- Initial market reactions of the Bitcoin ETFs have raised intriguing questions about the validity of the hype.

- Despite triumphant headlines, the anticipated price surge following the ETF launch has remained elusive.

- Theories have circulated surrounding the muted reaction displayed by Bitcoin on the 11 ETF launches.

Amidst a flurry of regulatory hurdles and years of anticipation, the cryptocurrency market finally witnessed a historic moment this week: the arrival of 11 approved Bitcoin ETFs. Though headlines splashed with triumphant declarations, the initial trading day unfolded with a muted price response, leaving many to ask: Was the Bitcoin ETF overhyped?

Here at DailyCoin, we take pride in keeping our audience well-informed. Thus, to satiate your curiosity, let’s delve into some noteworthy recent events surrounding the ETF launches as well as some insights into theories behind the subdued price action. To do this, we offer you the Bi-Weekly DailyCoin Bitcoin Regular, put together by our expert Kyle Calvert.

News and Events: Understanding Impacts

All 11 Bitcoin ETFs Debut on Wall Street

The much-anticipated launch of the Bitcoin ETFs sent shockwaves through the digital asset market, with Bitcoin’s price experiencing a 5% surge within minutes. However, this enthusiasm extended beyond the price action, as the 11 approved Bitcoin ETFs saw a combined $1.2 billion of volume flood in during the first 30 minutes of trading.

Gary Gensler Was the Bitcoin ETFs Deciding Vote

For years, SEC Chair Gary Gensler has been crypto’s public skeptic, consistently warning investors of rampant fraud in the industry. His hawkish stance naturally fueled speculation that he’d decline the Bitcoin ETF proposal. Yet, in a stunning twist, his vote unexpectedly became the deciding factor, greenlighting the very product he once seemed hell-bent on stopping.

Grayscale Trust Sets All-Time ETF Volume Record

The Grayscale Bitcoin Trust (GBTC) roared onto the scene, setting the trading floor ablaze with a record-breaking $2.3 billion in trading volume on its first day. This according to Bloomberg is the most for any ETF debut, ever. While the dust is still settling on the exact net inflow figures, one thing’s clear: investors have a serious appetite for Bitcoin exposure.

Community Sentiment

Whispers of a changing tide are coursing through the cryptocurrency sea. Bitcoin, the undisputed king for years, may be loosening its grip on the market cap throne, paving the way for a new wave of contenders in the form of major altcoins.

Sponsored

This shift, eerily reminiscent of prior bull market beginnings, has analysts cautiously optimistic about the future of the digital asset landscape. Michaël van de Poppe, founder and CEO of MNTrading, sees Ether rising against its dominant counterpart, claiming a larger slice of the crypto pie.

This sentiment echoes through the community, with analysts like Jesse pointing to technical indicators suggesting a potential dip for Bitcoin, but emphasizing a sturdy support network that could prevent a dramatic fall.

“There’s a high chance we drop to $44,000,” Jesse predicts, citing historical volume and Fibonacci levels as reliable safety nets. He envisions a scenario where even the absolute bottom of $38,000, marked by oversold conditions and impending catalysts like the ETF and halving, would be unlikely to breach.

“This is long-term vision time,” Jesse asserts. He warns against panic selling, as missing the potential upswing just months from now could leave investors in the dust. “Shave some off if you fear a dip,” he advises, “but trade with the belief that we’ll be higher four months from now.”

Current Outlook

Two weeks of turbulence have rocked the Bitcoin landscape, leaving investors scrambling to interpret mixed signals and chart the volatile cryptocurrency’s next move. After closing December 29 at $42,100, Bitcoin embarked on a wild ride, declining to a low of $40,500 before clambering back up to a heady $48,900. Bitcoin is currently trading at $44,000, down 5% from its daily peak.

The arrival of the much-anticipated spot Bitcoin ETF was expected to be the spark igniting a price explosion, but instead, the launch was met with a muted response. This left many scratching their heads, searching for explanations for the relative calm.

One compelling theory points to preemptive buying. Anticipating the ETF’s impact, the 11 firms providing the ETF service may have already loaded up on their Bitcoin, either gradually over time or in a single decisive move weeks before the launch. This would explain the muted price reaction.

This theory gains further credence from the fact that BlackRock’s ETF traded 25% in pre-market without Bitcoin moving, suggesting they were simply deploying their existing holdings. Another theory suggests the ETF was simply “priced in” – its impact on price completely discounted before its debut. While this may seem plausible, closer examination reveals cracks in the theory.

The day before the launch, a hacked post on the official SEC Twitter account falsely announced the ETF’s approval, triggering significant price swings. This event served as a stark reminder that the ETF was far from “priced in” and remained a potent catalyst for volatility.

However, it’s also possible the hacked post itself played a role in “pre-pricing” the ETF. By prematurely injecting the possibility of approval into the market, the hack may have inadvertently muted the actual launch’s impact.

Fear and Greed

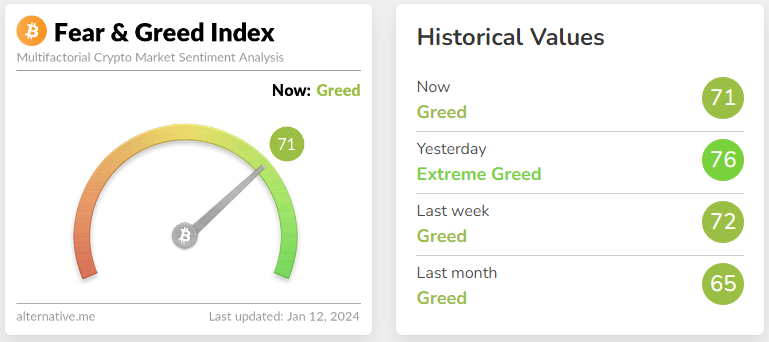

The way people feel significantly impacts the cryptocurrency market. To navigate these emotions, the Fear and Greed Index plays a crucial role. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 71, indicating an increase of 6 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- Bitcoin price trends demonstrate that repetitive patterns don’t guarantee future outcomes, indicating the need for cautious optimism amidst market speculation.

- While the influence of Bitcoin ETFs might appear trivial in light of the current Bitcoin price, their significance should not be underestimated.

Why This Matters

Bitcoin, the world’s most prominent cryptocurrency, serves as a barometer for the entire digital asset ecosystem. Its movements and trends hold profound implications for the broader market, influencing investor sentiment, regulatory decisions, and ultimately, the overall trajectory of cryptocurrencies.

To delve deeper into the unfolding landscape of Spot Bitcoin ETFs, explore additional insights in our comprehensive coverage:

All Spot Bitcoin ETFs Open for Trade for the First Time

If the prospect of Bitcoin reaching $49,000 intrigues you, discover the minute-by-minute developments in ETFs with our detailed analysis:

Bitcoin Eyes $49K as ETFs Hit $1.2B Volume in Minutes