- Bitcoin Whales and Sharks have been on a steady increase.

- Whales on the network have reached an all-time high.

- Despite increasing market interest, Bitcoin price hasn’t budged.

The crypto market has been on a rocky journey since early 2022, navigating events like Terra Luna’s collapse, the Ukraine-Russia war, and the FTX fiasco, making it quite challenging for major cryptocurrencies, including Bitcoin and Ethereum, to regain their lost valor.

However, while Bitcoin, the reigning king of crypto, has been knocked down by 62% from its towering peak of $69,000, Whales and Sharks have been quietly splurging and breaking records.

Bitcoin Whales Make a Splash

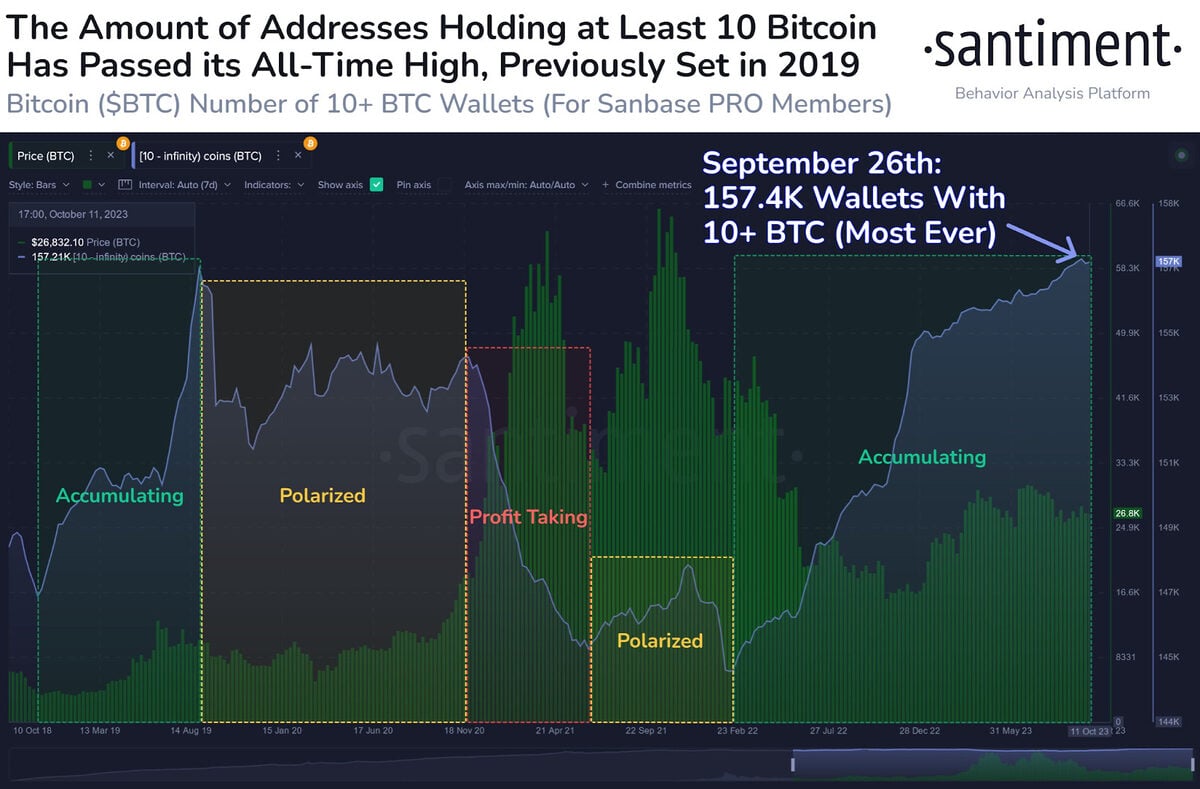

On October 15, market intelligence platform Santiment revealed that Bitcoin Whales and Sharks have significantly ramped up accumulation, leading to their numbers reaching an all-time high.

Sponsored

According to Santiment’s report, wallets holding over 10 BTC, equivalent to $272,000 when writing, have been on a steady rise. Since February 2022, over 11,806 new addresses have joined the pod, bringing the total number of Bitcoin whales to 157,000, the network’s highest.

Santiment notes that most of these new addresses appear to be smaller wallets ‘graduating’ to the new tier.

Still, despite market participants showing heightened interest in Bitcoin through increased buying pressure, the token remains within a tight price range.

Bitcoin Trapped in a Tight Range

Bitcoin has been struggling to break through resistance at the $27,000 price level, even in the presence of positive news concerning the SEC approving Grayscale’s pursuit of a Bitcoin ETF. The recent price action, marked by low volatility and volume, suggests that market participants are uncertain about how they should move.

Sponsored

As the new business week approaches, Bitcoin could experience increasing trading volume and high volatility, potentially breaking out of its trading range after failing to do so several times in the past week.

With macro learning bullish, Bitcoin could be due for a surge toward $28,000. However, should it botch its attempt at a breakout, it will move toward range lows and sweep up liquidity to gain momentum for another attempt.

At press time, Bitcoin exchanged hands at $27,200 with a daily trading volume of $250 million.

On the Flipside

- Reports revealed that Coinbase was the largest Bitcoin holder in the world, holding 5% of all existing BTC.

- Bitcoin’s year-to-date growth currently stands at 63%.

- NYDIG crowned Bitcoin as the best-performing asset of 2023.

Why This Matters

Despite Bitcoin’s recent price struggles, market participants have displayed unwavering confidence, demonstrated by their increased accumulation. This proves that investors are keenly interested in the token’s long-term prospects.

Find out why MetaMask disappeared from the Apple App Store:

MetaMask Reappears on Apple App Store After Brief Exit

Discover more about Cardano’s new delegation strategy:

Cardano’s New Delegation Strategy Struggles to Impress