2020 will be written in the history of bitcoin. Not only because of the pandemic, but due to the incredible price spurt, new record highs, and major tectonic shift in adoption.

Bitcoin climbed over 600% since Black Thursday in March and broke its new all-time high of $29.285 on the last day of the year. But unlikely its previous boom of 2017, the market makers behind the bull rally are different now. Mega wealth or institutional capital started to enter the game. Take a look at what effect it might have on cryptocurrency markets in the upcoming year?

The role of pandemic

Global COVID-19 pandemic shook up the economies and traditional markets this year. The major stock market indices like the FTSE, Dow Jones and Nikkei experienced the biggest falls in three decades.

The central banks cut interest rates to make borrowing cheaper and boost spendings to help the economies. Governments responded with economic relief measures and stimulus that only accelerated a threat of inflation.

Sponsored

Expansionary monetary policy stabilized the financial system. However, its rate went from about 5% a year to 15% a year making the US dollar lose its purchasing power nearly three times faster. Keeping big amounts of cash in personal and corporate accounts became risky as the savings were simply melting.

The investment options

Businesses and institutions were forced to look for options on how to diversify corporate treasury. The biggest challenge in times of global pandemic, appeared to be finding the best store of value asset, says Michael Saylor, the CEO of MicroStrategy, one of the biggest bitcoin investors.

According to him, there were not many options to choose from. Bonds do not generate a yield big enough to cover a 15% yearly loss of purchasing power. In stocks, only a few massive growth tech companies can surpass the rate. Growing real estate rents by 15% is not an easy task either in the current pandemic world. Even investments in scarce assets like gold has its risks, says Mr. Saylor:

The problem with gold is that gold miners produce 2% gold every year, so there's a built-in 2% inflation rate in gold. And then it’s centralized, it’s corruptible and you can print more gold derivatives. And that drives the price down.

In such circumstances bitcoin becomes the only “ultimately scarce” investment asset, claims MicroStrategy’s CEO. The world’s biggest crypto surpassed the 15% yield barrier in a single week, increased over 50% during the past month and its future price forecasts are even brighter.

The institutional choise

Microstrategy poured over $800 million into bitcoin this year and became one of the institutional pioneers showing their trust in crypto. British investment firm Ruffer Investment entered into BTC with another $744 million this month.

Insurance company MassMutual made a $100 million investment, financial giants like Fidelity and Square chose BTC as a hedge of their capital. The biggest crypto investment manager Grayscale accounts for over $16 billion AUM (Asset Under Management) in its Bitcoin Trust.

Wall Street billionaires become bitcoin advocates. Hedge fund investor Paul Tudor Jones compared bitcoin with internet stocks in their infancy, forecasting the sharp price growth. The global CIO of the multi-billion Guggenheim Investments claims bitcoin is still undervalued. Even the world’s largest asset manager BlackRock, with nearly $7 trillion AUM prepares for crypto-related offerings.

The winning investment asset

Despite the fact that bitcoin is still too volatile, the investors see it as a potential store of value, which is one of the reasons why so many of a big capital turn to the leading crypto, says Tom Jessop, President at Fidelity Digital Assets.

Since bitcoin is of a finite 21 million supply, the growing demand makes it resistant to depreciation. This means its value is and the buying power is meant to increase over time.

Accordingly, bitcoin is a decentralized store of value. No one owns the technology behind it, plus it is controlled by all bitcoin users. This makes bitcoin immutable for changes. Incorruptible and censorship-resistant digital currency acts as a property that any government can’t seize. According to Michael Saylor:

Bitcoin is at the point where it hasn’t been hacked in 12 years. It’s been copied 10 thousand times, but it’s the winner. When something is hundreds of billions of dollars and 20 times bigger than the next like-kind thing, that is the winner.

Technically and politically supported

During the past few months, bitcoin became more available for mainstream use. Anyone with an iPhone or PayPal account can plug into its network as easily as never before.

PayPal, the world’s biggest online payment platform with over 325 million active users, enabled cryptocurrency buying and trading services. Hundreds of millions of Apple Pay users in 60 countries have the ability to buy bitcoin after service integration with Lumi cryptocurrency wallet.

Square’s Cash App, a mobile payment service with over 30 million active users, generated over $1.63 billion in revenue in Bitcoin during Q3 2020. This is a more than 1000% increase compared to the same period of last year.

Two of the world’s largest digital currencies – bitcoin and ether – are recognized by the United States SEC and IRS. During the past few years, the US Congress introduced 40 cryptocurrency and blockchain bills.

