- Bitcoin ETFs have overturned their weeks-long trend of outflows.

- The crypto market recorded a similar wave of inflows in signs of recovery.

- The ongoing rebound suggests reignited interest in crypto funds.

The crypto market has witnessed mixed sentiment over the past weeks, marked by rollercoaster performances across assets and fluctuating interest among market participants. Negatively impacted, Bitcoin ETFs took a downward spiral of outflows, shedding over half a billion on May 2, 2024.

Now, in a reversal of fortunes, the market is displaying signs of recovery.

Bitcoin ETFs Signal Recovery

According to Farside Investors data on May 11, spot Bitcoin exchange-traded funds in the U.S. recorded a total of $116.8 million in the recently concluded week.

Sponsored

Fidelity’s FBTC led the charge with a dominant $111.3 million, surpassing Ark Invest’s ARKB, which saw a total of $82.8 million in inflows. FBTC and ARKB surpassed the once best-performing BlackRock’s IBIT, which continued its trend of underperformance with only $48.1 million in inflows.

In contrast, Grayscale’s GBTC reverted to its infamous lackluster performance. Despite commencing the week with a promising $67 million inflow, Grayscale ended the week on a sour note with a total of $175 million outflows.

Bitcoin ETFs such as VanEck’s HODL and Franklin Templeton’s EZBC, among others, recorded minimal inflows, contributing to a total record for the week of $11.7 million. The recovery witnessed across the U.S. Bitcoin ETF market mirrors the uptick observed across global crypto investment products.

Crypto Funds Reverse Negative Trend

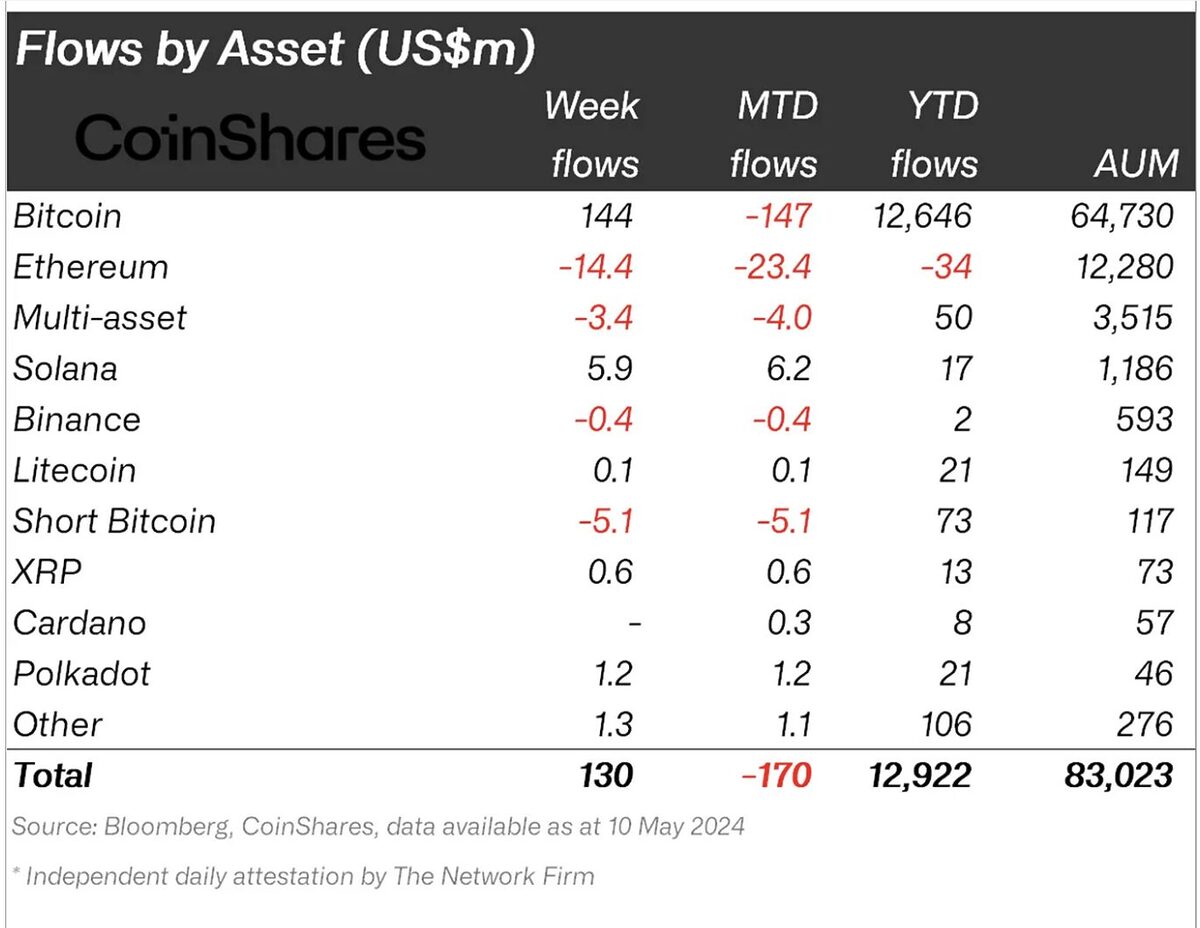

According to CoinShares data on Monday, May 13, the crypto market recorded $130 million in inflows in the past week. This marked the funds’ first set of recovery inflows, following an unimpressive performance that saw the market consecutively bleed for nearly five weeks.

Sponsored

Being the primary focus, Bitcoin (BTC) pulled $144 million, followed distantly by Solana (SOL), which saw a total of $5.9 million in inpour. Litecoin, XRP, Polkadot, and other assets also closed the week with an uptick, registering a cumulative $3.2 million.

However, the optimism didn’t extend to others, which bucked the trend with outflows. One notable loser was Ethereum (ETH), which led the negative train of approximately $23.3 million.

This brought the inflows to $130 million, marking an approximate 430% increase from the previous week’s $435 million outflow record.

Read more about the negative funds flow in the past weeks:

Crypto Funds Hit 2-Week Outflow Streak on Hawkish Fed Fears

Is CZ on the path to become an author? Discover more here:

Former CEO Turned Author? Binance CZ Teases What’s Next