The third Bitcoin halving passed a few weeks before and the world’s dominant cryptocurrency is suddenly gaining a lot of attention from institutional investors.

Despite the fact, that Bitcoin is going through the price volatility after the halving on May 11, institutional investors show an increasing interest to invest in Bitcoin over the past weeks. Since institutions usually tend to look for long-term investments, the fact indicates that Bitcoin might be bullish in the long run.

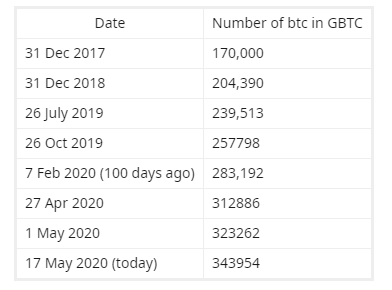

The American digital asset manager Grayscale Bitcoin Trust (GBTC) added over 60k of Bitcoins to its portfolio during the last three months. As says a Reddit post, a certain amount of Bitcoins is about 33-34% of all newly minted coins during the same period.

As can be seen, the GBTC increased the number of its Bitcoin purchases a few weeks before the third Bitcoin halving. Since April 27, the share of the Bitcoins bought by digital asset management fund jumped by nearly 15%. The GBTC currently has over 343k of Bitcoins.

Having in mind that GBTC’s assets are stored offline or in “cold” storage, as the fund claims on its website, the number of Bitcoins will be locked for the upcoming half-year.

This means that the current circulating supply of Bitcoins is already reduced by nearly 2%. In the meantime, the total supply of Bitcoin is limited and predefined at 21 million and is declining after each block reward cutting every four years.

Another significant turn to Bitcoin was done by hedge fund investor billionaire Paul Tudor Jones, who’s fund Tudor Investment Corporation bought Bitcoin futures a few weeks before Bitcoin halving. According to Bloomberg, the investment was done as a hedge against inflation. As the billionaire claimed, Bitcoin investment reaches up to 2% of his nearly $40 billion hedge fund.

The days after that, the biggest American financial firm JPMorgan announced it will begin opening bank accounts to Gemini and Coinbase cryptocurrency exchanges. As was stated in Forbes, JPMorgan will provide deposit, withdrawal, and transfer services for Coinbase and Gemini customers in the nearest future.

The key role of institutional investors

The tendency showing that institutions invest in Bitcoin is growing steadily. Besides that, the increasing interest of such kind of investors plays a significant role in shaping the character of the world’s leading crypto asset.

Sponsored

As DailyCoin reported previously the analytics admit, that institutional trust might decrease the volatility in Bitcoin’s price. According to market experts, institutional investors and Bitcoin’s futures contracts helped to establish the decentralized digital asset as a more stable investment. This means, that Bitcoin’s price fluctuations are supposed to become less sharp.

The Bitcoin stepped into the derivative markets as its futures contracts became available on cryptocurrency exchanges at the end of 2017. The futures contracts are derivatives financial contracts, that oblige parties to enter in transactions at a predetermined price and cost. Since then the Bitcoin derivatives market has witnessed impressive growth.

The increase was particularly abrupt within the first quarter of 2020 when the total volume of cryptocurrency derivatives exceeded $2 trillion and grew 314% compared to the 2019 fourth quarter’s average. Furthermore, the total crypto derivatives market turnover was around 8 times larger compared with 2019 Q1. In the meantime, the Bitcoin (BTC) futures remain the most popular and their futures contract turnover accounted for 78%.