- Bitcoin has been range-bound for the past two weeks, with brief volatile visits outside that range.

- Regulatory hurdles have dashed hopes of a Bitcoin ETF, leaving investors in suspense.

- Bitcoin’s recent stability has concealed a brewing storm in the cryptocurrency market.

It’s that time once more when we provide you with the latest update on Bitcoin’s price dynamics. As we delve into cryptocurrency, it becomes apparent that Bitcoin continues its rather uneventful journey, steadfastly maintaining its position around the $26,000 mark, even after two full weeks of trading.

Sponsored

One might have anticipated more pronounced market fluctuations amid recent events and significant news. In exploring this market, we aim to uncover intriguing developments that could signal imminent market volatility. To this end, we bring you the Bi-Weekly DailyCoin Bitcoin Regular, curated by our expert, Kyle Calvert.

Table of Contents

News and Events: Understanding Impacts

SEC Puts a Damper on High Hopes for Bitcoin ETF Approval

Investor excitement peaked as the prospect of regulatory approval for a Bitcoin Exchange-Traded Fund (ETF) entered the spotlight. The backing of industry titans such as BlackRock and Fidelity only further elevated expectations. However, the dreams of eager investors were abruptly dashed by the SEC.

Coinbase Debuts Crypto Lending Platform in the US

Coinbase has unveiled an institutional-grade crypto lending platform, extending its spectrum of services to American investors. This initiative is seamlessly integrated into Coinbase Prime, the exchange’s existing portfolio, as confirmed by a spokesperson representing Coinbase.

Bitcoin Punishes Late Traders with Whirlwind of Short Liquidations

On September 8, Bitcoin’s volatility continued with a “short squeeze,” driving it to September highs. Data showed liquidations of both short and long positions. The day before, BTC hit $26,400 but later dropped below $26,000, punishing late traders. Short liquidations totaled $23.5 million on September 7, with September 8 long positions still pending.

Current Outlook

As of the time of writing, Bitcoin has experienced a modest 1% surge in its valuation within the past 24 hours, currently hovering around the $25,900 mark. This marks a marginal decrease of 1% compared to its position during the previous edition of the DailyCoin Bitcoin Regular, which transpired two weeks ago.

Sponsored

On August 29th, Bitcoin showed notable price volatility, rallying by 8.5% to hit $28,167, but then swiftly reversing its gains over the next two days, dropping to as low as $25,328 by September 1st. In just 48 hours, Bitcoin underwent two substantial price swings of over 8%, ultimately returning to its initial price.

Community Sentiment

Cryptocurrency analyst Crypto Tony dismissed the strength of the overnight move in Bitcoin (BTC), advising that $26,600 was the line in the sand to cross before entering a long position.

“Nice rally off the $25,600 range low, but no follow through up to the range highs, so again, we are stuck mid-range,” he outlined alongside an explanatory chart. “No entry for me on Bitcoin unless we clear $26,600.”

Michaël van de Poppe, founder and CEO of trading firm Eight, ventured that the market was in the midst of the “final” Bitcoin price drop this time around.

“Technically speaking, we can solely focus on the price action in 2019, but that doesn’t grant a clear case. The case in 2015 (given the new participants joining this cycle into the markets -> institutions), we can correlate the current market with that cycle,” he stated. “In that regard, this is the final correction.”

Fellow trader Daan Crypto Trades highlighted the significance of reclaiming lost ground from August.

“Bitcoin was finally able to break above the September monthly open after testing it numerous times. It is now retesting it,” he told X subscribers on the day. “The question is, will it provide as much support as it did resistance? Up to the bulls to try and maintain a ‘green’ September.”

Quick Fire Targets

Level up your understanding of market dynamics with these key levels to keep an eye on. Monitoring these levels allows you to gain valuable insights into the market sentiment and potential price movements.

Support

First on our list is the initial support level at $25,740. Moving on, we have the second support level at $25,500. Lastly, we have the third support level at $25,360. These support levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Resistances

First on our list is the initial resistance level at $26,110. Moving on, we have the second resistance level at $26,230. Lastly, we have the third resistance level at $26,480. These resistance levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Fear and Greed

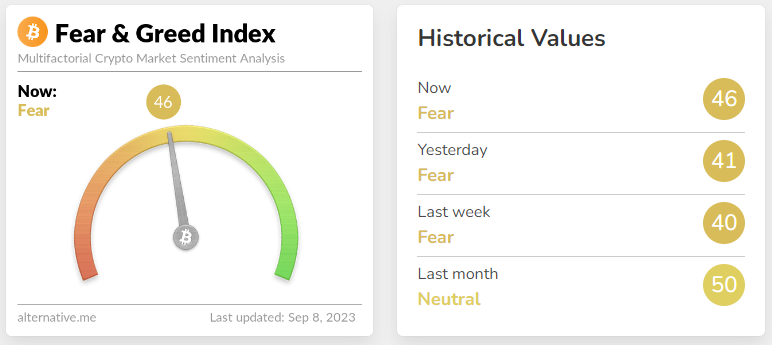

The way people feel significantly impacts the cryptocurrency market. The Fear and Greed Index plays a crucial role in navigating these emotions. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 46, indicating an increase of 7 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- The launch of Coinbase’s crypto lending platform could lead to increased volatility in the market as investors use the platform to take on more risk.

- The ultimate direction of Bitcoin’s price will depend on several factors, including investor sentiment, regulatory changes, and technical developments.

- The Fear and Greed Index is still in the “fear” zone, suggesting investors are still cautious about the cryptocurrency market.

Why This Matters

Bitcoin’s intricate market behavior is a compass for the broader cryptocurrency landscape, making comprehending its movements pivotal. As a frontrunner in the market, Bitcoin’s trajectory holds insights that ripple across the entire crypto domain, underscoring the significance of decoding its current stance and potential pathways.

To learn more about Grayscale’s BTC holdings and the revelations from Arkham, read here:

Grayscale BTC Holdings Identified: Arkham Reveals All

To stay updated on how inflation-ridden Turkey is turning to Bitcoin and whether the rest of the world will follow suit, read here:

Inflation-Ridden Turkey Turns to Bitcoin: Will the Rest of the World Follow?