- Major players have entered the race for a Bitcoin ETF.

- Market analysts are closely observing BTC’s price performance.

- The cryptocurrency industry is currently witnessing a fierce battle between bullish and bearish forces.

The industry has been hit with a wave of significant news as the current landscape is witnessing an intense confrontation between the bulls and the bears, setting the stage for a captivating showdown. To provide insights into these groundbreaking developments, we bring you the Bi-Weekly DailyCoin Regular on Bitcoin, expertly crafted by our expert on the subject, Kyle Calvert.

News and Events: Understanding Impacts

Sharp Decline as SEC Questions Adequacy of Spot BTC ETF Filings

In a significant setback for the cryptocurrency market, the spot bitcoin exchange-traded fund (ETF) applications, spearheaded by influential players such as BlackRock and Fidelity, have been dealt a blow. The U.S. Securities and Exchange Commission (SEC) has voiced its concern, deeming the recent filings insufficient, eliciting outrage within the community. Some critics questioned why the “Spot ETF filings for #Bitcoin are deemed ‘inadequate’ while a 2x leveraged futures ETF isn’t?”

MicroStrategy Adds 12,333 Bitcoins to its Stockpile

MicroStrategy continues to solidify its position in the cryptocurrency market by acquiring an additional $347 million worth of Bitcoin. Between April 27 and June 27, MicroStrategy procured an impressive 12,333 bitcoins, bolstering its reserves. This acquisition was executed at an average cost of $29,668 per coin.

ProShares Bitcoin ETF Sees Yearly High in Inflows

The ProShares Bitcoin ETF has witnessed an extraordinary influx of funds, reaching an all-time high this year. During the week ending on Sunday, June 25, astute investors poured more than $65 million into the fund, playing a pivotal role in propelling its total value beyond the significant milestone of $1 billion.

Current Outlook

At the time of writing, Bitcoin resides near the $30,000 threshold, exhibiting a promising upswing in its price trajectory compared to its position two weeks ago. This surge in value aligns with the imminent arrival of a significant quarterly options expiry event, solidifying its status as the second-largest occurrence in Bitcoin’s history.

Alas, the landscape took an abrupt turn when the news broke of the insufficient ETF filings. This revelation catalyzed a swift and substantial downturn in the price of BTC, witnessing a staggering plunge of over 3% or $1,000 in mere minutes.

Analysts are eagerly observing the impact of this event on the markets. June 30 holds great importance for BTC traders worldwide, as the options expiry is just one of several pivotal events.

Sponsored

To confirm a breakout on the monthly timeframes, it is crucial for BTC to close above the $29,255 mark. Simultaneously, market participants are closely monitoring the quarterly resistance level at $28,872.

This particular level has served as resistance in Q1 of 2023 and 2020 while acting as support in 2021. According to data from CoinGlass, a monitoring resource, Bitcoin has gained 8% in Q2 so far. However, this growth still pales in comparison to the exceptional performance witnessed in Q1, which boasted gains of over 70%.

Community Sentiment

Some individuals expressed optimism, anticipating that Bitcoin would overcome its inherent volatility and achieve new local highs. One such individual is Crypto Tony, a seasoned trader whose main objective was set at $32,000.

Jelle, a fellow trader, recognized the challenges faced by Bitcoin’s price in maintaining higher levels over extended periods. These moments of upward momentum were often followed by a retracement.

"While the upward wicks observed during this consolidation phase may appear daunting, it is worth noting that we have witnessed similar price movements in the highlighted regions," Jelle explained, reflecting on a BTC/USD chart spanning the previous year.

Quick Fire Targets

Level up your understanding of market dynamics with these key levels to keep an eye on. Monitoring these levels allows you to gain valuable insights into the market sentiment and potential price movements.

Support

First on our list is the initial support level at $30,000. Moving on, we have the second support level at $29,620. Lastly, we have the third support level at $29,200. These support levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Resistances

Next on the list is the initial resistance level at $30,820. Moving on, we have the second resistance level at $31,230. Lastly, we have the third resistance level at $31,620. These resistance levels are subject to change based on market conditions and should be used as a reference for analysis rather than definitive predictions.

Fear and Greed

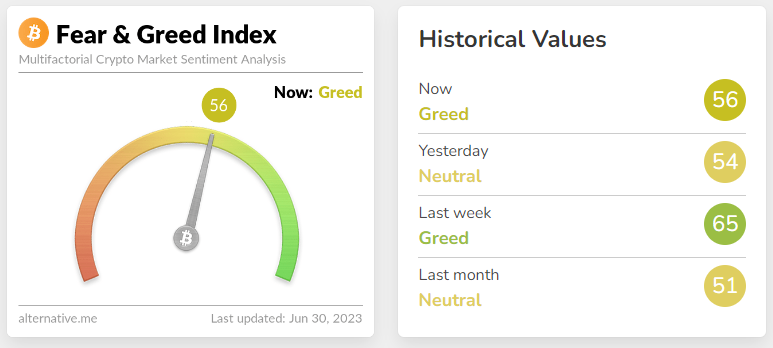

The way people feel significantly impacts the cryptocurrency market. To navigate these emotions, the Fear and Greed Index plays a crucial role. This index is built upon two fundamental concepts:

- Extreme fear suggests a potential buying opportunity.

- Excessive greed signals an overheated market.

The index ranges from zero to 100, with zero representing extreme fear and 100 indicating extreme greed.

Today’s Fear and Greed Index stands at 56, indicating an increase of 9 points compared to the reading from two weeks ago. It is crucial to note that the Fear and Greed chart undergoes daily fluctuations; therefore, it is essential to stay updated by regularly monitoring it.

On the Flipside

- While the Fear and Greed Index currently stands at 56, indicating moderate sentiment, critics argue that relying solely on such an index may oversimplify the complexities of the cryptocurrency market.

- There are differing opinions among traders on the significance of the support and resistance levels mentioned. Some believe that these levels may change rapidly based on market conditions, making them less reliable for precise predictions.

- There is a significant lack of trading volume in the market, which could hinder the sustainability of price movements.

Why This Matters

The latest developments in the cryptocurrency industry, including Fidelity’s entry into the Bitcoin ETF race and MicroStrategy’s substantial Bitcoin acquisition, underscore the growing mainstream acceptance of cryptocurrencies.

These events contribute to the increasing adoption of Bitcoin by institutional finance players, paving the way for more widespread integration of digital assets into traditional financial systems. Traders and enthusiasts alike should closely monitor these developments as they shape the future landscape of the crypto market.

Check out the last DailyCoin Regular to get a comprehensive analysis of the BlackRock ETF and community sentiment on Bitcoin. Learn more here:

DailyCoin Bitcoin Regular: BlackRock ETF? Community Sentiment, and Price Analysis

To learn more about recent XRP whale activity amidst a market dip, read here:

XRP Whales Seize Opportunity: $170 Million Acquired Amid Market Dip