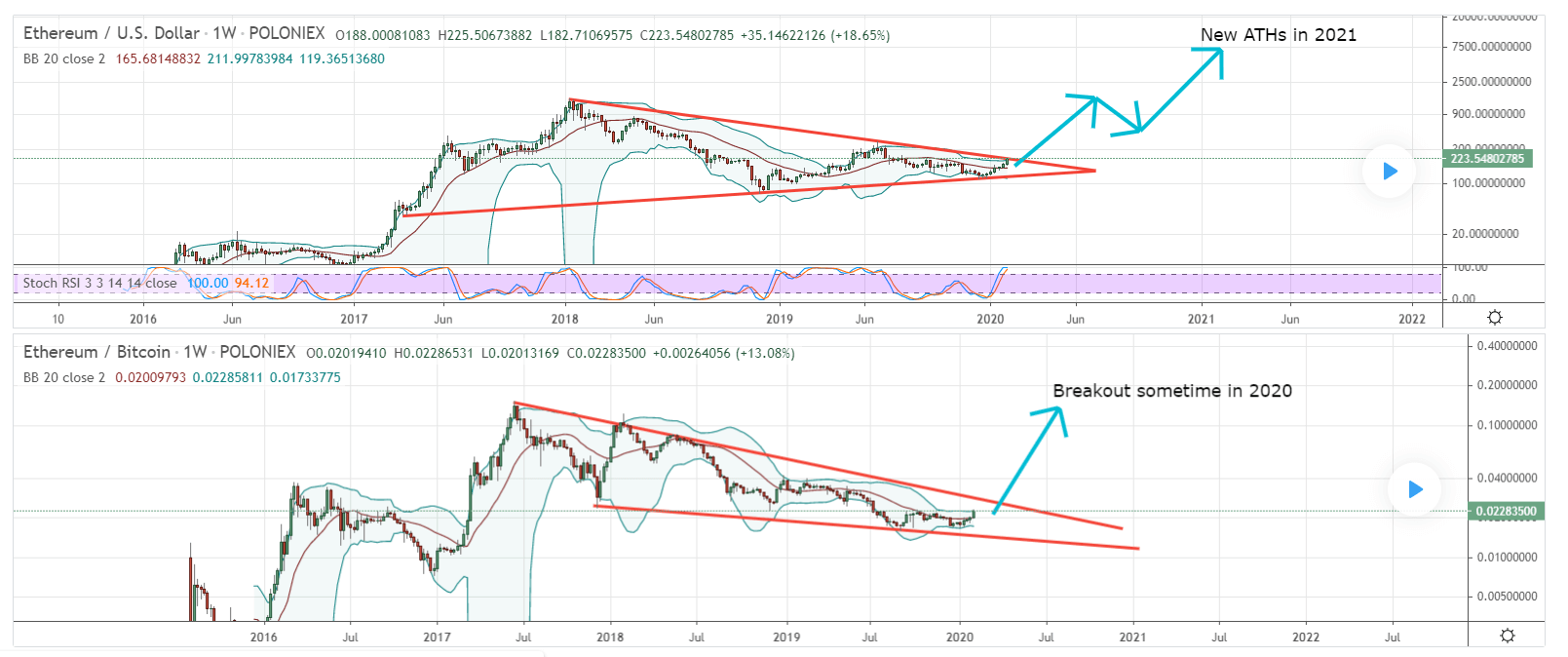

With the mentioned factors in mind, the short-term predictions for the Ethereum price might look bullish. According to the insights of crypto trader FlaviusTodorius67, Ethereum should go through the breakthrough this year. Following his technical analysis, ETH could reach the highs of around $1400 this year. The analyst even predicts that the second biggest cryptocurrency might reach the levels of the new all-time-high (ATH) next year.

