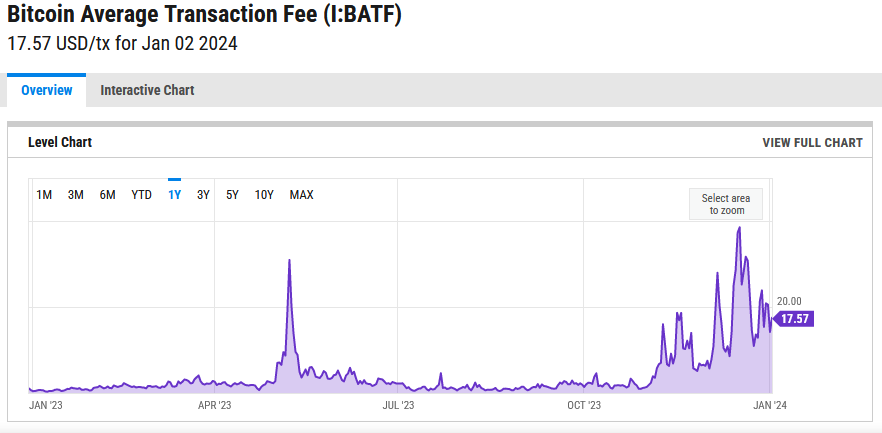

- Daily Bitcoin fees have risen significantly since December 2023.

- The Bitcoin network now generates more fees than any other blockchain.

- The knock-on effect is negative for users.

Transaction fees are critical for incentivizing network support from miners and validators. Transaction fees are dynamic and typically depend on the level of network activity, with high network activity generally equating to higher fees to use the network.

With the growing popularity of Ordinals, competition for Bitcoin block space is heating up, pushing transaction fees higher. Daily Bitcoin fees are now greater than all other blockchains, including Ethereum, which already has a reputation for sky-high fees.

Bitcoin Fees Now Highest of Any Chain

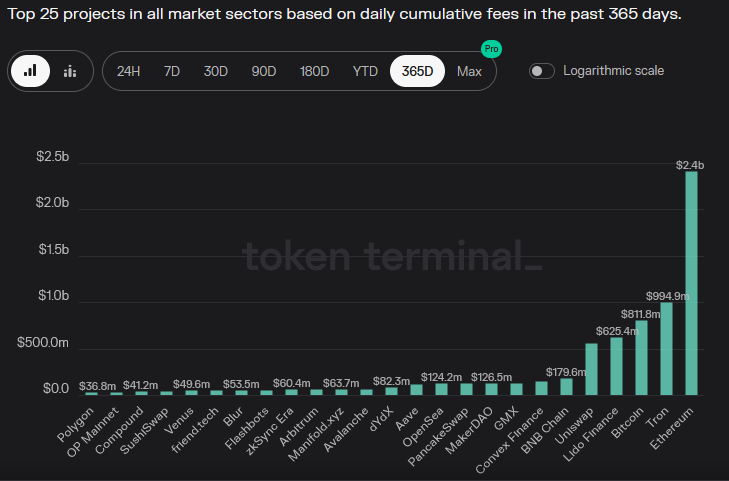

Will Clemente, co-founder of Reflexivity Research, noted that daily Bitcoin fees now consistently exceed those generated by other blockchains, including Ethereum. Using information from the data platform Token Terminal, Clemente found this pattern consistent across the daily, weekly, and 30-day time frames, indicating that this phenomenon is relatively recent.

Sponsored

Clemente calculated that Bitcoin’s annual network fees will come in at around $4 billion, based on the 30-day figure of $340.3 million, representing the daily cumulative fees over the past 30 days. The Reflexivity Research co-founder labeled this a boon for miners and “bullish for the security of the network.”

Zooming out to the 90-day showed that Ethereum generated the most daily fees on this time frame at $653.5 million, with Bitcoin placing second highest at $513.3 million and Tron third at $ 304.9 million. The changing dynamic of daily fees becomes clearer when examining the 365-day time frame, which puts Ethereum first with $2.4 billion in fees generated, Tron second with $994.9 million, and Bitcoin third at $811.8 million.

Apportioning Bitcoin’s 365-day cumulative fees on a 30-day basis equates to $67.65 million per month, which is approximately a fifth of the current 30-day rate of $340.3 million, highlighting the scale of the jump in fees since December. This spike is attributable to the resurgence in Ordinals Inscription activity, competing with monetary transactions for blockchain space.

Ordinals are to Blame

The recent spike in Bitcoin fees corresponds directly with the increase in Ordinals Inscriptions vying for blockchain space. According to Dune Analytics, over 53 million Ordinals Inscriptions have been written in the BTC blockchain, with hundreds of thousands of Inscriptions typically recorded daily.

Sponsored

Data from YCharts showed the average fee paid by users trending higher from November 2023, peaking at an average cost of $38.43 per transaction on December 17, 2023. Although the average transaction fee has since fallen to $17.57, there is no indication that demand for Ordinals will subside, fostering expectations that users will be forced to lump high Bitcoin fees for the foreseeable future.

On the Flipside

- While Clemente focused on the benefit to miners and network security, more fees generated come at the expense of users footing the bill.

- Fees can fluctuate wildly according to network demand, but Ordinals has created a consistent large-scale demand on the BTC network.

- Blockchains designed from the ground up as low-cost networks now have the opportunity to gain market share.

Why This Matters

Theoretical supply-demand dynamics suggest that users will leave Bitcoin for cheaper blockchains. But in practice, no other blockchain offers the same degree of security and trust, meaning many users will bear higher Bitcoin fees to keep using the network.

Read more on Grayscale’s latest bid to push through its Bitcoin ETF offering here:

Grayscale Bitcoin ETF Bid Questioned Over Amended Filing

Find out about the new US crypto tax requirement deemed almost impossible to comply with:

New IRS Crypto Law Targets Traders with Ambiguous Tax