- Binance.US has made a new addition to its board.

- The new appointment signals the exchange’s plan to improve public and regulatory perception.

- The addition of a new board comes as the exchange faces a lawsuit from the SEC.

Binance and its U.S. subsidiary, Binance.US, appear to be undergoing an image shift.

In the past few weeks, the international arm of the exchange has taken steps to highlight a willingness to conform to traditional corporate practices with the announcement of a board and the revelation of plans to seek a global headquarters.

Seemingly in line with the operational shift on the international front, Binance.US has appointed a new board member in a move signaling a commitment to compliance amid business-threatening regulatory woes.

Binance.US Taps New York Fed Compliance Chief

On Tuesday, April 16, Binance.US announced the appointment of Martin C. Grant, former Compliance & Ethics Officer at the Federal Reserve Bank of New York, to its board of directors. According to the statement, Grant is joining the board “to help oversee financial reporting processes and internal controls” in Binance.US’ push for greater compliance.

Sponsored

Interim Binance.US CEO Norman Reed tipped the veteran compliance chief’s appointment to reflect the company’s commitment to best practices.

"The addition of a director of Martin’s caliber to the Binance.US Board reflects the strength of our business and demonstrates our commitment to maintaining the highest standards of compliance and integrity," Reed asserted.

Grant, who currently serves as Global Head of Regulatory Affairs at financial services firm JST Digital, boasts over three decades of experience at the New York Federal Reserve, more than half of which was spent as head of compliance handling issues involving anti-money laundering and sanctions enforcement.

Sponsored

The former compliance chief’s appointment comes as the firm navigates charges from the U.S. SEC for allegedly operating an unregistered securities exchange as well as the reputational impact of the international arm of the exchange reaching a $4.3 billion settlement with the Department of Justice (DOJ) over money laundering charges.

Binance.US Worst Hit

In the aftermath of the June 2023 charges from the SEC, Binance.US has been forced to engage in multiple layoffs and transition to a crypto-only model as banking partnerships have come under strain.

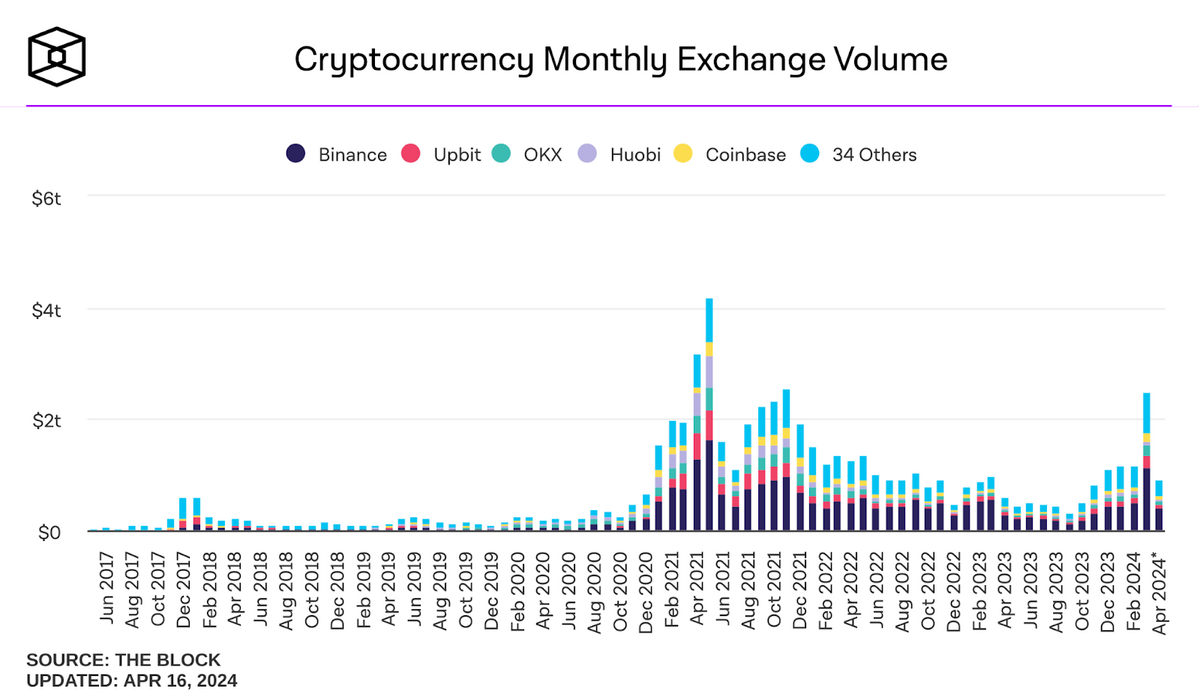

Amid the hurdles, Binance.US’ monthly trading has all but flatlined, averaging below $1 billion. As of September 2023, contrarian investors had already begun suggesting that the exchange’s story was all but over. Recent efforts, however, indicate that the rumors of the exchange’s death have been greatly exaggerated.

On the Flipside

- Whether Binance.US’ recent board appointment will achieve the desired result remains to be seen.

- Binance.US faces stiff competition from exchanges like Coinbase and Kraken.

Why This Matters

Many have written off Binance.US amid the exchange’s struggles with regulatory challenges. The firm’s recent board appointment, however, suggests that it has yet to give up on the prospects of making a comeback.

Read this for more on Binance.US:

Binance.US Suspended in 2 States as Regulatory Heat Rises

See why OKX’s X Layer promises to be a boon for Polygon (MATIC):

Polygon (MATIC) Ecosystem Bolstered as OKX’s Layer 2 Goes Live