Cryptocurrency exchanges are witnessing the new record amounts of Bitcoins departing from the accounts.

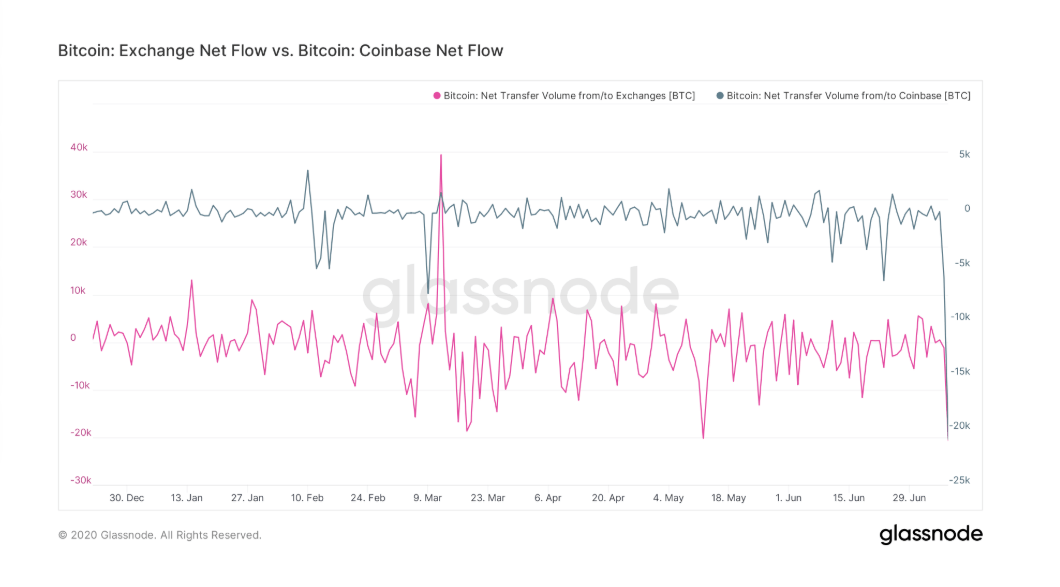

The highest year-to-date number of the world’s dominant digital assets was taken out of the custodial cryptocurrency exchanges this week. According to the data of crypto research company Glassnode, 20,660 more Bitcoins (worth of over $191 million) were withdrawn than deposited on July 8.

Coinbase, the US biggest cryptocurrency exchange, was at the top of the list with an even bigger amount of 20,787 Bitcoins being withdrawn from its custodial Bitcoin accounts. The amount equal to around $192 million is higher compared to the total for all other digital asset exchanges.

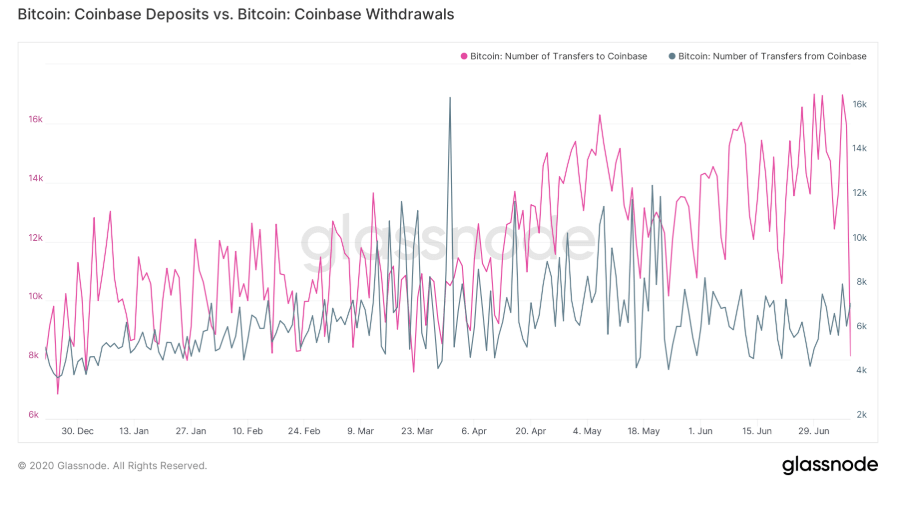

Interestingly, the data reveals the sharp contrast among the number of Bitcoins that were deposited and withdrawn into the Coinbase exchange. As the chart shows, the exchange currently recorded around 10 thousand more deposits (over 16k) compared to the significantly lower number (around 7k) of withdrawal orders.

The high amount of Bitcoins leaving the exchange and the respectively low number of the withdrawal transactions suggests that bigger amounts were taken out by fewer investors. This means massive exit is caused by major investors, or in other words – Bitcoin whales.

Sponsored

Historically, the fact of whales moving their digital assets out of the trading platforms to safer places like cold storage cryptocurrency wallets, assumes large investors are looking to hold their assets. Since whales tend to secure their Bitcoins, this might be a positive signal to the leading cryptocurrency and its price.

According to market experts, the massive withdrawals indicate the upcoming bull trend, which usually starts months after the average withdrawal hits the year-high. As claims market analytic Ki Young Ju, the CEO of digital asset research company CryptoQuant, the best time to buy Bitcoins is especially when the big investors leave the exchanges:

In the meantime, the whale’s retraction is not the only indicator that Bitcoin is preparing for the new bull run. The fundamental factor like hash rate suggests the benchmark cryptocurrency might soon jump the uptrend. The hash rate of Bitcoin is currently sitting at the all-time highs of around 125 TH/s. Meanwhile, the increasing usage of stablecoins is also acting as a support for the Bitcoins price increase. According to the same Glassnode, the increased stablecoin supply signals that the buying power of Bitcoin can also grow.