- Total Web3 funding reaches $9.13B in 2023.

- Significant investments from Asia-Pacific and the U.S.

- Fewer projects are failing, signaling the maturity of the Web3 sector.

Venture capitalists have not yet given up on Web3 despite the crypto bear market and the hype around AI. 2023 data shows that, while venture funding dropped from a year prior, last year’s data also showed signs of recovery.

Moreover, the data shows that significant investments are moving into the Asia-Pacific region. Coupled with lower failure rates of crypto projects, the numbers show signs of a maturing Web3 space.

Web3 Fundraising in 2023

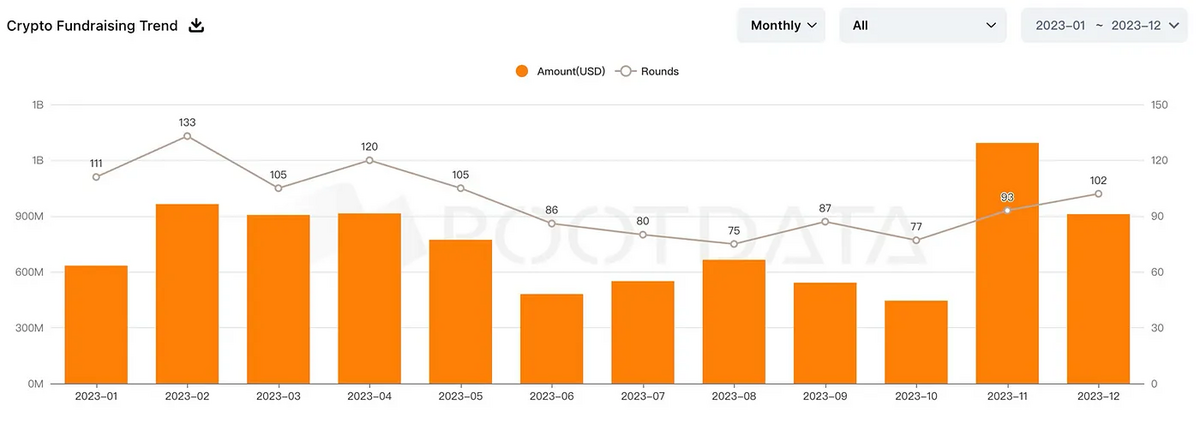

The RootData report, published on Monday, January 5, highlights significant developments in Web3 fundraising for 2023. The total financing in the Web3 sector reached $9.13 billion, with the highest single-month financing in November at $1.312 billion. This shows a gradual recovery and growth trajectory, especially in the fourth quarter, which exceeded the fundraising totals of the first three quarters.

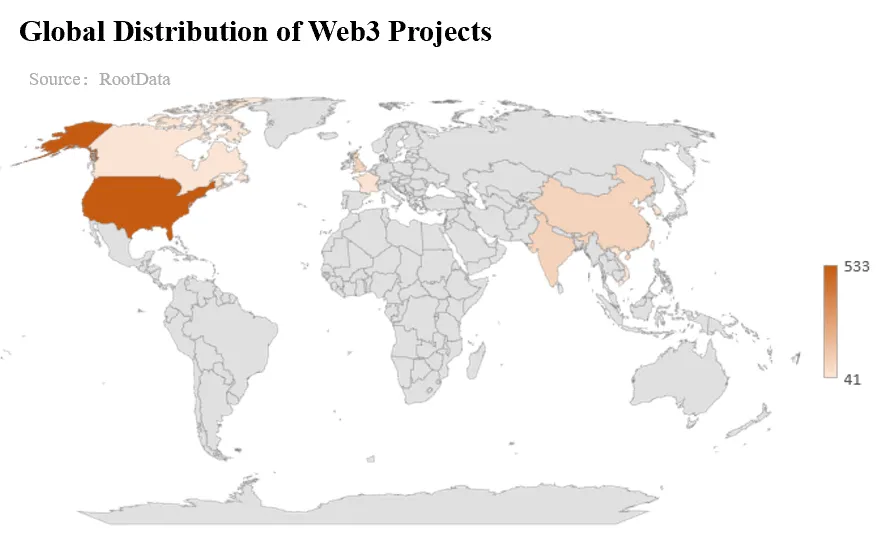

The report indicates a diverse global distribution of Web3 investments. Major contributions and fundraisings were noted from prominent financial institutions and venture capital firms. The most notable investments and growth in the Web3 ecosystem came from regions such as the Asia-Pacific, led by firms like HashKey Capital and DWF Labs, and substantial investments from U.S.-based institutions like a16z Crypto.

Lower Funding Accompanied by Less Projects Failing

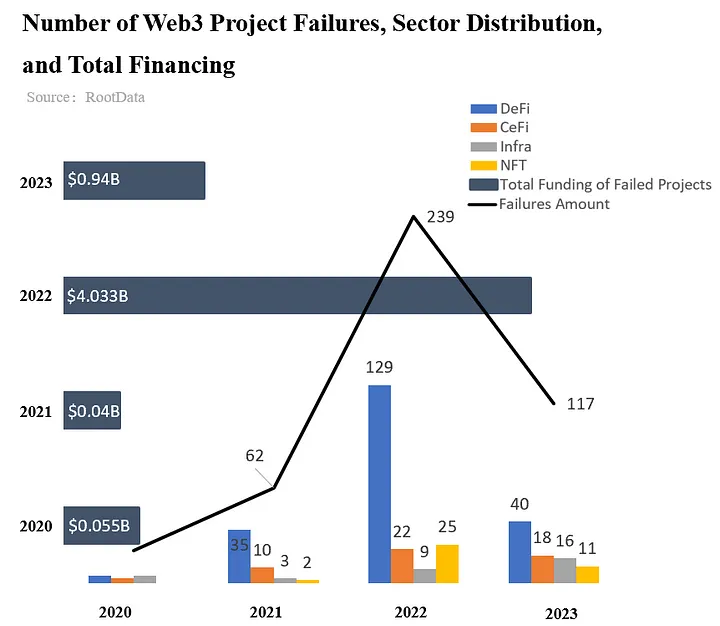

Despite a significant drop in Web3 funding, there was a significant decrease in the number of failed Web3 projects in 2023 compared to the previous year. Approximately 120 projects declared bankruptcy or ceased operations in 2023, a stark contrast to the 239 projects that faced similar fates in 2022.

This decrease, from a total financing amount of $4.033 billion in 2022 to $940 million in 2023, reflects the industry’s gradual maturation and stabilization. The sectors most affected by failures were DeFi, CeFi, and infrastructure.

On the Flipside

- The year 2023 also marked significant technological innovations within Web3. These include advancements in blockchain interoperability, scaling solutions, and integrating AI and machine learning technologies into blockchain applications.

- The year 2023 also marked significant technological innovations within Web3. These include advancements in blockchain interoperability, scaling solutions, and the integration of AI.

Why This Matters

The financial trends in Web3 indicate a shift in investment patterns, highlighting the growing importance of digital assets in the global economy.

Sponsored

Read more about venture capital funding:

Venture Capital Crypto Funding: Who Gets the Most Now?

Read more about the charges against Terraform Labs execs:

Do Kwon’s Former CFO Faces Life in Prison After Extradition