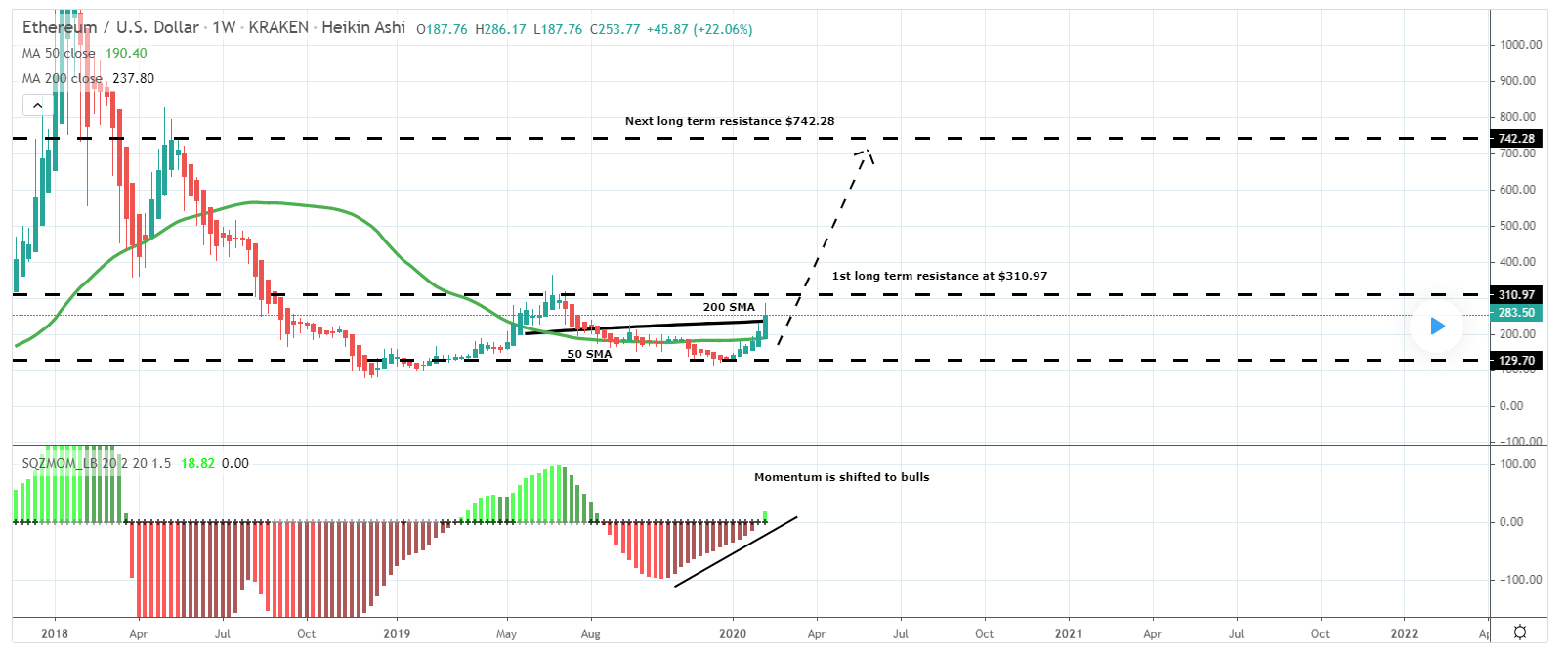

The more reserved, however still optimistic scenario is painted by another crypto analyst called Moon333. Although he also expects the bullish moves of ETH, his technical Ethereum price predictions for 2020 show the long-term resistance level at $742.28.

The popular forecasting website Longforecast, however, presents much more cautious ETH price predictions. According to its data, the coin might end 2020 with the lowest price of $261. The best possible scenario could reach the level of $324 though.

Another crypto prediction website Investing Haven is more bullish for Ethereum and predicts its price to climb up to $750. The website claims that these projections are based on two leading factors: “Bitcoin’s long term uptrend combined with “risk-on” in the global investing community (global markets).” Furthermore, InvestingHaven expects the bullish trend to continue in 2021, mainly based on the increasing interest of institutional investors.

