- Bitcoin bulls have started the week on a firm footing following last week’s close.

- The March Consumer Price Index (CPI) print is due for release on April 12.

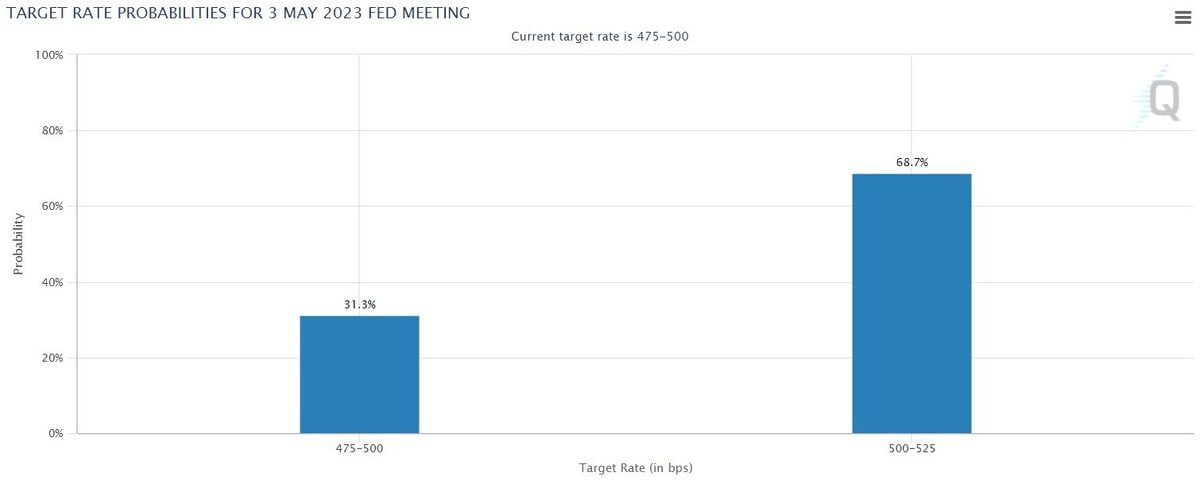

- Sentiment has begun to show that the market does not believe that rate hikes will continue much longer.

Bitcoin has started the week on a strong note, with bullish investors propelling the BTC price to a fresh ten-month high weekly close, as it awaits FOMC and CPI data.

After a relatively quiet week, last-minute volatility has traders excited about the prospects of a repeat attack on the $30,000 resistance level, although there are still several obstacles to overcome.

Investors Anticipate $30K Move as Bears Denied Lower Levels

On April 9, Bitcoin surprised investors with late gains, pushing BTC/USD to local highs of $28,540 before returning to consolidate below the closing level of just above $28,300.

Sponsored

This is impressive in itself, marking fresh ten-month highs for weekly closes as bears are continually denied a return to lower levels.

BTC/USD 1-Week Candle Chart. Source: TradingView

While Bitcoin’s current upward momentum is encouraging, it’s important to exercise caution as there is still a risk of BTC/USD forming a “double top” structure that could lead to a return to $20,000 levels, even though this outcome seems unlikely.

On the other hand, there are no clear bearish divergences on higher time frames, suggesting a retest of $28,600 and a possible breakout to $30,000 could be in the cards. It’s crucial to consider these factors alongside the soon-to-be-released macroeconomic data.

Macroeconomic CPI Data Meets Fed’s Hawkish Stance, High Volatility Expected

This week, the macroeconomic data releases will be significant, with the Consumer Price Index (CPI) print for March scheduled for release on April 12, along with fresh insights into Federal Reserve policy.

Sponsored

The U.S. CPI data due for March is a familiar event that accompanies heightened volatility in risk assets, making April 12 a crucial date to watch for “fakeouts” in crypto markets.

The Federal Reserve will also produce the latest Federal Open Market Committee (FOMC) meeting minutes. However, this creates a complex environment for asset performance in relation to the CPI, as traders hope for faster than anticipated inflation reduction while the Fed remains hawkish.

As a result, there’s a divergence between the Fed’s stance and market sentiment. CME Group’s FedWatch tool indicates that the upcoming FOMC meeting will result in a 0.25% rate hike, just like last month. These odds are highly flexible and respond quickly to any new macro data releases, including CPI.

Fed Target Rate Probabilities Chart. Source: CME Group

On the Flipside

- While the CPI release and Federal Reserve policy insights are essential macroeconomic events, they are not the only factors that influence Bitcoin’s price movements.

- A breakout to $30,000 may be on the cards, but there is always the risk of a market correction

- Though the Fed has expressed hawkish sentiment and will opt to continue raising interest rates, Bitcoin has been able to move upward during similar periods in the past.

Why You Should Care

The release of macroeconomic data and Federal Reserve policy updates can have a significant impact on Bitcoin’s price and the broader cryptocurrency market. As the leading cryptocurrency, Bitcoin’s performance often sets the tone for the rest of the market.

To learn more about the discovery of the Bitcoin white paper on macOS, read here:

Bitcoin’s Ultimate Easter Egg: Hidden White Paper in MacOS

To learn more about why Ripple’s XRP is not considered a security, and an explanation from Lawyer Jeremy Hogan read here:

Ripple XRP Not a Security Under SEC Howey Test, Says Lawyer Jeremy Hogan