- Leading ERC-404 token PANDORA has experienced a considerable price decline this week.

- Despite the market correction, Nansen’s data suggests that most investors are unfazed.

- Pandora and ERC-404 developers have revealed efforts to address concerns surrounding the project.

Over the past two weeks, an experimental token standard called ERC-404 has taken center stage in the Ethereum ecosystem as it promises native NFT fractionalization. Amid the hype, projects building around the experimental token standard had seen their token prices soar to thousands of dollars.

While the excitement appears to be cooling amid broader discussions of the potential trade-offs that come with the standard and the emergence of rival implementations, data suggests that many investors in the original project built by the standard’s developers look to be in it for the long haul.

Pandora Holders HODL

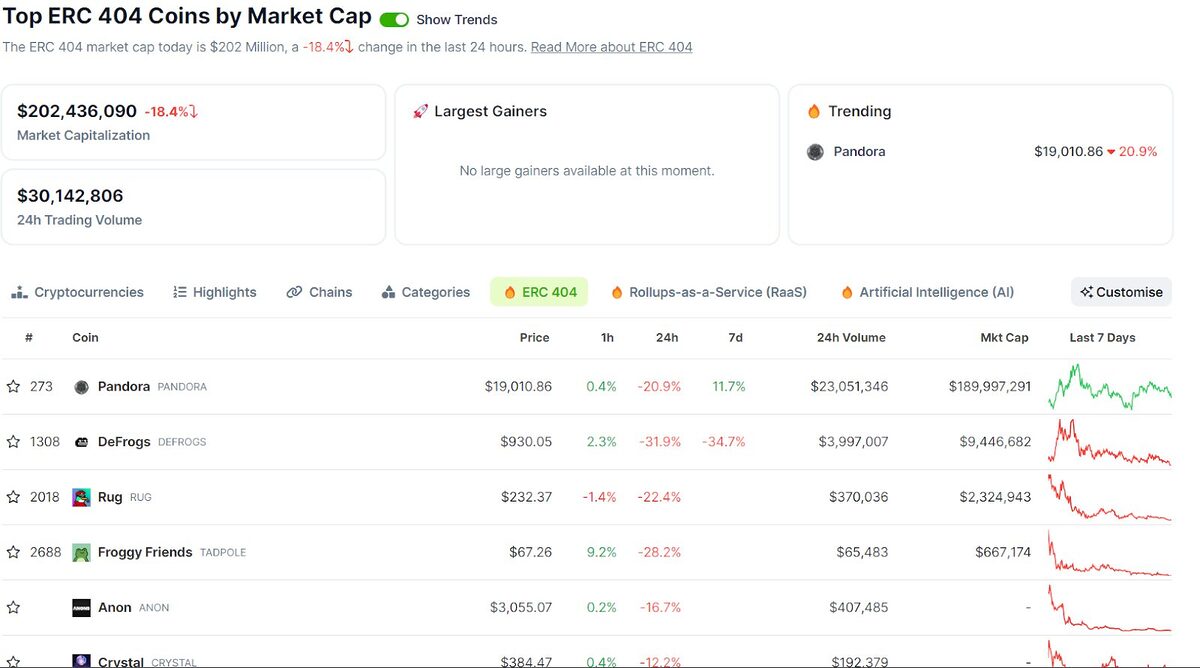

After meteoric price runs recorded last week, the ERC-404 sector has seen a steep decline, and the price of PANDORA, the sector’s leading token, has not been exempted. Per CoinGecko data at the time of writing, PANDORA is trading over 20% lower than it did 24 hours before at just over $19,000.