The European Union adopted a comprehensive package of legislative proposals for the regulation of cryptocurrency assets. The moves in both continents suggest the two biggest digital currencies are politically adopted, regularized, and thus cannot be banned.

Factors that trigger the changes

The narrative

In a year of a global pandemic, bitcoin is changing its narrative. It is no longer a speculative asset traded by retail traders, but “the world’s best long duration investment grade safe haven treasury asset”, says Michael Saylor, the man behind hundreds of millions invested in bitcoin:

Bitcoin is something you're gonna use to give money to your grandchildren. It’s gonna be here for 30 years, 40 years. This is the ultimate long duration safe-haven asset.

The investor believes that the shift in bitcoin’s narrative has enough power to trigger significant future changes. However, the theory of bitcoin as a long-term investment asset is still young as only 1% of the world’s population is following it. But it’s just a matter of time when another 99% will join.

The conservative companies like MassMutual with a $230 billion dollar general fund are discovering bitcoin. Their $100 million investment is quite small, claims Mr. Saylor, but what happens when such giants decide to pour 1% or 2% of their capital into the leading crypto?

Accordingly, the world’s total amount of financial assets (stocks, bonds and real estate) is around $300 trillion. Half of these investments are held as a store of value, meaning the main reason for holding them is their resistance to depreciation, not loyalty, emotional attachment or any other specific reason.

In times of pandemic, inflation, and low interest rates, there is no fundamental argument why $150 trillion dollars could not be shifted into bitcoin.