Ethereum price prediction for 2025

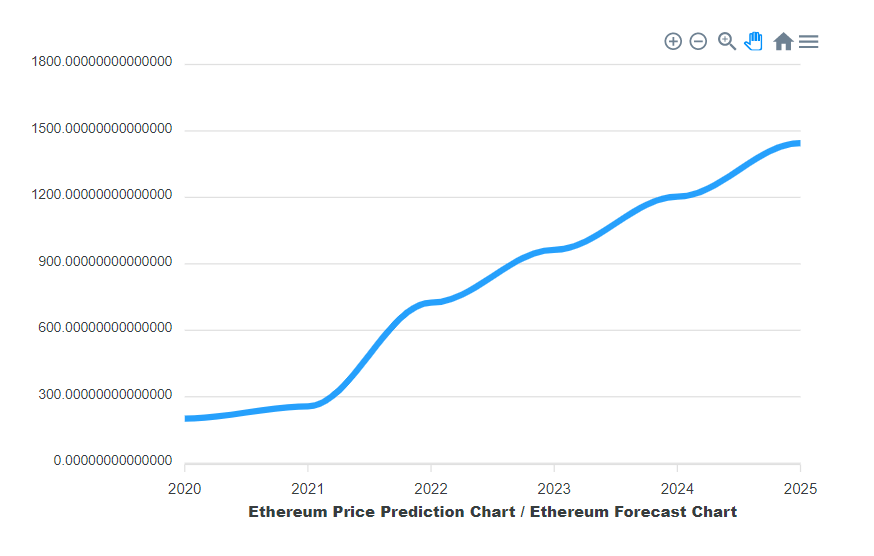

In the meantime, the CryptoGround forecasts positive long-term growth. The website predicts that the price of Ethereum will approach the level of $1.500 in five years. The price here is calculated automatically taking into account the historical ETH price movements.

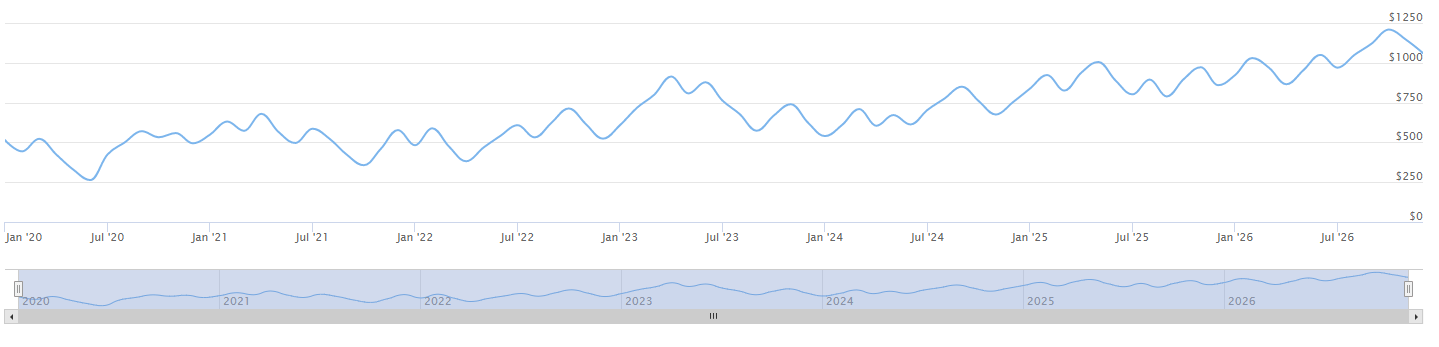

Following the data of another crypto price aggregator DigitalCoinPrice the price of Ethereum should fluctuate around $1.000 in 2025. The website, which uses algorithms to analyze previous price movements, suggests that Ethereum might exceed the level of $1.200 at the end of 2026.

Is Ethereum a good investment?

The whole cryptocurrency market is maturing and gets more and more interest from the institutional investors, though it still remains volatile and difficult to bring precise price predictions. Despite the fact, there are various fundamental factors that might play an important role in shaping the future of the world’s second-biggest cryptocurrency.

Despite the fact that 2020 already brought an incredible shock for both traditional and cryptocurrency markets, the rest of the year should bring very important changes for Ethereum as well. The planned transition to the Proof of Stake consensus algorithm is expected to spark the demand for Ethereum that might result in its price growth. The increasing use of decentralized finance (DeFi) projects is already fueling the value of the ETH.

Since cryptocurrency analytics predict positive future changes in ETH price, it’s critically important to evaluate the current market situation as well as fundamental and technical factors before investing.