The institutional adoption of Bitcoin has started. Institutional investors or mega whales enter the market lured to profit from digital assets.

Bitcoin increased over 330% during the year of pandemic, zero interests and inflation of fiat. In just a few months financial giants like MicroStrategy, Ruffer Investments, MassMutual included Bitcoin in their portfolios. GrayScale Bitcoin Trust accumulated over $13 billion assets under management.

The number of whales is at an all-time high. Over 2300 wallets combined hold more than 1000 BTC, which is around 42% of total BTC supply. Moreover, since the start of the recent bull rally, whales have sent hundreds of thousands of BTC to smaller wallets holding under 1000k BTC.

As mega whales become a significant force behind the crypto market, the big question is how will they change the playground?

The types of investors

Before diving deeper to explore what power whales have on other investors, let’s have a look at their types.

Sponsored

Generally investors can be grouped into two opposite categories – individual and institutional ones. Both categories have different investment terms, goals or risk tolerance. Their income expectations and liquidity needs also vary.

- Individual (retail) investors

Individual or retail investors are non-professionals, usually speculators, day traders or small investors. They have smaller purchasing power than institutional counterparties, might trade less frequently and follow trends instead of setting them.

- Institutional investors

Institutional investors are professional market movers that make large transactions on behalf of their clients. Mostly they are pension funds, hedge or mutual funds, banks, endowment funds, insurance companies.

Sponsored

Institutional investors or mega whales are considered as better educated. They use advanced trading techniques, have teams of analysts and access to in-depth market data and financial analysis when choosing investment options.

The role in the economy

Large players are an important part of economic growth as they ensure the functioning of capital markets. Institutional investors aggregate capital necessary for growth of businesses and for liquidity of the markets.

Mega whales make markets more institutionalized, says PwC, as their interest sets requirements of transparency, increased liquidity and investment predictability.

Due to the pressure for higher returns and commitments to clients, institutional investors are obliged for more responsible investing. This means taking complex investments across different asset classes and refraining from risky assets. From this perspective, their investments in digital currencies can be perceived as a good sign indicating trust and price growth.

How do they affect the markets?

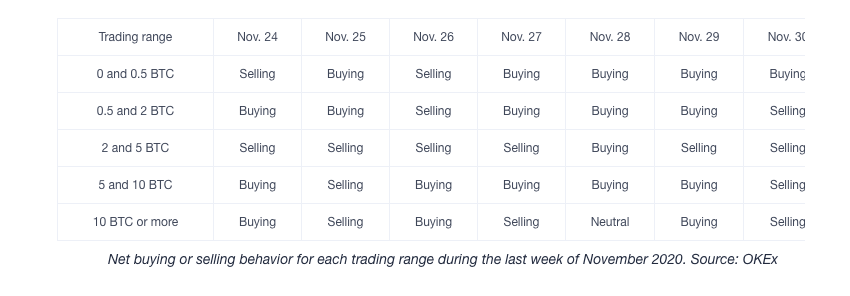

During the bitcoin bull rally in November 2020 big investors took profits when BTC reached its new all-time highs. On vice versa, they executed more buying trades as soon as bitcoin started recovering after the price drop.

Meanwhile individual investors acted completely the opposite. They chased the rallies. Retailers bought bitcoin when prices increased and sold when they dipped, reported OKEx crypto exchange.

As shared data shows, whales and individual investors act totally different when markets thrive and crash.

When big players trade, they often do it with massive inflows of funds to drive the market. Large buy or sell orders send signals to other investors, trigger the sentiments and lead to sudden and significant price changes.

A massive buy order moves the price up as it creates a false picture of higher demand. While the significant sell order suggests investors should get worried and thus moves the prices into the exact opposite direction. Echoing the OKEx:

Large traders, whales and institutions are in the business of buying low and selling high. It is not in their interest to continue buying coins at new highs and making them even more expensive.

The ways to manipulate

Big investors have levers to impact the crypto market. They can use methods like spoofing or layering to make prices move in their favour.

- Spoofing is a form of market manipulation when traders place large orders with no intention to execute them.The large bluff order is followed by a sequence of smaller ones placed simultaneously to create an appearance of high demand or selling.

- Layering is somewhat similar bluff, the only difference is multiple orders placed at different prices to manipulate selling or buying interest. Both methods are practices of disruptive algorithmic trading, when false orders are canceled prior to the deal’s execusion.

- Futures contracts allow betting on what asset’s price will be in the future and are optimal for manipulations. One of classical manipulations here is Banging the close, which involves placing a large volume of orders just minutes before the contract’s expiry time to influence the settlement price.

Often legal, but mostly prohibited by law, market manipulation is a part of the game. Different investors use different investment strategies to earn returns, and there it is possible to make some eloquent discoveries.

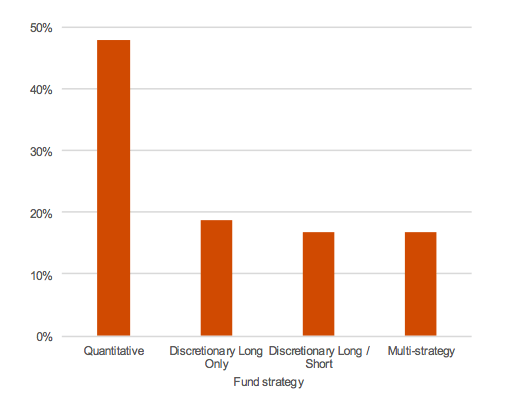

For example PwC study reveals that one of the most common investment strategies among crypto hedge funds is quantitative. Nearly half (48%) of most active global crypto hedge funds are using it.

