- Officials say that the “digital real” could be a major boost for fintech firms.

- CBDCs could cut costs and enable completely new financial services.

- Fintech firms leverage technology to offer better financial services.

Traditional finance (tradFi) is long overdue for disruption. Brazil’s central bank believes CBDCs could unlock significant innovation in the financial technology industry. This could cut costs, expand access, and create new services, transforming banking for good.

On Monday, Brazil’s central bank announced a pilot project for the country’s digital currency. The bank set the public release of the “digital real” for 2024 after an initial testing phase and evaluation.

Digital Real Enabling Innovation in Fintech

The “digital real” will leverage distributed ledger technology (DLT) to democratize access to financial services. Brazil’s central bank says this system would reduce costs and enable significant financial innovation.

Sponsored

“This environment reduces costs and brings the possibility of financial inclusion for people,” Fabio Araujo, the initiative’s coordinator, said. “You have services that are very expensive to carry out, such as repo operations, which today are only for banks, but which could be performed by anyone with a technology based on digital currencies.”

Digital real would not just leverage digital payments, Araujo said. The country already has a popular instant payment service, Pix. Instead, the nation’s CBDC could create space for financial technology companies to innovate.

"This could reduce the cost of credit, the cost of improving the return on investments. He added that there is great potential for new service providers, fintechs, democratizing access to the market and offering new services," he added.

The financial technology (fintech) industry leverages technological innovation in the design of financial services. One example is Cash App, a company by Jack Dorsey’s Block. Others include Venmo, Klarna, Stripe, etc.

Sponsored

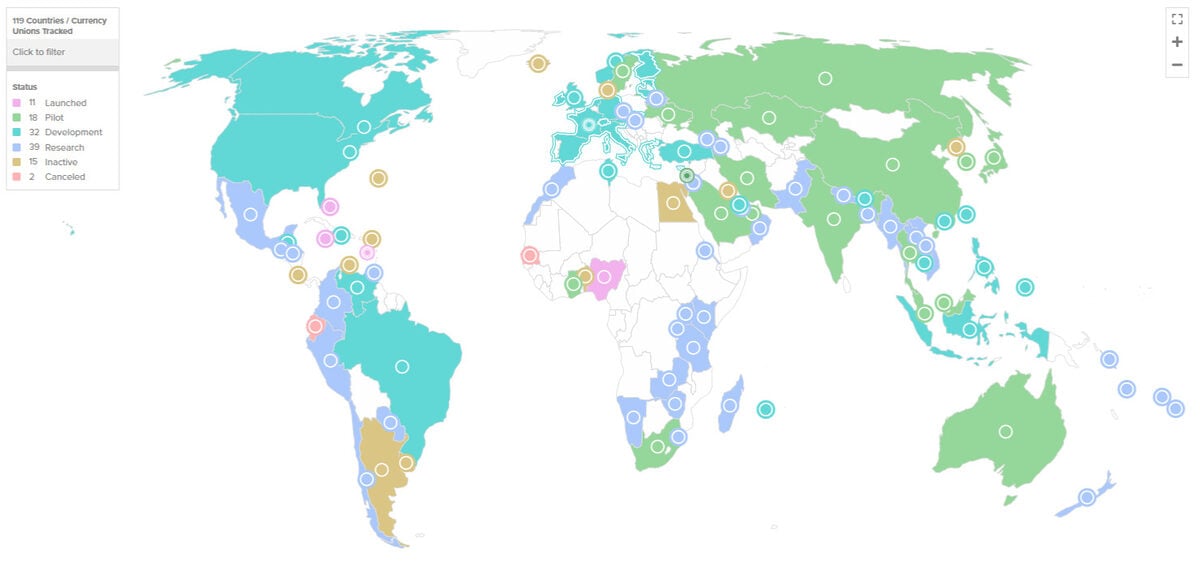

Brazil is the latest country to announce a central bank digital currency (CBDC) pilot. According to the Atlantic Council, almost every major developed country is at some stage of research and development of its own CBDC.

Source: Atlantic Council

CBDCs are a digital version of the government’s fiat currency. Like crypto, they leverage Distributed Ledger Technology. However, unlike crypto, CBDCs are centralized in the hands of the government.

On the Flipside

- The new system would not make banks obsolete. Bank deposits will continue to exist within the Brazilian CBDC, Araujo said. Banks rely on consumer deposits to generate credit for loans.

- Banks are eager to get in on the new wave of innovation. “Banks are very interested in this new tokenized world; in every conversation we have, they have shown a lot of interest,” Araujo said.

Why You Should Care

Fintech innovation could make financial services more accessible. It could also enable new financial products for consumers.

Read all you need to know about CBDCs:

CBDC Explained: Everything You Need to Know About Central Bank Digital Currency

Read about Binance’s regulatory troubles with SEC:

Voyager Bankruptcy Judge Gives SEC Ultimatum Over Binance.US Deal