- Bitcoin has been range-bound for the past two weeks, with a brief visit to a three-month low.

- The improvement in GBTC’s performance could signal a growing institutional interest in Bitcoin.

- The recent fluctuations in Bitcoin’s price could suggest that a breakout is imminent.

With a firm and seemingly unwavering resolve, Bitcoin remains ensconced in a rather unremarkable trajectory. It has found a stable abode for a consecutive fortnight of trading, firmly anchored at the $26,600 threshold.

Sponsored

One might have anticipated more pronounced market fluctuations amid recent events and significant news. In exploring this market, we aim to uncover intriguing developments that could signal imminent market volatility. To this end, we bring you the Bi-Weekly DailyCoin Bitcoin Regular, curated by our expert, Kyle Calvert.

News and Events: Understanding Impacts

Fed’s Pause on Rate Hike Fails to Disturb Crypto Market

The Federal Open Market Committee had chosen to maintain interest rates at the levels established in July this year. Financial markets had widely anticipated this decision, with an astonishing 99% likelihood of a pause in rate hikes, as indicated by data from CME Group’s FedWatch Tool.

Bitcoin Futures Open Interest Jumps by $1 Billion

On September 18, Bitcoin saw a surprising $1 billion surge in open interest on derivatives exchanges, raising questions about whale accumulation ahead of Binance’s legal document release. However, a closer look at derivative metrics reveals a more complex story, with the funding rate showing no clear signs of excessive buying pressure.

GBTC Discount Reaches 2021 Low

GBTC, a Bitcoin investment trust, has improved its performance since BlackRock announced plans to apply for a Bitcoin spot ETF in the US. As of September 9th, GBTC shares are trading at a 17.17% discount to Bitcoin, the smallest discount since December 2021.

Current Outlook

Two weeks ago, Bitcoin concluded its trading day at $25,910, underscoring the relative stability in its pricing— a modest $700 deviation since the last DailyCoin Bitcoin Regular.

Sponsored

Fast forward to the present, the cryptocurrency has experienced fluctuations over the past two weeks. BTC briefly dipped to $25,000, reminiscent of its performance in June 2023. Nevertheless, Bitcoin exhibited resilience, recovering from the slump and ascending to $27,475, ultimately stabilizing at its current valuation of $26,600.

Community Sentiment

In a recent tweet, trader Jelle said that he expects “choppy waters” on Bitcoin, while trader Skew predicted a “lively FOMC trading environment” after scanning broader exchange activity.

Daan Crypto Trades also projected volatility during the aftermath of the FOMC meeting. Despite the different predictions, all three traders agree that the $26,500-$26,800 area will be a key point of contention.

Crypto Tony, meanwhile, has flagged $26,800 as the “line in the sand” for Bitcoin bulls to protect.

“This is what I am looking for to remain in my long position. Must hold above $26,800 support zone, or we risk creating a deviation,” he commented alongside his own chart.

Quick Fire Targets

Level up your understanding of market dynamics with these key levels to keep an eye on. Monitoring these levels allows you to gain valuable insights into the market sentiment and potential price movements.

Support

First on our list is the initial support level at $26,230. Moving on, we have the second support level at $25,870. Lastly, we have the third support level at $25,370. These support levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Resistances

First on our list is the initial resistance level at $27,100. Moving on, we have the second resistance level at $27,600. Lastly, we have the third resistance level at $27,960. These resistance levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

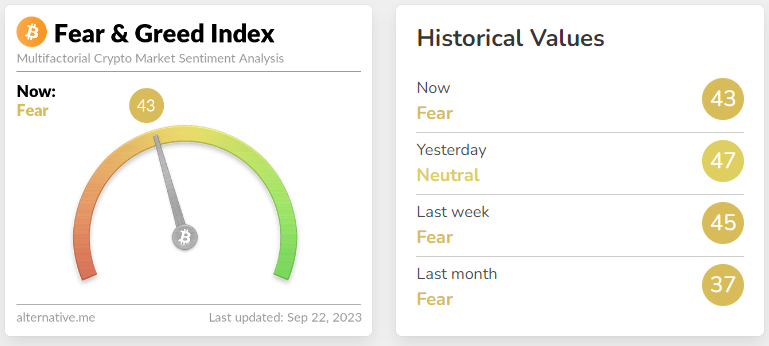

Fear and Greed

The way people feel significantly impacts the cryptocurrency market. The Fear and Greed Index plays a crucial role in navigating these emotions. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 43, indicating a decrease of 3 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- The Federal Open Market Committee’s decision to maintain interest rates at their current levels could decrease market risk-taking behavior.

- The recent $1 billion surge in open interest on derivatives exchanges could indicate that large traders are positioning themselves for a sell-off in Bitcoin.

- GBTC is still trading at a significant discount to Bitcoin, suggesting that institutional investors are not yet fully convinced of Bitcoin’s long-term prospects.

Why This Matters

Bitcoin’s price movements can significantly impact the broader cryptocurrency market. The factors discussed in this article could lead to increased volatility in Bitcoin’s price in the coming weeks and months, which could have implications for investors and traders alike.

To learn more about how Binance is delisting stablecoins due to MICA rules, read here:

Binance Prepares to Delist Stablecoins Due to MiCA Rules

To learn more about how Bitcoin is experiencing record congestion, read here:

Bitcoin Overflows with Pending Tx in Record Congestion