Quantitative strategy refers to approaching the market “in either directional or a market neutral manner”. This means funds will be focusing on market-making (high volume trade), arbitrage and low latency (algorithmic) trades.

While all of the strategic trades include sophisticated algorithms, there is a room for interpretations on the manipulation possibilities. Used to improve liquidity through fast and frequent orders, algo trading is a controversial trading method, which can lead to large market fluctuations and help market makers take advantage over smaller investors.

Algorithmic strategies are highly popular among hedge fund investors. Their usage increased even more when big players entered cryptocurrency markets, says Neil Panchen, CTO at London-based hedge fund firm Altana Wealth. According to him, crypto market are still young for single strategy funds:

However, the market is not mature enough yet for single strategy funds, like arbitrage and event driven, to perform continuously through the full cycle.

Strategic approach

Meanwhile Ankush Jain, Chief Investment Officer at digital assets-focused investment firm Aaro Capital, claims that despite institutional focus on quantitative strategies, fundamental ones became highly profitable this year:

Growth can be mixed depending on the market environment at any moment in time, with most of the growth and focus in recent years centring on quantitative strategies. But with the market on a tear this year, fundamental strategies have started to achieve “very high returns”.

He also identified four general strategies in the blockchain and cryptocurrency hedge fund space that cover different risk/return profiles: market neutral, long/short, opportunistic and long-term.

Market neutral strategy tends to offer conservative risk profiles, lower risk and lower returns. Investors may generate 15-20% per year after fees. “That’s been particularly popular among institutional investors, who don’t want to take on too much directional exposure to the market.”, says Mr. Jain.

More directional long/short strategy offers higher volumes and more liquidity. The strategy is gaining traction from funds and is used in the derivatives market.

Opportunistic and long-term strategies are more fundamental and based on blockchain project developments or events. They work best during strong bull markets like the one of 2020.

How mega whales place their orders?

The most of the massive cryptocurrency transactions are done via the OTC (Over the Counter) desks. It’s an alternative to exchanges especially focused on high volume trades.

The OTC Markets Group reports $2.3 billion average daily volume on the OTC trades. It’s almost four times higher compared with around $540 million daily volume of Coinbase Pro. OTC Market Group operates the largest OTC markets in the US and Grayscale Bitcoin Trust (GBTC) sits on the top of its list.

OTC trades

The OTC trading is off-exchange and designed on high liquidity orders. The deals here are based on private, personalized and direct trades between two parties. Trades are not publicly listed and other market players are unaware and usually unaffected.

According to Ari Paul, co-founder of crypto investment firm BlockTower Capital, OTC responds two primary large order needs – providing liquidity and taking the risks that investors wish to avoid:

For larger orders OTC desks may give a better price than you could get yourself via their first function A: giving you access to hard to get liquidity. The OTC desk may be onboarded with 10+ crypto exchanges and has algorithms to execute a large order over time.

This is how OTC works. Let’s say an investor wants to sell $50 million of bitcoins immediately. Placing full order on the exchange is almost impossible due to liquidity and possible market collapse as retail investors follow the moves of the whales.

Even placing split orders might have a similar effect. Panic sales can push bitcoin price even lower, cause slippage and result in unprofitable orders or even losses.

In such situations OTC desks can be a solution. They can sell $50 million bitcoins to other OTC buyers or gradually trade them on the exchanges. OTC desks have higher balance sheets and are more resilient to the risk of asset price changes. We can say they work as a buffer to protect crypto markets from massive order risks. On the other hand OTCs are inseparable from crypto exchanges and can manipulate prices themselves.

But aren’t there any bright sides?

Institutional investors come to the markets that have reached a certain development stage and meet fundamental criteria, like regulatory basis, infrastructure or investor interest.

The regulatory framework sets the game rules and gives a degree of certainty that helps investors feel confident. Infrastructure development brings new financial products and services related to cryptocurrencies, allows setting up the structures compliant with AML (Anti Money Laundering) and KYC (Know Your Customer) requirements.

The cryptocurrency market has matured together with the appearance of institutional investors. It went through a significant evolution within the past years. Multiple traditional financial institutions entered the cryptocurrency business, crypto-related products were listed on stock exchanges.

The maturing crypto industry creates opportunities for new cryptocurrency businesses to emerge and develop. While the increasing public awareness results in broader academic studies and researches on blockchain and cryptocurrencies.

So what should you do to survive?

Retail investors trade on a small scale and can not control how the mega whales play. However, depending on their position, they still can take advantage of unethical market manipulations.

Mega whales invest on behalf of their clients and report on the results every quarter or every year. This leads to more frequent trading that can result in short-term volatility, which is most dangerous for day traders and short-term investors.

In such circumstances the best strategy for individual investors is thinking long-term, says alternative investment platform for individual investors YieldStreet. Ignore short-term market corrections, stay vested for the long run to avoid market manipulations.

Otherwise, look for unusual movements in average trading volume. Stay away from low volume cryptos. And follow the fundamentals: a strong performance of assets with weak fundamentals might signal manipulation.

Conclusions

Institutional investors trade frequently and in large amounts. Since they are the major traders in the crypto market, it is logical that their behavior affects its liquidity and consequently, volatility.

Normally, more liquid assets are easier to acquire and thus their prices become more stable. The perspective is quite nice for those expecting crypto to become a medium of exchange.

However, manipulative activity of market makers can have an opposite effect and highly increase asset’s volatility. Those sudden price changes might be useful for long-term investors, but they are highly risky for short-term traders.

Since the crypto market is based on speculations on assets value instead of on intrinsic value, it stays dependent on sentiments and investment strategies of big players.