- Bitcoin moves above $50,000.

- Retail interest falls as BTC posts new yearly highs.

- Institutional influence is growing.

Cryptocurrency markets are no strangers to turbulence, but Bitcoin’s journey in recent months has tested even the most battle-hardened investors. Although the US SEC eventually caved in and approved all BTC ETF applications on January 11, the ensuing 22% drawdown to $38,500 had many second-guessing their support for institutional players.

More than a month on, it appears that Bitcoin has bottomed from the post-ETF lows. BTC began moving higher over the past week to tap $50,400 in the early hours (UTC) of February 13 to record a more than two-year high. Retail investor interest has yet to mirror Bitcoin’s recovery, which has dipped since last month, according to Google Trends.

Bitcoin Searches Dip Lower

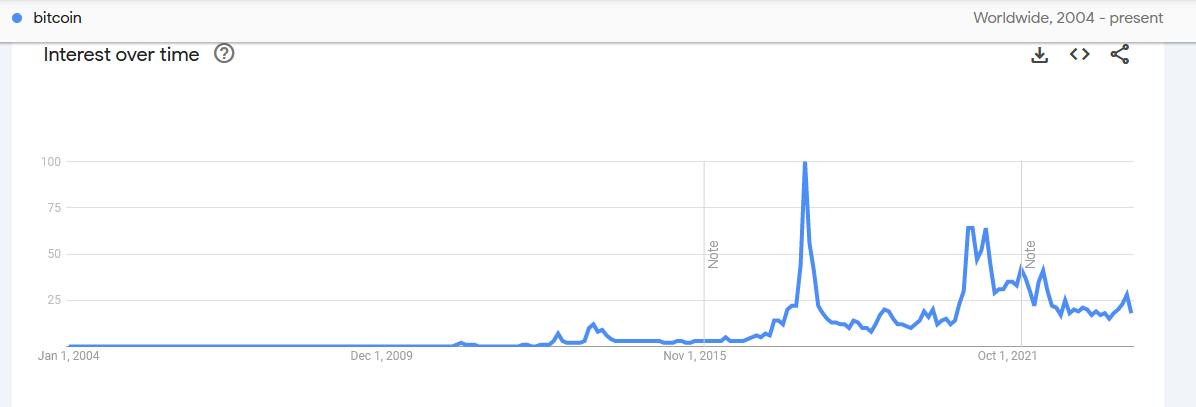

The depressed frequency of Bitcoin searches on Google was highlighted by YouTuber Elliot Wainman, AKA EllioTrades, who posted a Google Trends chart for the search terms Bitcoin and crypto. Wainman stated that despite BTC recovering from ETF lows, “retail is NOWHERE TO BE SEEN.”

Sponsored

The YouTuber added that he found it confusing that the world, in general, is missing out on what he believes will be the “biggest wave of capital to ever flow into a new asset class.”

Analysis of the search term “Bitcoin” on Google Trends showed a peak score of 100 in December 2017, as BTC posted its $20,000 all-time high. Searches for Bitcoin have since failed to recapture that level. This is particularly notable as BTC hit its current all-time high of $69,000 in November 2021, which equated to a Google Trends score of 35.

Sponsored

As BTC began winding up in February to recover from the January ETF lows, the search score for Bitcoin fell to 18 from 28 last month during the ETF lows.

Based on this pattern, it is clear that there is no correlation between price and Google searches. This also suggests that institutional factors have become more influential on the BTC price since November 2021.

BTC’s Recovery

With institutions now seemingly the key driver of Bitcoin price, BTC posted a 111-week high of $50,400 on February 13. This marked a 31% gain since bottoming at $35,500 on January 23, at the height of the ETF sell-off.

Zooming out to the weekly timeframe showed that the bear market bottom was in at $15,600, as panic sellers offloaded their bags during the FTX fallout in November 2021. Since then, a basing structure emerged until Q4 2023, when bulls took control to send the leading cryptocurrency higher.

While the ETF-led rebalancing in January dampened the macro uptrend, Bitcoin is on track to close four consecutive weekly green candles, signaling a continuation.

On the Flipside

- Digital asset investing is volatile and unpredictable, with short-term price movements often moving against expectations.

- While BTC has recovered its post-ETF losses, most altcoins have yet to recapture previous yearly highs.

- Current economic instability may shift investor priorities away from speculative assets.

Why This Matters

With retail interest sidelined as Bitcoin crosses meaningful price levels, the opportunity widens for institutions to “catch up.” A likely explanation for the lack of retail interest at this time centers around individuals getting burnt from the litany of recent bankruptcies, scams, and volatile swings, and being indifferent about jumping back in.

Read about Bitcoin ETFs receiving record-breaking capital inflows here:

Bitcoin ETFs Smash Multiple Records in First Trading Month

Find out Pudgy Penguins NFTs taking on BAYC here:

NFT Showdown: BAYC and Pudgy Penguins Vie for Dominance