- Ripple has been disputing the claim that XRP is an unregistered security since 2020.

- Legal expert Jeremy Hogan has suggested that Ripple’s XRP cannot be classified as a security.

- The SEC has not yet shown any implied or explicit investment contract in its case against Ripple.

Ripple’s XRP is not a security, according to Jeremy Hogan, a partner at the law firm of Hogan & Hogan. The lawyer claims that XRP can only be considered a security under the definition of an investment contract, as it does not fit other definitions of securities such as stocks or bonds.

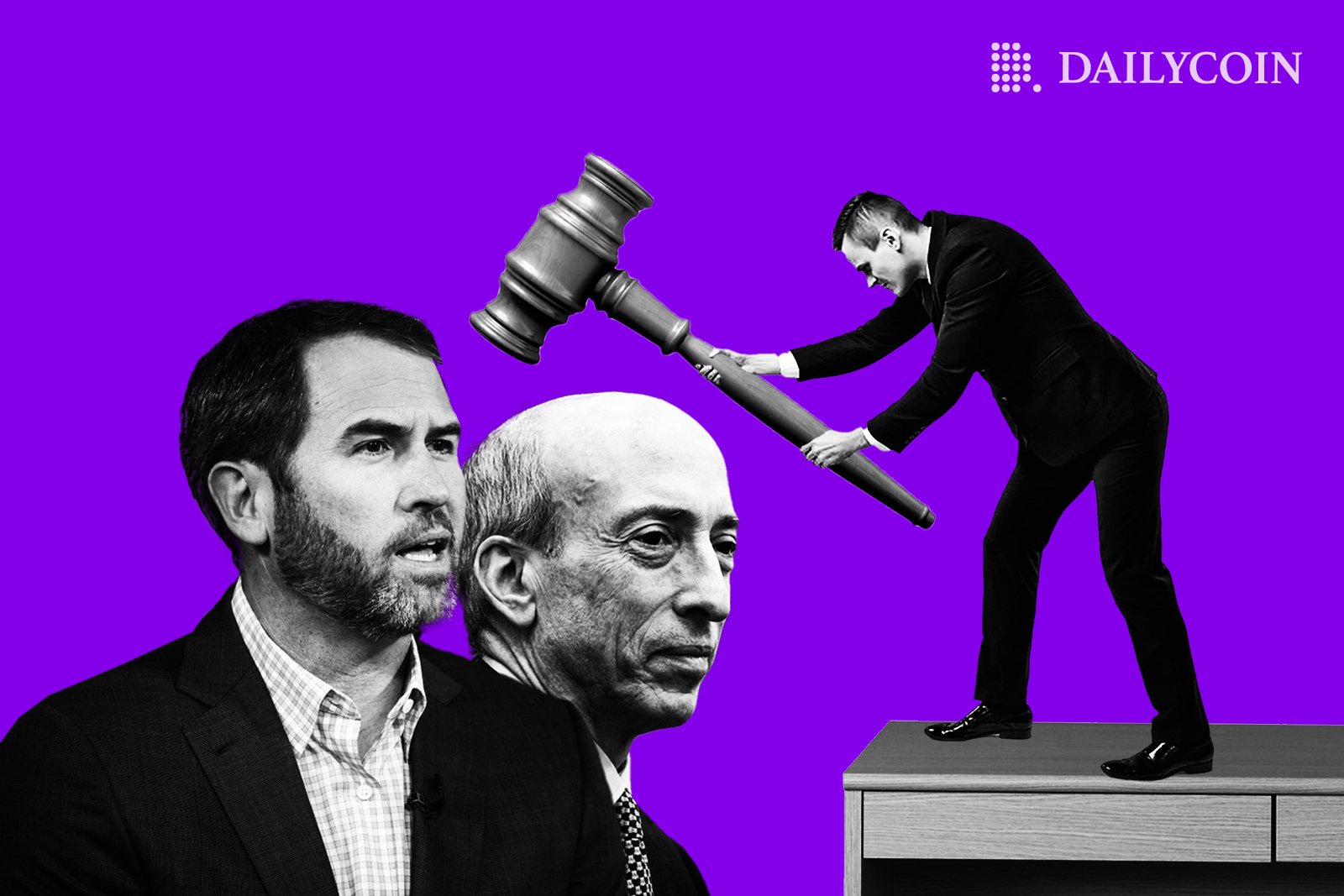

The United States Securities and Exchange Commission (SEC) initiated the lawsuit in December 2020, alleging that Ripple had illegally sold its XRP token as an unregistered security.

Ripple has disputed this claim, arguing that it doesn’t constitute an investment contract under the Howey test, determining if a transaction qualifies as an investment contract.

SEC Failed to Show Ripple Had Obligation to XRP Investors

In a series of tweets on April 9, Hogan argued that the SEC had not demonstrated an implied or explicit investment contract in its lawsuit against Ripple.

Hogan further argues that all of the blue sky cases, which the Howey case relies on for defining an investment contract, involved some form of a contract regarding the investment.

According to Hogan, the crux of the issue is not whether Ripple used money from the sale of XRP to fund its business but whether the SEC has proven that there was either an implied or explicit contract between Ripple and XRP purchasers relating to their investment.

Hogan claims that there was no such contract. Hogan also explained that the SEC’s argument tears the “investment” from the “contract” as a simple purchase, without more, cannot be an “investment contract.”

Sponsored

He sees it as just an investment, similar to buying an ounce of gold, as Ripple is not obligated to do anything except transfer the asset.

On the Flipside

- Even if XRP is not considered a security, it still faces significant competition from other cryptocurrencies in the market

- Despite Jeremy Hogan’s arguments, XRP could still be classified as a security under U.S. law since the SEC’s ongoing lawsuit has not yet been resolved.

- Ripple’s ongoing legal battle with the SEC has raised questions about the regulatory status of other cryptocurrencies and how they will be treated under U.S. law in the future.

Why You Should Care

Jeremy Hogan’s argument that Ripple’s XRP is not a security under the definition of an investment contract is significant as it could potentially undermine the SEC’s case against Ripple.

If the court agrees with Hogan, Ripple would not be required to register XRP as a security, and the case against the company would be weakened.

FAQs

No, Ripple XRP (XRP) is not currently classified as a security. However, there is ongoing litigation between the SEC and Ripple Labs Inc. over whether XRP should be considered a security or not.

XRP is a decentralized digital currency that operates independently of Ripple. Unlike traditional securities, XRP does not represent ownership in a company, nor does it give investors the right to a share of Ripple’s profits or assets.

Yes, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, Inc. in December 2020. However, the case is still ongoing.

To stay updated on the latest news and updates regarding the SEC vs. Ripple, read here:

Ripple vs. SEC: The Lawsuit Plagued with More Delays

To learn more about the impact of BTC options expiry on the cryptocurrency market, read here:

$1.2B BTC Options Expiry: Bulls Concentrated Bets Above $29K