- Bitcoin ETFs continue to maintain their positive momentum in February.

- After Bitcoin tapped $64,000, the ETFs followed suit, breaking numerous records.

- Bitcoin ETFs’ success raises concerns of an impending supply crunch.

February has been quite an eventful month for Bitcoin, as the reigning crypto king moves full steam ahead toward its previous all-time high. Mirroring this heightened market enthusiasm, the ETF industry is also following suit, witnessing record-breaking numbers just as Bitcoin comfortably tops $60,000 heading into the new month.

Bitcoin ETFs Break More Records

Since gaining approval, Bitcoin ETFs have performed remarkably, reeling in billions of dollars in volume and inflows, serving as a testament to the growing demand and popularity of the token as an investment.

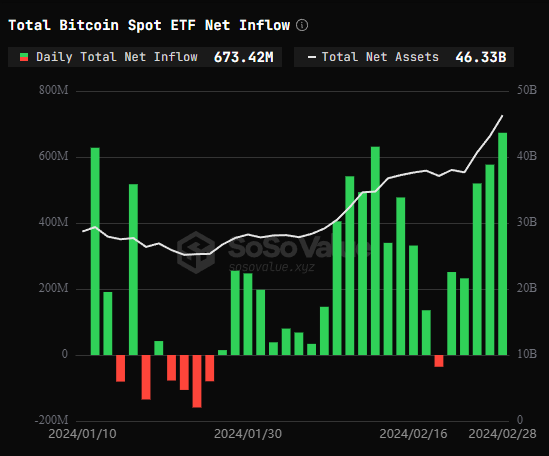

After wrapping up the first month of trading with over $10 billion in assets under management, Bitcoin ETFs maintained the positive momentum, doubling it to $20 billion by February’s close. It also broke a myriad of records on the last day of the month, marking a new all-time high in net inflows and volume.

Sponsored

On February 28, Bitcoin ETFs hit a record-high volume of $7.4 billion with a total net inflow of $673 million. While Grayscale continued its outflows, the remaining nine ETFs saw a net inflow surpassing $890 million.

BlackRock led the charge by setting a new all-time high, attracting over $612 million. Fidelity and Ark 21Shares followed suit, collectively reeling over $260 million.

These milestones come on the heels of Bitcoin’s ongoing rally as it soared past $60,000. Additionally, they also coincide with the countdown to the halving, which has recently sparked concerns about a potential Bitcoin supply crunch.

Bitcoin Looming Supply Crunch

Since gaining approval in January, Bitcoin ETF managers have quietly gobbled up hundreds of thousands of bitcoins. BlackRock alone holds over 150,000 bitcoins. With Bitcoin producing 900 coins every day and that number set to halve after April, a looming supply crunch is on the horizon as issuers ramp up their accumulation.

Sponsored

Analysts express concern that if Bitcoin ETFs maintain their shopping spree, their yearly haul could outstrip Bitcoin’s production. The impending supply crunch could later trigger a Bitcoin price explosion, propelling it to unprecedented highs beyond its previous all-time high.

On the Flipside

- With the intense institutional interest in Bitcoin, there are concerns that retail investors could face challenges in accessing and participating in the market.

- Bitcoin’s ascent to $64,000 and its subsequent drop wiped out over $700 million in 24 hours across crypto-tracked futures.

- MicroStrategy, the largest publicly traded holder of Bitcoin, holds 174,000 bitcoins.

Why This Matters

Bitcoin’s ongoing rally catalyzes an impending supply crunch as financial giants fill their bags, leaving only crumbs for retail investors seeking to claim their share.

Find out what happened to Coinbase:

Coinbase Crash: Users Report $0 Balances as BTC Crosses $63K

More on Bitcoin:

$736M Liquidated: Bitcoin Seesaw Gets Traders Rekt Both Ways