- Unprecedented transaction volumes and record-breaking circulation figures have underscored XRP’s resurgence.

- Major XRP stakeholders, known as “whales,” have played a pivotal role in the unfolding narrative.

- Legal battles with the SEC and a partial victory have added complexity to XRP’s regulatory landscape.

As the battle for regulatory clarity between Ripple and the U.S. Securities and Exchange Commission (SEC) rages on, XRP’s remarkable surge in activity and utility during August has captured the attention of both seasoned investors and keen observers.

The On-Chain Data is Off the Chain

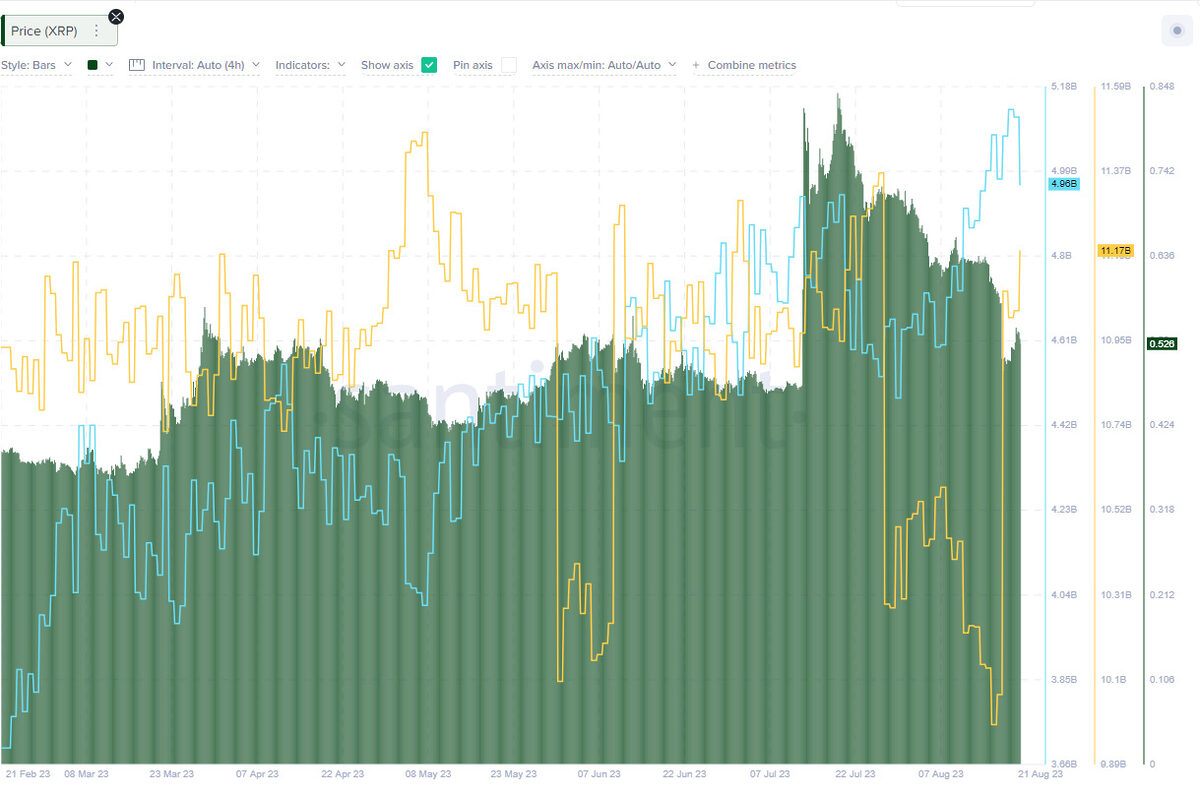

According to Santiment’s findings, the on-chain transaction volume within the XRP network achieved an unprecedented peak, tallying an impressive 4.8 billion tokens. Furthermore, the circulation of XRP soared to an all-time high, reaching a staggering two billion.

Sponsored

These encouraging metrics can, to a significant extent, be attributed to the fervor exhibited by major XRP stakeholders, commonly referred to as “whales,” who have conspicuously augmented their holdings over the preceding months.

As of August 20th, 2023, 221 wallet addresses boasted holdings ranging from 10 million to one billion XRP, amassing a substantial reservoir of 16.13 billion XRP. In monetary terms, this trove translates to an approximate valuation of $8.71 billion, with XRP trading at $0.56 per coin.

Ripple’s Legal Triumph Clears XRP’s Security Status Hurdle

Their rationale is to lay the foundation for a triumphant outcome in Ripple’s legal battle with the SEC, substantiating the argument that XRP should not be classified as a security. Furthermore, Santiment’s report underscores a remarkable upswing in development activity pertaining to XRP, signifying a robust adoption rate within the developer community.

The prevailing consensus attributes XRP’s extended bearish trajectory mainly, if not exclusively, to the SEC’s lawsuit, which was first set in motion in December 2020. Nonetheless, July saw a notable triumph for Ripple as Judge Analisa Torres decreed that XRP does not fall under the purview of U.S. securities laws, marking a substantial victory.

On the Flipside

- The SEC lawsuit has already caused significant damage to XRP’s reputation, with some exchanges having delisted or suspended cryptocurrency trading, making it less accessible to the broader market during the previous bull market.

- Despite the recent positive developments, XRP still trails far behind its previous all-time high, leaving investors who bought at its peak in 2018 with substantial losses.

Why This Matters

XRP’s resurgence, marked by heightened activity and renewed utility, underscores its resilience amidst a protracted legal battle with the SEC. This resurgence reaffirms investor confidence and sets the stage for competition among top cryptocurrencies, potentially reshaping the crypto landscape in the coming months.

Sponsored

To learn more about XRP’s role as a bridge currency with a Japanese financial giant, explore this article:

XRP Becomes Bridge Currency for Japanese Financial Giant

For insights into how Ripple’s XRP is evolving from its computer code origins, delve into this recent article:

XRP’s Value Reduced to “Nothing but Computer Code” in SEC Case