- Last week, crypto funds broke a GBTC-led two-week outflow streak.

- Bitcoin and Solana funds dominated inflows.

- Despite recent declines, GBTC outflows remain a concern for market participants.

Crypto funds, including other newly approved Bitcoin ETFs, have mostly struggled to keep pace with Grayscale’s GBTC outflows, at least up until last week. Last week, these crypto funds, particularly the recently approved Bitcoin ETFs, managed to stage a comeback, breaking a two-week streak of net outflows.

Bitcoin and Solana Funds Win Big in Comeback

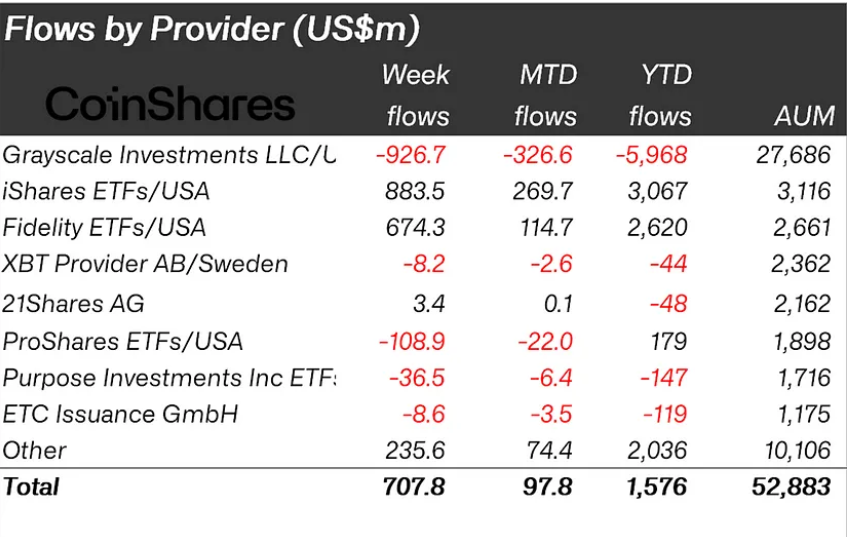

Last week, crypto funds recorded net inflows of $708 million, beating significant outflows of over $926 million from Grayscale and an additional $162 million from other ETFs, according to CoinShares’ most recent crypto fund flows report released on Monday, February 5.

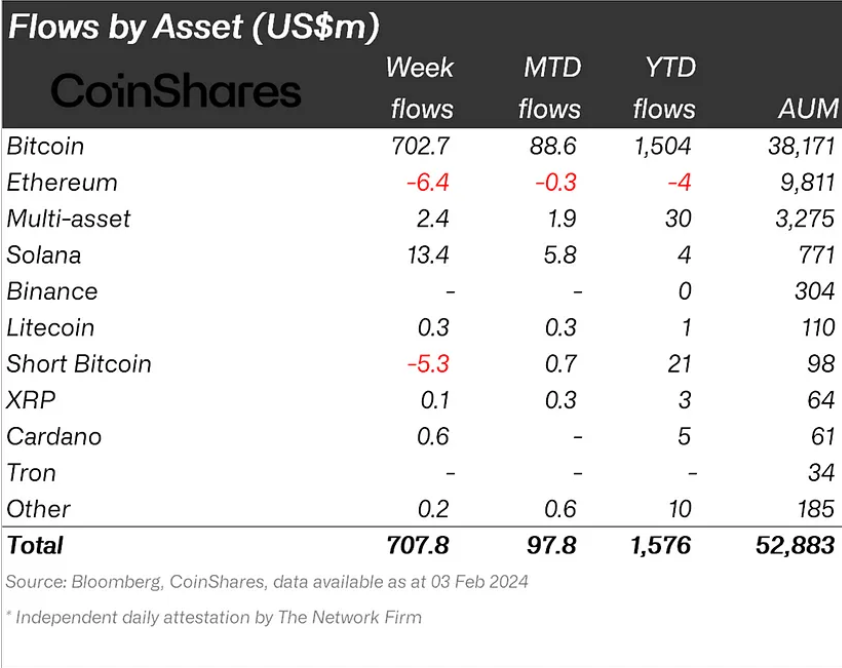

Unsurprisingly, Bitcoin was the primary focus of inflows, with $703 million representing a staggering 99% of inflows for the week. The asset benefited significantly from sustained interest in ETF offerings like BlackRock’s IBIT and Fidelity’s FBTC, which saw inflows of $883.5 million and $674.3 million, respectively. On Thursday, February 1, IBIT became the first Bitcoin ETF to surpass GBTC in daily trading volume.

Nonetheless, funds tied to Bitcoin were not the only ones to record significant outflows. Per CoinShares’ report, Solana funds also recorded $13 million in inflows last week, highlighting the asset’s continued investor appeal, which had come to the fore last year.

Sponsored

The shifting crypto fund flow dynamic begs the question of whether GBTC’s outflows may soon be at an end.

When Will the Grayscale GBTC Outflows Scourge End?

Amid a flight of investors to ETFs with lower fees, profit-taking by investors who had taken advantage of a significant discount on GBTC’s share price to net asset value, and dumping from restructuring bankrupt crypto firms like FTX, GBTC has recorded outflows of nearly $6 billion, per BitMEX Research data as of Friday, February 2, putting considerable selling pressure on Bitcoin’s price.

While these outflows have eased in recent weeks, the fund’s fees remain nearly five times as high as the competition at 1.5%, making the possibility of a near-abrupt end to GBTC outflows unlikely as GBTC’s Bitcoin holdings exceed 473,000 BTC, valued at over $20 billion at current rates.

Sponsored

Recent plans by bankrupt crypto lender and Grayscale sister company Genesis to sell 35 million GBTC shares worth $1.3 billion have also raised further market uncertainty.

On the Flipside

- Funds tied to leading altcoins Ethereum and Avalanche recorded outflows of $6.4 million and $1.3 million, respectively.

- Despite the significant outflows, Grayscale has likely made the most profit among all the U.S. spot Bitcoin ETF issuers due to its high fees.

Why This Matters

Crypto fund flows typically provide insight into investor sentiment, but GBTC flows have made this sentiment more challenging to assess. Last week’s data, however, suggest strong interest in Bitcoin and Solana.

Read this for more on recent crypto fund flows:

$500M Exited Crypto Funds Last Week Despite Easing GBTC Tide

Learn about swirling speculation of a Binance data leak:

Binance Leak Murmurs Spark User Data Security Concerns