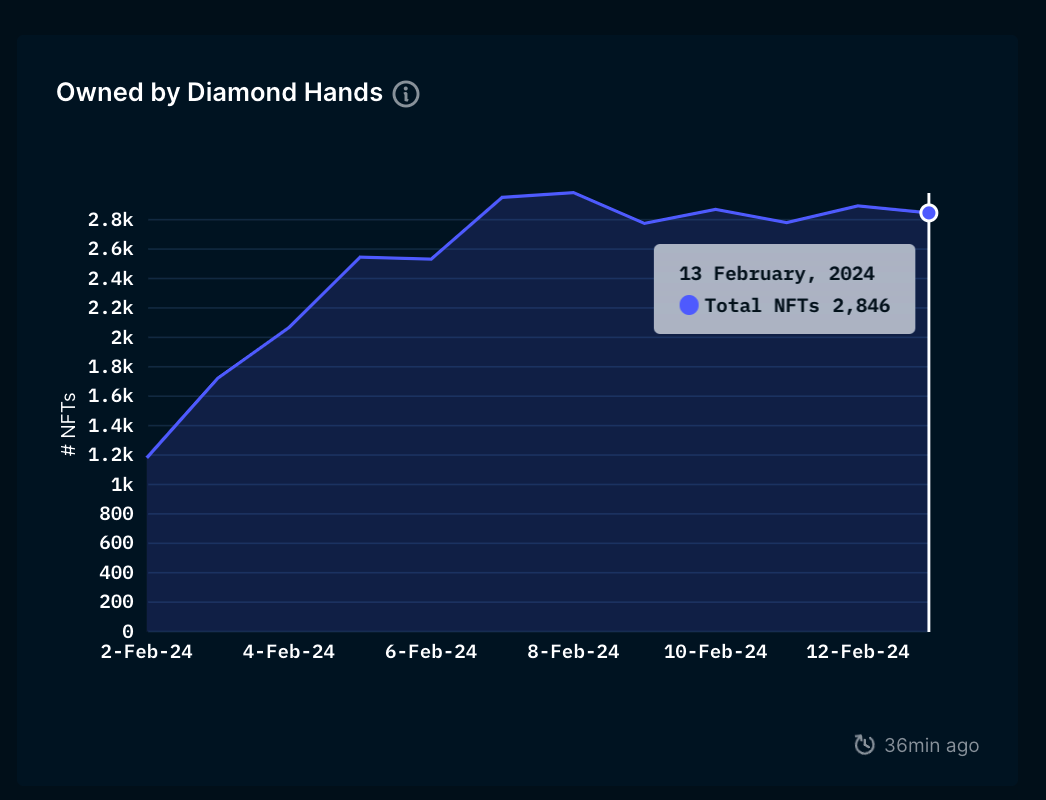

Despite the recent rut, a Tuesday, February 13 Nansen report shared with DailyCoin suggests that most PANDORA holders are not budging. The crypto analytics firm noted that diamond hands hold 50% of the project’s full tokens or NFTs.

Sponsored

“This rate of retention, or ‘diamond-hand’ percentage, is quite impressive for a new project,” Nansen noted.

As highlighted by Nansen, leading NFT collections like Pudgy Penguins and Bored Ape Yacht Club boast retention rates of 53% and 44%, respectively.

Can ERC-404 Tokens Find Their Stride Again?

As the initial excitement fades, investors have been forced to come face to face with the implementation’s drawdowns that attempt to combine the features of fungible ERC-20 tokens with those of non-fungible ERC-721 tokens.

Sponsored

With potentially inefficient code implementation and token transactions typically involving the burning and re-minting of associated NFTs, ERC-404 transactions have cost way more than the average Ethereum transactions while pushing the average fees for other users on the network higher.

At the same time, concerns over the ease of exploits on projects built around the experimental standard exist.

Amid these concerns, ERC-404 developers have disclosed that they are working to optimize the token standard. Using the official Pandora X account on Tuesday, February 13, these developers shared preliminary test results of an ERC-404 v2.1 code showing a 28% reduction in mint costs and a 50% reduction in transfer costs.

These optimization efforts will likely be vital in deciding whether the experimental standard can have staying power or whether it will end up as another passing crypto fad.

On the Flipside

- ERC-404 remains an experimental and unofficial Ethereum token standard as it has yet to pass through the official request for comment phase.

- Rival ERC-404 implementations have emerged, claiming to tackle problems associated with the original implementation.

Why This Matters

Sizable market corrections can typically shake out investors, especially for new and largely untested projects like Pandora. Nansen’s recent report suggests investors strongly believe in the project’s prospects despite current woes.

Read this for more on ERC-404:

ETH’s Hybrid Token Sector Heats up as ERC-404 Rival Emerges

See how MATIC is performing in the current market rally:

MATIC Shrugs off Sell Pressure to Push $0.9 as BTC Smashes $51K