- Elliptic sounds the alarm on the growth of cross-chain crime.

- Laundering of illicit funds cross-chain has almost doubled since last year.

- Cross-chain DEX THORSwap has been singled out by authorities.

Cryptocurrency-related crime has been drawing increasing attention and concern, threatening to undermine public trust and stifle mainstream adoption of digital assets. Criminals are using increasingly sophisticated techniques to evade detection and capture, with cross-chain crime identified as a problem area.

Elliptic, a blockchain analysis firm, defines cross-chain crime as the act of swapping crypto assets between different tokens and blockchains to obscure the origin of funds and launder illicit proceeds. The firm has observed that cross-chain crime is growing at a rate beyond its previous predictions.

Cross-Chain Crime Booms

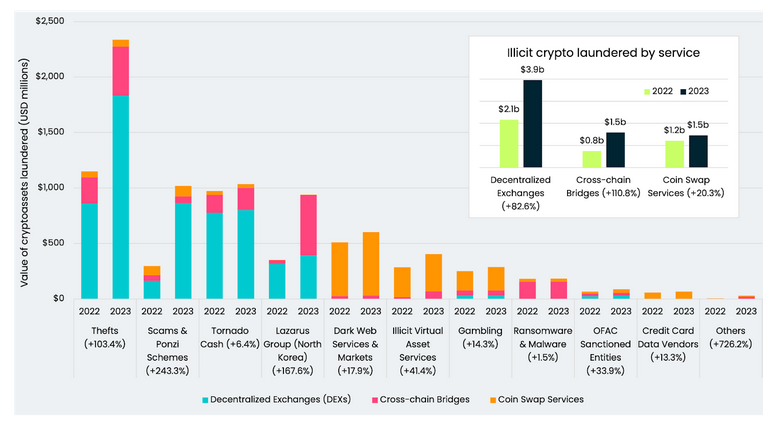

According to a new report from Elliptic, over $7 billion in illicit assets have been laundered cross-chain in 2023 so far. The firm had previously estimated that cross-chain crime would amount to $6.5 billion by the end of 2023, demonstrating a rate of growth faster than previously estimated.

Sponsored

Further illustrating the uptrend in cross-chain crime, Elliptic also mentioned that last year’s figure was calculated at $4.1 billion, which is almost half of the amount laundered in 2023 to date.

Elliptic blamed the upsurge in cross-chain crypto crime on most blockchain analysis solutions lacking the capability to detect and monitor the flow of funds once bridged to a different chain. What’s more, the firm also raised issues with some cross-asset service providers not enforcing KYC standards.

“These bad actors can therefore make their activities difficult to trace by engaging in prolific asset- or chain-hopping,” explained Elliptic.

Splitting cross-asset service providers by decentralized exchanges (DEXs), cross-chain bridges, and coin swap services showed that DEXs saw the biggest jump in laundering activity rising to $3.9 billion from $2.1 billion last year.

Sponsored

Of all the categories of crime that lead to cross-chain laundering, thefts, scams, and Ponzi schemes, the Lazarus Group saw the biggest increases from 2022, up 103%, 243%, and 168%, respectively.

While certain crimes propel most of the cross-chain laundering growth this year, authorities are starting to fight back with THORSwap set firmly in their sights.

THORSwap Under Regulatory Pressure

Cross-chain DEX THORSwap shocked the crypto community with the announcement that its front end would enter “maintenance mode” on October 6. The move was the result of pressure from authorities, who had raised exceptions over the heightening prevalence of criminal activity on the platform.

In general, the crypto community responded negatively to the news. In turn, this reignited debate around users’ privacy rights and whether authorities are correct to intervene at the expense of individuals’ rights.

On the Flipside

- Crypto criminals and investigators are locked in a game of cat and mouse, with the latter playing catch-up.

- The growth in cross-chain laundering foreshadows potential issues as blockchain interoperability expands.

Why This Matters

As long as criminals exploit crypto, authorities have political cover to impose draconian rules that stifle innovation and violate privacy. Preventing criminal abuse of crypto cannot be at the expense of civil liberties and fostering technological progress.

Learn more about authorities clamping down on the THORSwap cross-chain DEX here:

THORSwap Slams Emergency Brake as Regulators Come Knocking

Find out about the flaw in Friend.Tech’s security process here:

Flurry of Friend.Tech SIM Jackings Put Users on High Alert