First quarter has been turbulent for various markets worldwide. However, despite the crisis that coronavirus has brought, some markets show outstanding statistics of their Q1 results. And one of them is the dapp market.

Binance-related dapp analytics DappReview monitors over 4300 decentralized apps across public blockchains and recently published its 2020 Q1 Dapp Market Report. It shows that the number of dapp transactions has increased over the last year.

According to the report, the total transaction volume across 13 blockchains reached $7.9 billion over the year. This is nearly 82% more compared with the total transaction volume of 2019 Q1.

Furthermore, the majority of these transactions were generated by three major protocols: Ethereum (ETH), Tron and EOS. All together these giants contributed over slightly more than 99% of the total transaction volume.

Sponsored

However, only Ethereum had witnessed year-over-year growth, while Tron and EOS both suffered decreases in users and transaction volume. According to the report, Ethereum-based decentralized finance (DeFi) projects were the main volume growth driver. Transaction volume across the dapps increased 778% compared to 2019.

Most of the volume of Ethereum-based DeFi projects were made in ERC-20 tokens, such as WETH, DAI or USDC. Report also states that total transaction volume of ETH-based dapps reached $5.64 billion in the first quarter of this year. The increase of 652% is also remarkable compared to the $743 million of 2019 Q1.

Best performing categories

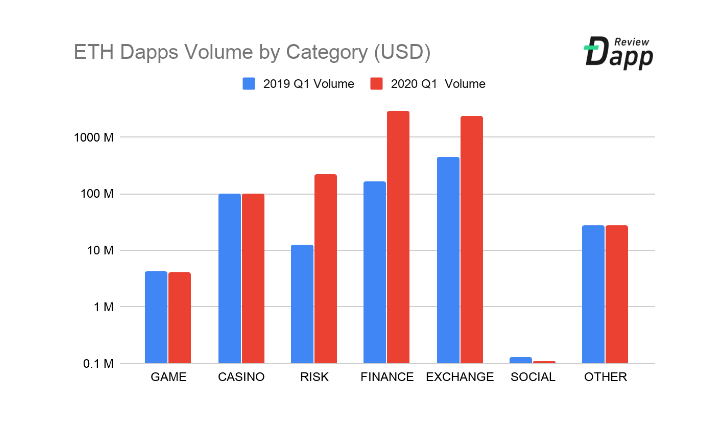

DappReview also reports that the ecosystem of ETH dapps remained diverse, however it performed very steadily compared to other blockchains. While dapps in Game, Casino and Other categories mirrored the level of previous year, categories like Risk, Finance and Exchange increased over the last three months.

Compared to the same quarter of 2019, the transaction volume of Finance dapps increased over 1700% and reached $2.95 billion. The increase in the Exchange category is 430% with the current amount of $2.34 billion.

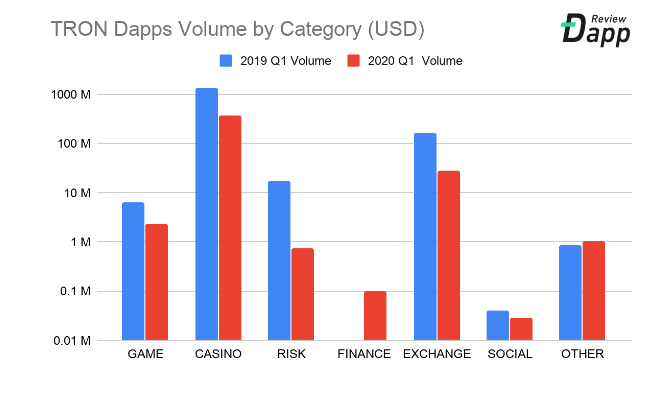

Meanwhile, the total transaction volume of TRON-based dapps went down by nearly 74% over the year, decreasing to $411 million compared with $1.57 billion at the same time of 2019. The decrease mainly connected with the end of hype of Casino dapps, which joined TRON’s ecosystem last year for rewards on gambling mining tokens and generated enormous daily volumes last March.

Despite the fact that almost all categories declined in transaction volume compared to 2019 Q1, casino dapps still dominate TRON blockchain with 92.1% of total volume.

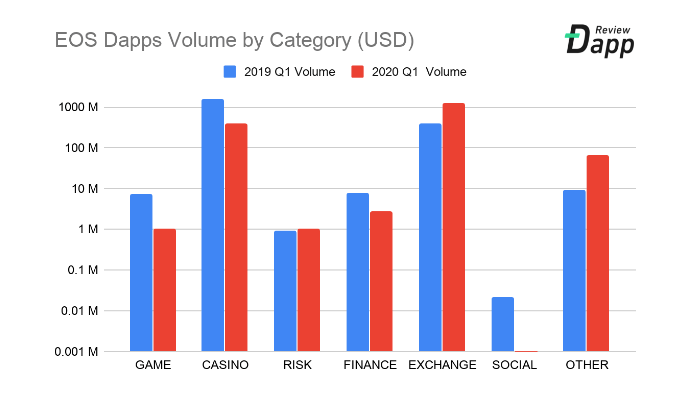

In terms of EOS-based dapps the situation is quite similar to TRON. The total transaction volume was down nearly 12% compared to last year’s Q1. The volume on Casino dapps fell nearly 75% within a year. However the transaction volume in the Exchange dapps category jumped nearly 227% to $1.2 billion, making it the largest sector on EOS.

To conclude, ETH dapps dominate the whole DeFi sector, while both EOS and TRON share the Casino transaction volume. Besides, EOS also has substantial market shares in the Exchange category.

DappReview also noted that most volumes dropped during this March following the general market decline caused by the coronavirus pandemic and oil wars. Just over 245 new dapps were launched during the first three months of 2020, showing the 60% drop compared with the same timeframe of the previous year.

Report also stated that a lot of new creative products are launching and evolving in the Game, Non-Fungible Token (NFT) and CryptoArts space.