- Crypto lobbying expenditure has increased by a staggering 1,130% in the last five years.

- Crypto lobbying has more than doubled every year in that period.

- The surge in lobbying expenditure reflects increasing regulatory scrutiny of crypto.

As the crypto industry faces increased regulatory scrutiny, crypto companies are fighting back. Major players in the crypto space are investing significant amounts of money into efforts to sway politicians and regulators. This is why crypto lobbying expenditure has increased by 1,130% in the last five years.

What Drives Crypto Lobbying?

Louis Schoeman, a crypto expert at Forex Suggest, offered his insights on the rapid increase of lobbying expenditure in the crypto industry. In a Monday, July 31 statement to DailyCoin, he highlighted the various challenges and setbacks affecting the industry’s credibility.

Schoeman explained, “The crypto industry has faced significant challenges and setbacks which have affected the industry’s credibility. Scandals, catastrophic firm crashes, plunging cryptocurrency values, plummeting funding levels, and users fleeing the industry to place their hard-earned funds into savings have all plagued the industry.”

Sponsored

He specifically pointed out the aftermath of the FTX scandal and the indictment of its prominent founder, Sam Bankman-Fried. These events have led the industry to strive to rectify the damage, significantly increasing lobbying expenditure.

"Crypto firms are increasingly attempting to influence the regulatory process in order to ensure that any new legislation is in their best interests," Schoeman noted.

He further highlighted the threat of the Securities and Exchange Commission’s lawsuits against major crypto firms like Coinbase and Binance.

These lawsuits could challenge the prevailing notion and result in a shift in regulatory oversight by asserting the Securities and Exchange Commission’s (SEC) jurisdiction over the industry, which has long argued that tokens are not securities and, as such, should not be subject to SEC regulation,” Schoeman explained.

The Exponential Rise in Crypto Lobbying Expenditure

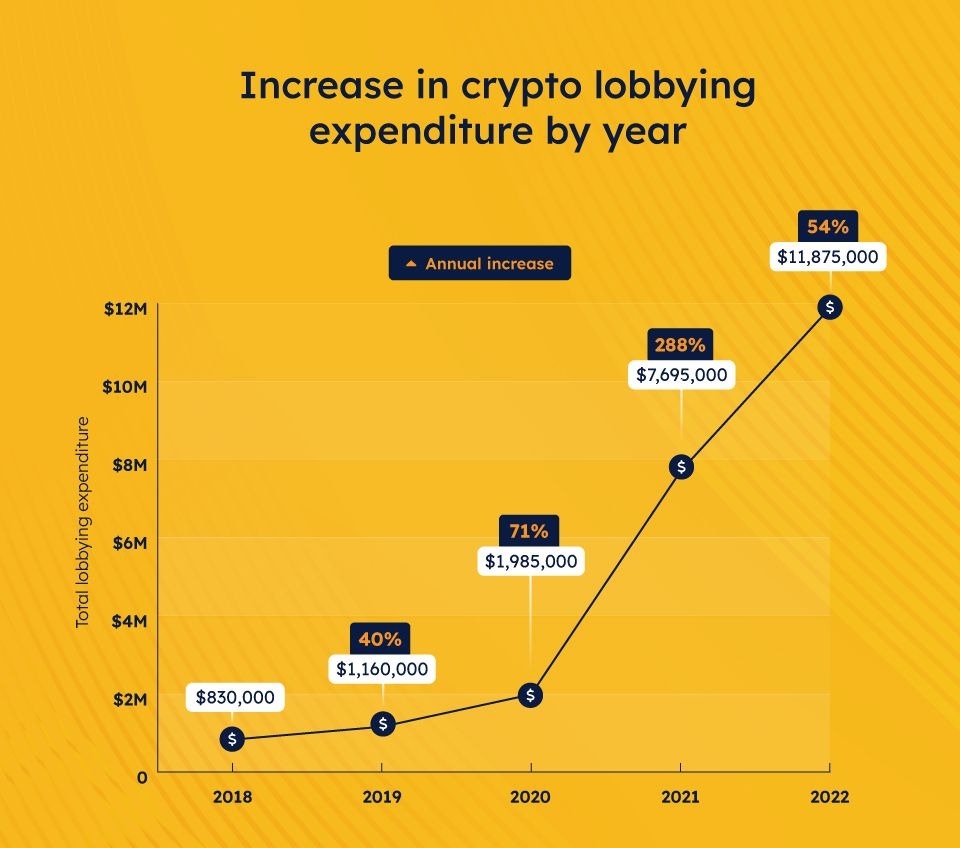

According to research by Forex Suggest, crypto lobbying expenditure in the United States has seen a dramatic increase of 1,130% over the past five years. Lobbying expenses rose from $830,000 in 2018 to $11,875,000 in 2022.

Sponsored

In 2022, the data showed a 54% increase in lobbying expenditure compared to the previous year. However, 2021 saw the most significant increase in lobbying expenditure, up 288% yearly.

Overall, crypto lobbying more than doubled yearly during that period, growing at an average rate of 113.3%. Moreover, if the current trend continues, crypto lobbying expenditure could reach over $133 million by 2026.

In crypto lobbying, certain companies have emerged as the top spenders. Coinbase leads the pack with a substantial expenditure of $3.39 million on lobbying the US Government. Following closely is the Blockchain Association, a non-profit committed to advancing the future of crypto in the US, with a lobbying expenditure of $1.9 million.

The third highest spender is the crypto trading platform, Robinhood, which spent $1.84 million on lobbying efforts. Looking at the total lobbying expenditure over the past five years, Coinbase remains the leader with nearly $5.52 million spent, followed by the Blockchain Association and Robinhood with $3.91 million and $3.89 million, respectively.

On the Flipside

- Based on past trends alone, it is impossible to predict where crypto lobbying will be in the future. However, crypto lobbying will likely follow if the industry continues to grow.

- While crypto companies are intensifying their lobbying efforts, it is not certain that they will convince lawmakers to take their side.

Why This Matters

The rise in crypto lobbying expenditure clearly indicates the industry’s efforts to influence regulatory processes and ensure favorable legislation. This trend could significantly impact the regulatory landscape of the crypto industry.

Read more about crypto lobbying efforts:

Crypto Lobbying Rose 922% in the Last 6 Years – Coinbase Leads

Read more about the SEC’s latest crackdown on the crypto industry:

SEC Going After Crypto Auditors? Commissioner Peirce Dissents