- Binance has lost 20% of its market share since reserving its zero-fee trading promotion for BTC/TUSD.

- The lost market share has not gone to leading U.S.-based competitors as some would expect.

- A researcher has said the SEC is to blame for consumers ignoring U.S.-based crypto trading venues.

Binance is the world’s leading crypto exchange by 24-hour trading volume despite being at least five years younger than its biggest competitors, Coinbase and Kraken. One of the reasons for Binance’s meteoric rise was its heavy focus on marketing strategies.

One such strategy was its zero-fee trading campaign for Bitcoin pairs, which launched in July 2022 despite a bear market that saw its competitors drop trading volume and revenue. However, Binance decided to roll back this campaign on March 22. It may have hurt its market share.

Binance Losses Explained

In July 2022, Binance launched zero-fee trading for 13 Bitcoin trading pairs to celebrate its fifth anniversary.

Sponsored

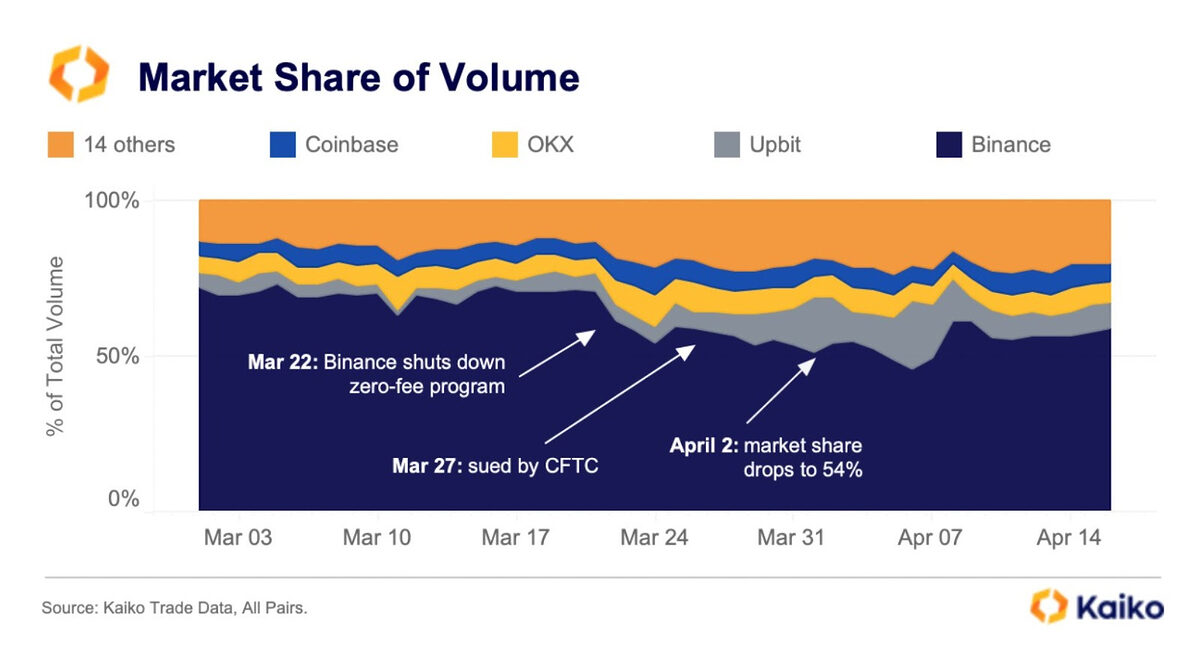

According to Kaiko, Binance’s market share grew from 50.5% to 72% in March, at which point the crypto exchange decided to roll back the perk, reserving it for only the BTC/TUSD pair. While Binance did not explain the rationale behind the limitation, the pivot to TUSD following U.S. regulatory crackdown on Paxos’ played a significant role in the decision.

Since rolling back the campaign, Binance has lost nearly all the market share it gained within the promotion period – about 20% – according to Kaiko data as of April 2, shared by Kaiko researcher Connor Ryder in a tweet on April 19.

Where Did the 20% Market Share Go?

According to Kaiko researcher Ryder, the market share did not go to competitors like Coinbase or Kraken as some would expect. The researcher revealed that Binance’s lost market share has instead reached overseas exchanges like Upbit.

Sponsored

"Early signs are that share has gone overseas, to the likes of Upbit in Korea, rather than Coinbase," the researcher wrote.

Ryder has tipped U.S. crypto regulatory uncertainty as the reason for this, particularly pointing fingers at the U.S. Securities and Exchange Commission (SEC).

“Could be the biggest opportunity in years for an exchange to capitalize, but the SEC is driving volume overseas,” he wrote.

SEC vs. Crypto

Regulators in the U.S. appear to be on the warpath with the crypto industry, with the SEC choosing to assert jurisdiction over the nascent market through enforcement actions.

In February, the SEC revealed a $30 million settlement deal with Kraken that saw the crypto exchange shutter its crypto staking service for U.S. customers. The markets regulator alleged that Kraken’s staking service was an unregistered securities offering.

In March, Coinbase confirmed that it had received a Wells notice – an indication of the SEC’s intent to launch enforcement actions – despite claimed best efforts “to come in and register.” According to Coinbase, the Wells notice alleged that “an undefined portion of our listed digital assets, our staking service Coinbase Earn, Coinbase Prime, and Coinbase Wallet” could violate securities laws.

SEC chair Gary Gensler maintains that existing securities laws apply to crypto despite calls for separate rules within the industry. Gensler doubled down on this stance in a recent Congressional hearing adding that he has never seen an industry “sonon-compliant with laws.”

Lawmakers fear that the SEC’s approach may drive U.S. crypto investors into the arms of companies incorporated abroad.

On the Flipside

- Coinbase is ramping up global expansion efforts with plans to launch a derivatives exchange in Bermuda, which market watchers say could help it better compete with Binance.

- Deribit, a leading derivatives crypto exchange based in Panama, has taken a leaf from Binance’s book to launch zero-fee spot trading for BTC/USDC, ETH/USDC, and ETH/BTC pairs.

Why You Should Care

Better competition among crypto businesses could improve services and reduce consumer costs. The SEC’s efforts, however, could be handicapping U.S.-based businesses.

To learn more about Binance’s newfound romance with TUSD, read this:

Binance’s New Flame TUSD Secures Zero-Fee BTC Trading as BUSD Sinks

What to learn about what caused Bitcoin’s latest flash crash? Read this:

Crypto Markets Bleed as Bitcoin Loses a Week’s Gains in 15 Minutes