- Bitcoin’s price has been lingering, resembling stability rather than its usual dynamism.

- Anticipation has gripped the market as the SEC’s potential verdict on Bitcoin ETFs looms.

- A seesaw battle between bullish and bearish forces has unfolded.

Another boring two weeks have passed, with Bitcoin’s price remaining stagnant, akin to that of a stablecoin, rather than a dynamic cryptocurrency. This lackluster trend has left numerous enthusiasts contemplating: When will we see the volatility, and in which direction will we go?

Sponsored

Delving into this lateral market, we aim to unveil intriguing developments that could be early indicators of imminent market volatility, and in pursuit of this goal, we bring you the Bi-Weekly DailyCoin Regular on Bitcoin, expertly crafted by our expert on the subject, Kyle Calvert.

News and Events: Understanding Impacts

MicroStrategy Adds 467 BTC to its Growing Bitcoin Portfolio

MicroStrategy bolstered its Bitcoin portfolio by acquiring an additional 467 BTC, valued at $14.4 million. The company’s cumulative Bitcoin ownership currently stands at an impressive 152,800 BTC. Notably, MicroStrategy’s most recent BTC acquisition came at a rate of $30,835 per unit.

El Salvador Grants Binance Pivotal Licenses

Binance, the prominent player in the realm of cryptocurrency exchanges, has recently secured a pair of pivotal licenses within the borders of El Salvador. This accomplishment ushers Binance into the distinguished position of being the inaugural fully-licensed crypto exchange to operate within the nation’s confines.

SEC’s Decision on a Bitcoin ETF Might Be Revealed Today

The anticipation surrounding the SEC’s verdict on the Bitcoin ETFs remains palpable. Despite the absence of an exact timetable provided by the securities regulator, there exists a reasonable likelihood that the agency could disclose its decision on one of the ETF applications as soon as today, August 11th.

Current Outlook

As of the time of writing, Bitcoin has seen a 0.25% decrease in its price over the last 24 hours, being traded around the $29,480 area. Trading up 0.65% since the last DailyCoin Bitcoin Regular, two weeks ago. Despite encountering obstacles and falling to the $28,500 level, Bitcoin was able to hold, exhibiting tenacity as it strives to regain its bullish trajectory.

Sponsored

A familiar battleground emerges as the struggle between bullish and bearish forces intensifies within a market characterized by its lateral movement. The ongoing attempts at BTC price breakouts prove to be exercised in futility, ensnaring both factions

Community Sentiment

The existing state of affairs has remained virtually unaltered since the middle of June, with a foundational support level at $28,500 and a resistance point at $31,800. To instigate a substantial transformation, it becomes imperative for the bullish forces to secure dominance over the vicinity encompassing $29,700.

Notably, the contentious territory ranging from $29,500 to $29,700 is a focal point for an intense power struggle between bullish and bearish entities, as astutely observed by Daan Crypto Trades.

Zooming in on the transient fluctuations in BTC’s price, an observant trader named Skew sheds light on the palpable frenzy encompassing the mid-$29,000 range in the Bitcoin domain.

Notably, recent exchange transactions showcase a scenario where substantial buy orders effectively absorb the downward selling pressure, as witnessed on August 11.

Delving deeper, Skew expounds on the spot price dynamics within the four-hour time frames, deeming them “feeble” despite maintaining a position above assorted exponential moving averages (EMAs).

Quick Fire Targets

Level up your understanding of market dynamics with these key levels to keep an eye on. Monitoring these levels allows you to gain valuable insights into the market sentiment and potential price movements.

Support

First on our list is the initial support level at $29,290. Moving on, we have the second support level at $29,150. Lastly, we have the third support level at $28,940. These support levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Resistances

First on our list is the initial resistance level at $29,640. Moving on, we have the second resistance level at $29,850. Lastly, we have the third resistance level at $29,980. These resistance levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Fear and Greed

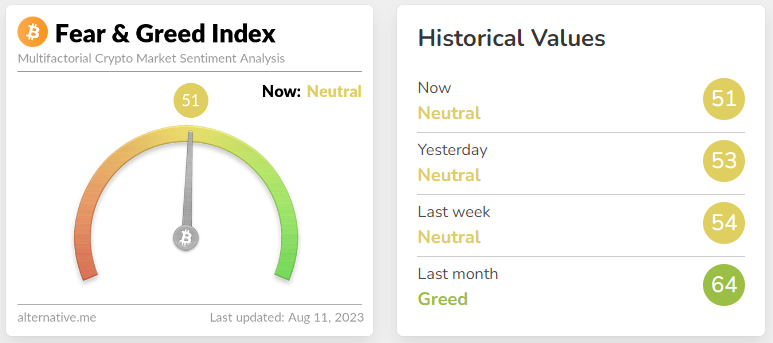

The way people feel significantly impacts the cryptocurrency market. To navigate these emotions, the Fear and Greed Index plays a crucial role. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 51, indicating a decrease of 1 point compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- The anticipation surrounding the SEC’s verdict on Bitcoin ETFs is palpable, as its approval or denial could serve as a much-awaited catalyst, propelling the market into a definitive direction.

- Though a valuable gauge of market sentiment, the Fear and Greed Index might oversimplify the intricate interplay of human emotions and external factors in shaping cryptocurrency trends.

- While community sentiment emphasizes specific support and resistance levels, it’s worth noting that unexpected volatility can happen at any moment with BTC.

Why This Matters

MicroStrategy’s Bitcoin holdings surge and Binance’s licenses in El Salvador signal the growing adoption of digital assets. Market dynamics may shift as Bitcoin navigates support and resistance levels. Investors and enthusiasts should stay informed.

To learn more about the SEC’s legal battle with Ripple, including possible scenarios for how the appeal could go, read here:

3 Scenarios in Ripple vs. SEC Showdown Discussed by Legal Experts

To learn more about the recent CPI data and the lack of volatility in the cryptocurrency market, read here: