Cardano smart contracts are a staple of the ADA ecosystem. These decentralized agreements form the backbone of innovative applications and products on the Cardano network and are inherently designed to be efficient and secure.

While Cardano smart contracts are theoretically similar to those of other languages, some things still set them apart.

What are Cardano smart contracts, and how are they different from those on Ethereum (ETH) or Solana (SOL)?

Table of Contents

What are Cardano Smart Contracts?

Cardano smart contracts are self-executing programs that automatically trigger when certain specified conditions are met. It’s a bit like a regular contract, except that all individual processes are automated, like signing, verifying, and executing contractual terms.

Sponsored

That all sounds very simplistic. What’s the real benefit here? Why are smart contracts such a big deal?

Smart contracts are a powerful innovation because they facilitate a much more streamlined contract execution process. Instead of dancing through hoops and paying fees to intermediaries whenever you want to trade financial assets, record data, or execute any blockchain activity, smart contracts mean you can bypass all the middlemen.

What Makes Cardano a Good Environment for Smart Contracts?

Cardano has proven itself a top-tier blockchain network for smart contract development. With its unique infrastructure and thriving community, the Cardano network was crowned Santiment’s #1 platform for blockchain developers in 2023.

Sponsored

Cardano is best known for being the world’s first blockchain to be designed from the ground up using academic theory and a research-driven approach. As a result, the Cardano network has enjoyed unmatched security and stability. Cardano is one of the only leading Layer 1 blockchains that can attest to having 100% since its launch.

On top of that, Cardano is also extremely energy-efficient and affordable to use. While legacy networks like Ethereum battle with high gas fees and slow transaction speeds, Cardano’s impressive scalability means it can support thousands of smart contracts without debilitating gas spikes and dropped transactions.

How are Cardano Smart Contracts Different?

By this stage, you might be wondering, what makes Cardano smart contracts different from those we might find on other networks like Ethereum and Solana?

The use cases aren’t vastly different. Despite being slightly different in architecture, smart contracts on all networks are designed to serve similar purposes.

However, some factors still set Cardano smart contracts apart from those we might find on other networks. Cardano smart contracts are written in Plutus, a Haskell-based programming language specifically designed for the Cardano blockchain.

This is both a blessing and a curse. Plutus is a secure and diverse programming language that allows for plenty of composability and developer creativity, but it’s also quite niche.

Languages like Solidity and Rust are used on several blockchains, but Plutus is exclusive to Cardano. Finding Cardano developers is much harder than finding developers for other networks because budding programmers need to learn Plutus before building on the network instead of applying common languages they might already be familiar with.

While this might add a layer of prestige to Cardano’s development, it also raises the barrier to entry.

Cardano Smart Contract Growth

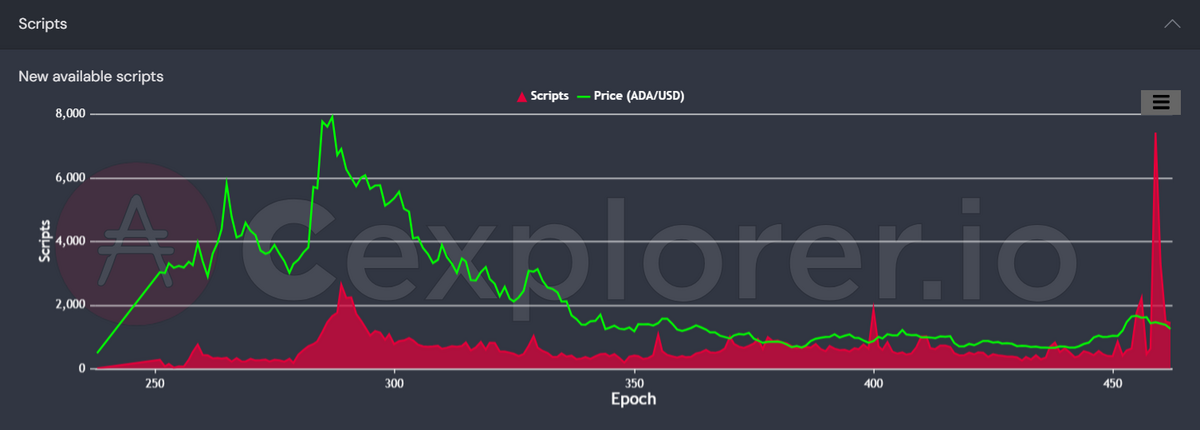

As you can imagine, a booming crypto market has encouraged a surge of developer activity on Cardano, with developers eager to build new applications ahead of a future bull run.

In particular, the number of new Plutus scripts deployed on Cardano has rapidly increased in recent months.

On-chain data shows that over 10,000 smart contracts have been deployed in recent months, with massive spikes of developer activity becoming increasingly common.

Seeing the trend sustained as the crypto market continues to heat up would be unsurprising.

Cardano Smart Contract Pros and Cons

Cardano smart contracts come with their fair share of positives and negatives. Let’s recap the key points.

Pros

- Secure and Composable – Plutus, Cardano’s native programming language, is designed to create safe and versatile smart contracts.

- Wide Variety of Use Cases – The potential use cases of Cardano smart contracts cover dozens of industries, with more utilities being discovered.

- Growing Demand – The surging amount of Cardano smart contracts being deployed proves there is plenty of demand for Cardano-based applications.

Cons

- Low Developer Supply – Plutus’ exclusivity means that native Cardano developers are in short supply. This might stifle adoption and contribute to Cardano’s sluggish growth compared to other networks.

On the Flipside

- Cardano smart contracts are not too different from those on other networks like Ethereum and Solana, which are far more accessible.

Why This Matters

Cardano smart contracts are a key feature of why the Cardano network has the potential to be so disruptive and successful in the future.

FAQs

Plutus is the main programming language used to create Cardano smart contracts.

Ethereum has the largest number of smart contracts deployed on-chain across all networks.

That depends on your investment strategy and goals. Different smart contract cryptos have vastly different levels of risk. We recommend that you conduct thorough research and never buy more than you can afford to lose.