- The SEC case has put Binance’s handling of customer deposits under increased scrutiny.

- A Binance.US statement about issues with Bitcoin Cash withdrawals has heightened concerns.

- The notice has sparked a flurry of reactions online.

Binance, the world’s largest crypto exchange, is never far from controversy. Concerns over the exchange’s operations have peaked as the United States Securities and Exchange Commission has accused it of mishandling customer deposits and wash trading in a lawsuit filed in June 2023.

Amid the growing uncertainty, the U.S. arm of the exchange may have inadvertently confirmed customer fears with a notice about issues with Bitcoin Cash (BCH) withdrawals.

Binance.US Admits “Temporary Shortage” of BCH

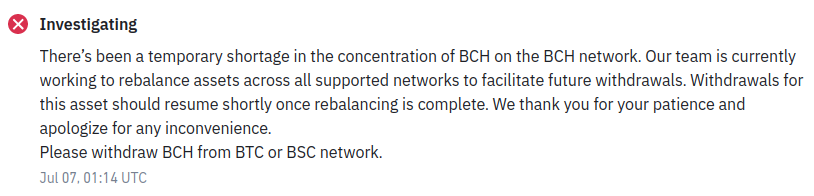

In a July 7 notice that has made the rounds on crypto Twitter, Binance.US lets slip that it has a “temporary shortage” of native BCH, urging customers to withdraw using the Bitcoin network or Binance Smart Chain (BSC) pegged tokens.

The user who shared the notice refuted the possibility that the exchange could transfer funds from its cold wallet to its hot wallet, asserting that as of Monday, July 10, the issue remained unresolved on the exchange’s status page.

Sponsored

The notice has unsurprisingly sparked questions about the safety of customer deposits on the crypto exchange.

Sponsored

As Cinneamhain Ventures partner Adam Cochran was quick to point out, it was concerning for the exchange to claim not to have native BCH but be able to process withdrawals for the BSC-pegged token as the latter ought to be backed 1:1 by native BCH on Binance.

Binance.US did not immediately respond to a request for comment, and at the time of writing, the issue no longer appears on the exchange’s status page.

On the Flipside

- Binance lawyers have refuted the SEC’s claim that Binance mishandled customer deposits.

- Binance and the SEC recently reached an agreement to secure Binance.US customer deposits.

- Binance was previously accused of not holding a 1:1 reserve of BSC-pegged BUSD.

Why This Matters

Binance claims to hold a 1:1 backing of all BSC-pegged tokens. Without this equivalent reserve, these tokens could lose value relative to their native tokens, with potentially catastrophic effects for projects and token holders.

Read this to learn about Binance.US’ troubles in the wake of the SEC case:

SEC Case Continues to Weigh on Binance.US as BTC, USDT Trade at Discount

Polygon is leading the latest altcoin rally on its path to recovering from the SEC’s securities label. Find out more: