- Binance has suspended GBP services to new users.

- The exchange has shared why it can no longer offer on-and off-ramps in the U.K.

- The exchange can still resume GBP services soon but has a tight deadline.

The crypto industry’s horrendous start of the year continues. With multiple crypto-friendly banks either imploding or being outright shut down, crypto access to traditional banking and payment services weakens each day.

The latest victim is Binance, which has informed its users that its GBP service provider has dropped their partnership.

Binance, the world’s largest centralized crypto exchange, sent a letter to its users on Monday informing them that it has suspended GBP deposits and withdrawals to new users.

Sponsored

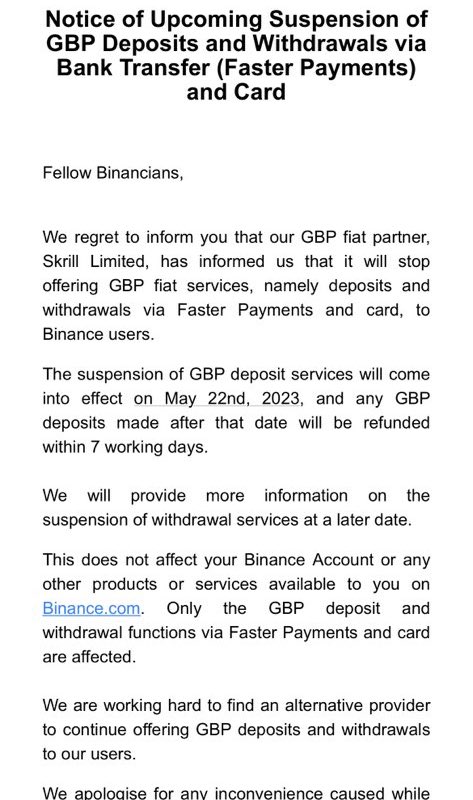

That’s because Binance’s GBP service provider Skrill Limited has decided to stop offering GBP fiat services. Binance said that if it can’t find another banking partner in the U.K. by May 22, the exchange will need to halt GBP deposits and withdrawals for all users.

Binance letter to its users. Source: Twitter.

Binance said that all other products and services, like buying crypto with fiat on its exchange remain operational.

Sponsored

The news of Binance suspending its GBP operations comes as U.S. regulators shut down crypto-friendly banks left and right.

U.S. Regulators Shut Down Multiple Crypto-Friendly Banks

Binance’s announcement of suspending GBP deposits and withdrawals comes as no surprise as regulators in the U.S. have been on a roll shutting down crypto-friendly banks and service providers.

In the span of a week, three crypto-friendly banks either blew up or were shut down by authorities in the U.S. All of them – Silvergate, Silicon Valley Bank, and Signature Bank – played an important role in providing crypto companies and venture capital (VC) firms access to traditional banking services.

The closure of Signature Bank raises the most questions. The bank got abruptly shuttered amid the chaos created by the failure of Silicon Valley Bank last week. The regulators cited “systemic risk” as the reason for closing the bank, though they have yet to provide specific details.

However, some people believe one of the reasons for closing Signature Bank was its friendliness with crypto firms. Former congressman and co-sponsor of the Dodd-Frank bill Barney Frank said that Signature Bank was closed by U.S. regulators in part to send “an anti-crypto message” to the industry.

The abrupt shutdown of Binance’s BUSD stablecoin can also be seen as an anti-crypto message. The U.S. Securities and Exchange Commission (SEC) ordered Paxos to stop issuing the Binance-branded stablecoin on the grounds that it believes it’s an unregistered security. Both Paxos and Binance have disagreed with this argument.

On the Flipside

- Binance can find another partner in the U.K. given its size and dominance in the market. That’s of course provided the U.K. government doesn’t follow the path of U.S. regulators and has no intentions to drive out crypto companies from the country.

Why You Should Care

Binance is the largest crypto exchange in the world. Suspending GBP deposits and withdrawals for all users in the U.K. would be a huge blow to the exchange itself and the crypto industry in the U.K.

Read more about Binance’s intention to exchange $1B for crypto assets:

Binance to Dump $1B BUSD for BTC, ETH, BNB… Here’s Why

Read more about Cathie Wood’s latest Coinbase stock purchase:

Cathie Wood’s Ark Buys Another $20M Worth of Coinbase Stock