High return rates

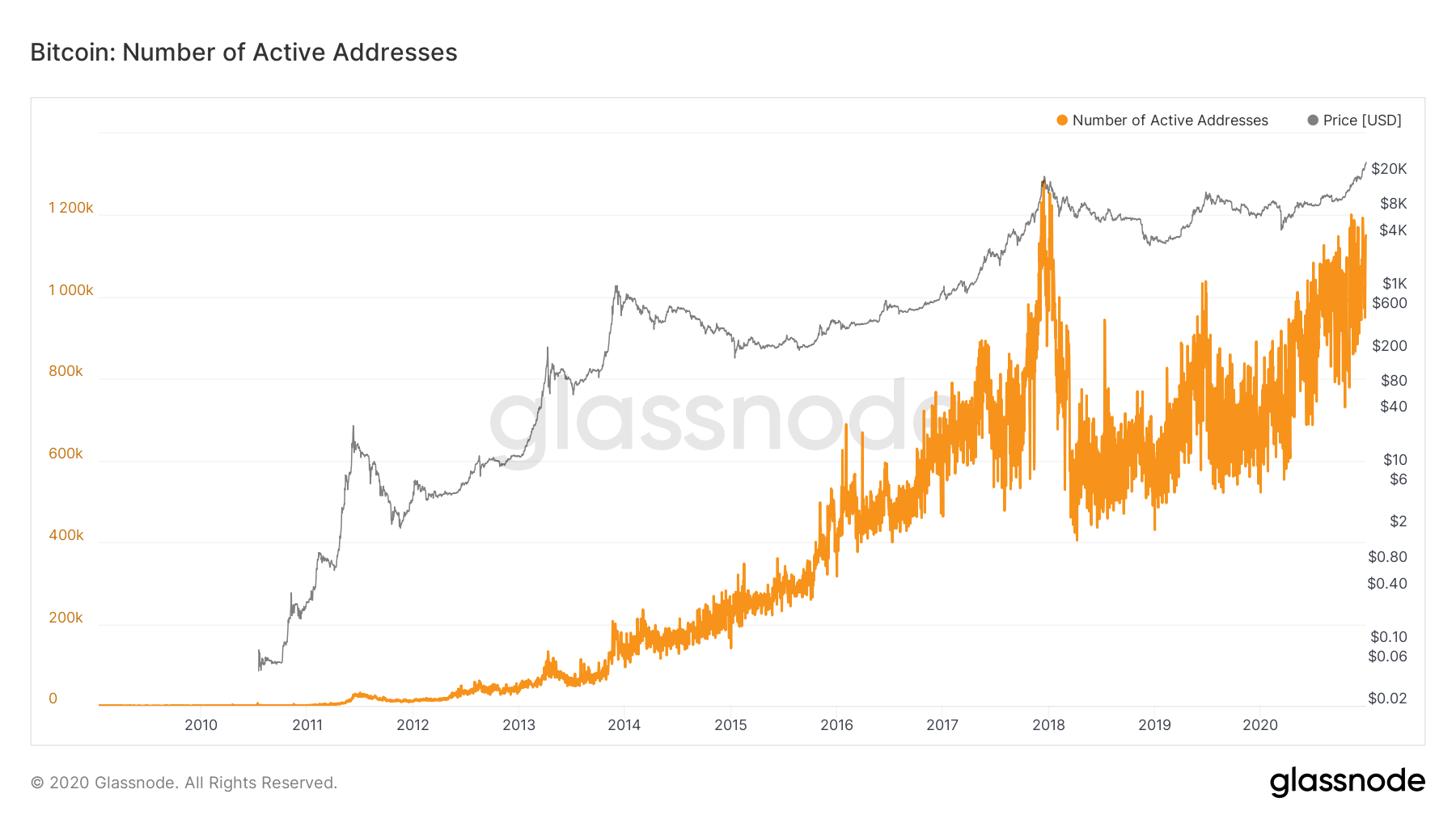

Bitcoin is a great example of Metcalfe’s law. A concept used in computer networks and communications states that the value of a network is proportional to the square number of connected users.

The value of bitcoin grows proportionally as the activity of its users. As bitcoin rallied to its new price highs this November-December, its network was also seeing the growth of active users and entities as shown in Glassnode’s statistics.

In terms of price surge bitcoin became one of the best-performing assets this year, whose returns outperformed traditional safe haven investments like gold. Its price has risen over 40% during the past month alone.

In times of historically low interest rates and increasing inflation, bitcoin is the institutionally acquired asset to preserve wealth and purchasing power. Furthermore, one can expect to double it every year for the next three years, says Michael Saylor.

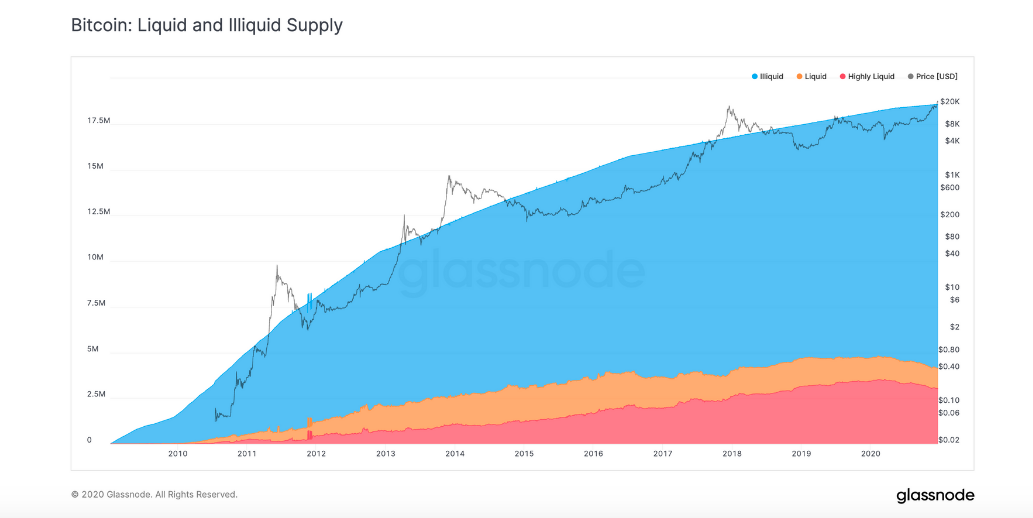

As Glassnode recently reported, 14.5 million (78%) of circulating bitcoin supply is held by illiquid entities. “A sustained rise of illiquid bitcoins is an indication of strong investor hodling sentiment and a potential bullish signal,” says the company.

On the flipside

- Bitcoin becomes the playground of the mega big capital. Its price movements rely on the sentiments and investment strategies of big players.

- Retail investors trade on a small scale and cannot control how the whales play.

- To make an impact – mass adoption in retail is necessary. Younger generations are onto crypto, but the majority still need encouragement and education on digital currencies.

Can capital switch trigger a massive FOMO in 2021?

The world already has COVID-19 vaccines. But even if they prove themselves to be effective, the pandemic legacy on economies will not disappear fast. Government debts, low interest rates, and the melting purchasing power of fiat currencies will keep us looking at how to preserve our wealth.

Bitcoin has strong fundamentals to be the winning investment for the upcoming years. Nevertheless, the general acknowledgment of BTC as a long-term store of value is yet in its initial stage. The growing acceptance will inevitably accelerate the transition and bitcoin adoption rate.

With all this knowledge in mind, the question is what can we do today to feel proud of ourselves after five years?