- The SEC’s pending verdict on Grayscale’s Bitcoin ETF application has injected uncertainty into the market.

- Speculation has swirled as an elusive BTC whale has accumulated over $3 billion worth of assets.

- Amidst wavering market sentiment, experts have postulated a plausible price resurgence.

Bitcoin has displayed a consistent contrariness to prevailing trends, with the price action of BTC gravitating persistently towards the $26,000 mark over the last two weeks. Despite indicators like the relative strength index (RSI) signaling a significant overselling of Bitcoin, the cryptocurrency refused to present any semblance of a rebound.

Sponsored

Delving into this market, we aim to unveil intriguing developments that could be early indicators of imminent market volatility, and in pursuit of this goal, we bring you the Bi-Weekly DailyCoin Regular on Bitcoin, expertly crafted by our expert on the subject, Kyle Calvert.

Table of Contents

News and Events: Understanding Impacts

Bitcoin’s RSI Plummets to Levels Not Seen Since Covid Crash

The daily RSI of BTC has plunged to points that haven’t been observed since the crash induced by the COVID-19 pandemic in March 2020. The RSI, a frequently employed technical tool, measures price shift speed. Ranging from 0 to 100, values above 70 signal overbuying, while readings below 30 suggest overselling.

SEC Yet to Make Verdict on Grayscale Bitcoin Spot ETF

Numerous applications for Bitcoin ETFs are under scrutiny by the SEC, with BlackRock leading the charge. However, Grayscale’s application distinguishes itself by seeking to reshape an existing BTC-focused financial product into an innovative creation. Presently, there is no verdict concerning the much-anticipated Grayscale-SEC legal case.

Emerging BTC Whale Stirs Speculation: Is it Gemini or Blackrock?

Over the last three months, an emerging Bitcoin whale has gathered 118,300 Bitcoins. These digital assets hold a value exceeding $3 billion by prevailing market rates. The owner’s identity remains uncertain, sparking diverse conjectures that pivot towards entities like Gemini and BlackRock.

Current Outlook

As of the time of writing, Bitcoin has seen a 1% decrease in its price over the last 24 hours, being traded around the $26,100 area. Trading down 11% since the last DailyCoin Bitcoin Regular, two weeks ago.

Sponsored

The current value of Bitcoin remains beneath the significant 20-week exponential moving average, standing at $27,480. This is a crucial threshold to reclaim, as it is key to rejuvenating any signs of positive upward movement.

Community Sentiment

Michaël van de Poppe, the originator and CEO of trading enterprise Eight, pointed out the conspicuous oversold indicators emanating from the RSI.

Each instance of such a market movement typically culminates in a rapid resurgence resembling a V-shaped trajectory, followed by stabilization at an elevated level, elucidated by Van de Poppe in relation to preceding instances of abrupt Bitcoin price declines.

He augmented his viewpoint by expressing a high likelihood that Bitcoin could orchestrate a resurgence directed at the $26,500 threshold or potentially exceeding it.

CryptoJelleNL, another analyst specializing in cryptocurrency, likened the ongoing price behavior of Bitcoin to that observed in September 2020—before the initiation of the preceding bullish market cycle.

Drawing a parallel to the historical context, the analyst envisioned a scenario marked by gradual absorption of market dynamics and a steady ascent over a considerable period, mirroring the dynamics of the earlier cycle.

Quick Fire Targets

Level up your understanding of market dynamics with these key levels to keep an eye on. Monitoring these levels allows you to gain valuable insights into the market sentiment and potential price movements.

Support

First on our list is the initial support level at $25,740. Moving on, we have the second support level at $25,500. Lastly, we have the third support level at $25,060. These support levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Resistances

First on our list is the initial resistance level at $26,420. Moving on, we have the second resistance level at $26,860. Lastly, we have the third resistance level at $27,100. These resistance levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Fear and Greed

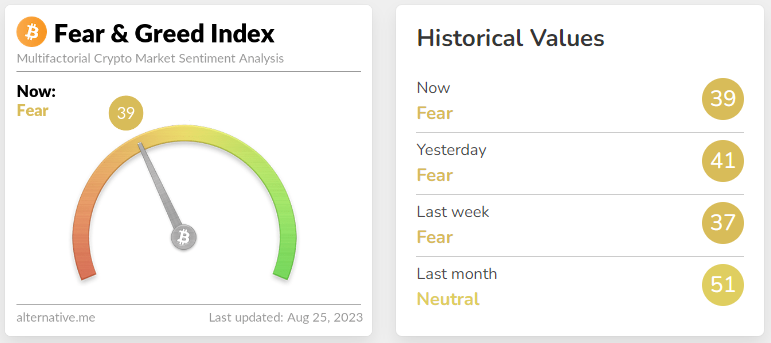

The way people feel significantly impacts the cryptocurrency market. To navigate these emotions, the Fear and Greed Index plays a crucial role. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 39, indicating a decrease of 12 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- Considering the viewpoint of the Twitter user CryptoJelleNL, it’s important to recognize that history doesn’t rigidly replicate itself, and the evolution of market dynamics is influenced by changing circumstances.

- While crypto analysis provides valuable insights, it’s not intended to be accepted at face value; rather, it serves as a guide, nudging individuals to form their informed assumptions about the market.

Why This Matters

Bitcoin’s intricate market behavior is a compass for the broader cryptocurrency landscape, making comprehending its movements pivotal. As a frontrunner in the market, Bitcoin’s trajectory holds insights that ripple across the entire crypto domain, underscoring the significance of decoding its current stance and potential pathways.

To learn more about how Bitcoin holders should prepare for September’s potential challenges, delve into the insights here:

Worst to Come? Why Bitcoin Holders Should Brace for September

For a closer look at the current state of BTC exchange supply, read the details here:

Why Is the BTC Exchange Supply at Its Lowest Level in 6 Years?