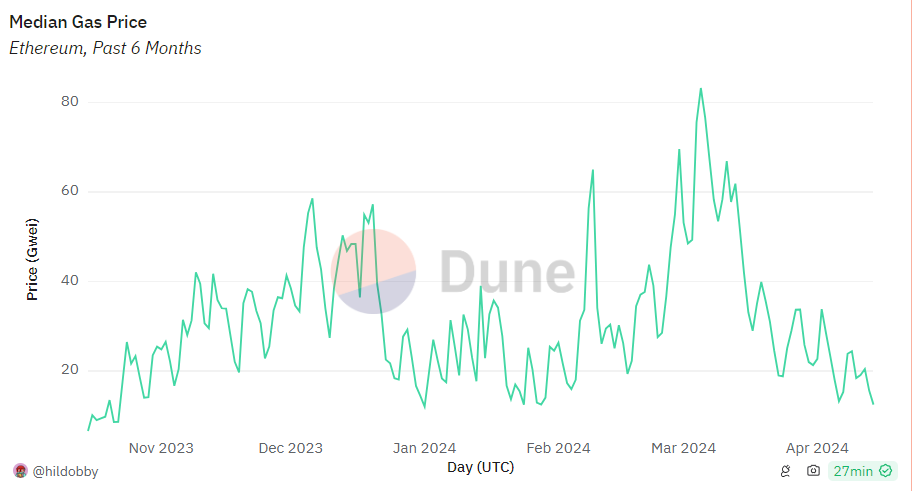

- Transaction fees on Ethereum have plummeted in the past month.

- On Sunday, April 14, these fees reached their lowest point in 2024.

- The fee drop comes as attention shifts to Solana and Base.

Amid the recent memecoin mania, on-chain activity appears to be shifting away from Ethereum to Solana and, most recently, Layer 2 chains like Base. While some may see this, particularly the flows to Solana, as a loss to Ethereum, there’s a silver lining for everyday network users: fees are dropping.

Ethereum Gas Price Takes a Dive

According to Dune Analytics data compiled by Dragonfly Capital Head of Data Science, Hilderbert “hildobby” Moulié, Ethereum’s gas price has been in free fall since early March 2024. On Sunday, March 14, the average gas price plummeted to 12.5 gwei, marking a new 2024 low.

Gas price, typically denominated in gwei (0.000000001 ETH), refers to the cost users have to pay per unit of gas (the computational effort required to conduct an action on the Ethereum network). To calculate transaction fees, users have to multiply the amount of gas needed for the transaction by the gas price.

Sponsored

Gas prices are primarily determined by market forces of demand and supply. When there are many transactions waiting to be processed, the demand for gas is high, driving up its price. At the same time, when network activity drops, gas prices also drop.

The recent decline in gas prices on Ethereum coincides with the peak of the recent memecoin mania on Solana as well as the Dencun upgrade, which saw some of this volume also move to Layer 2 networks, particularly Base, as transaction fees on these networks also plummeted.

Read these for more on Ethereum:

Ethereum’s Next Upgrade Will Boost Wallet UX, but at What Cost?

SEC Requests Comments on Ethereum ETFs as May Deadline Looms

Sponsored