- Bitcoin has recently surged to yearly highs, sparking anticipation for a bullish festive season.

- December’s historical favorability for Bitcoin’s performance has raised questions about the month’s trajectory.

- Uncertainty has loomed over whether the trend will lean definitively upwards or downwards this December.

Bitcoin has continued its upward trajectory, recording another two weeks of gains since our last DailyCoin Bitcoin Regular update. As Bitcoin continues its upward trajectory, the community eagerly awaits the next leg of this bull run. With December just beginning, the question on everyone’s mind is whether Santa has come bearing gifts or not.

Here at DailyCoin, we take pride in keeping our audience well-informed. Thus, to satiate your curiosity, let’s delve into some noteworthy events from the past week. To do this, we offer you the Bi-Weekly DailyCoin Bitcoin Report, put together by our expert, Kyle Calvert.

News and Events: Understanding Impacts

BlackRock and Ark Hold Private Bitcoin ETF Talks with SEC

Representatives from BlackRock, Ark, and Nasdaq have met with the Securities and Exchange Commission (SEC) to discuss the creation of a spot Bitcoin exchange-traded fund (ETF). The SEC is expected to decide whether to approve a spot in Bitcoin ETF in the coming months.

Someone Made a Bitcoin Oopsie

A Bitcoin user accidentally paid $3.146 million (83.65 BTC) in transaction fees for a $5.2 million (139.32 BTC) transfer. This colossal fee, which dwarfs the actual transaction amount, has baffled the cryptocurrency community and sparked discussions about transaction fees and potential user error.

Delayed SEC Decision Fuels Mass Bitcoin ETF Approval Hype

The SEC’s recent postponement of its decision date on spot Bitcoin ETF applications submitted by Franklin Templeton and Hashdex has sent shockwaves through the cryptocurrency industry. The delay, which pushes the decision to January 10, 2024, has sparked intense speculation about a mass Bitcoin ETF Approval.

Community Sentiment

Bitcoin (BTC) prices surged above $38,000 on Thursday, marking the first significant move in the latter half of the week.

Sponsored

Popular trader Skew noted the positive monthly close, stating, “Could see some multi-week compression between $35K – $39K.” He also pointed to major resistance on monthly timeframes at $47,000 and around the 2021 all-time high of $69,000.

Fellow trader and chartist JT echoed Skew’s assessment, highlighting the strength of the recent price action. “Monthly candle was excellent with a candle body low of $34.5K. This is important because the lower candle BODY low was higher than the preceding candle BODY high. This is a sign of strength!”

The high-timeframe chart outlook was described as “consistent and constructive” by JT, suggesting a potential for further upside.

Bitcoin’s rally came despite mixed macroeconomic data prints from the United States. This lack of response to economic factors indicates that traders primarily focus on the cryptocurrency’s technical indicators.

Material Indicators co-founder Keith Alan highlighted the historical resistance/support (R/S) lines within the range, noting their significance in shaping Bitcoin’s price trajectory. “If you think BTC is hovering around an arbitrary price, you would be mistaken. There is a significant amount of historical confluence in this little R/S Flip Zone,” he wrote.

Current Outlook

Bitcoin has seen a modest price increase over the past two weeks, rising 4.87% to its current value of $38,380. Traders are cautious, anticipating potential volatility around the upcoming holiday weekend.

Despite Bitcoin’s 12% gain over the past 30 days, there is a possibility of a significant surge as the holidays approach. This anticipation is primarily driven by the belief that Santa will provide us, good girls, boys, and NBs, with a pump this Christmas.

On a more serious note, December has historically been a favorable month for Bitcoin, with returns often exceeding losses. However, the month’s overall performance remains unpredictable, and a definitive upward or downward trend cannot be ascertained.

Fear and Greed

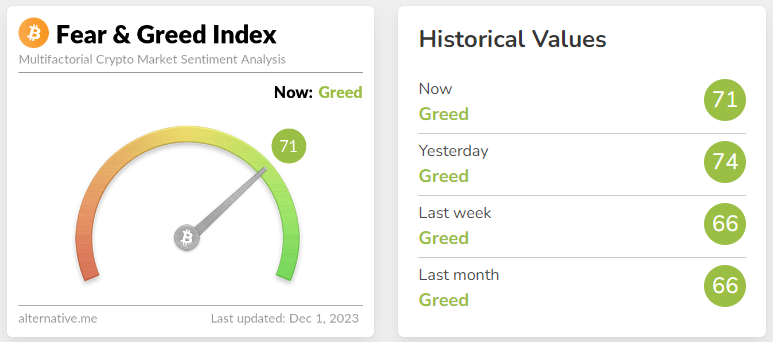

The way people feel significantly impacts the cryptocurrency market. The Fear and Greed Index plays a crucial role in navigating these emotions. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 71, indicating an increase of 8 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- Bitcoin price trends demonstrate that repetitive patterns don’t guarantee future outcomes, indicating the need for cautious optimism amidst market speculation.

- December has experienced five positive months and six negative months in recent years. However, this does not mean that this December will be positive.

Why This Matters

Bitcoin’s dynamics reverberate throughout the cryptocurrency landscape, making each event and trend crucial for gauging the market’s pulse. Understanding the implications of expiring options, market sentiment, and regulatory decisions is key to grasping the broader crypto market’s direction and potential shifts in investor behavior.

To learn more about the delayed SEC decision fueling Bitcoin ETF hype, read here:

Delayed SEC Decision Fuels Mass Bitcoin ETF Approval Hype

To delve deeper into the debate sparked by Bitcoin’s record $3.1M gas fee, read here:

Bitcoin’s Record $3.1M Gas Fee Sparks Debate in Community