- Two United States senators are advocating against the approval of spot ETFs by the SEC.

- The lawmakers have called for tightened regulations for the asset class.

- Bitcoin ETFs have recorded significant success since launch.

The United States Securities and Exchange Commission (SEC) has had the industry on edge for the potential approval of more crypto exchange-traded funds following its historic greenlight of Bitcoin ETFs on January 11, 2024. However, the commission’s unpredictable nature and cautious approach to the asset class have cast doubts on the heightened anticipation, predicting the future of investment vehicles as challenging.

Adding to the uncertainty, political pressure is mounting on the regulatory commission, threatening to halt the approval of crypto-backed exchange-traded products.

Senators Urge SEC to “Limit” ETF Approvals

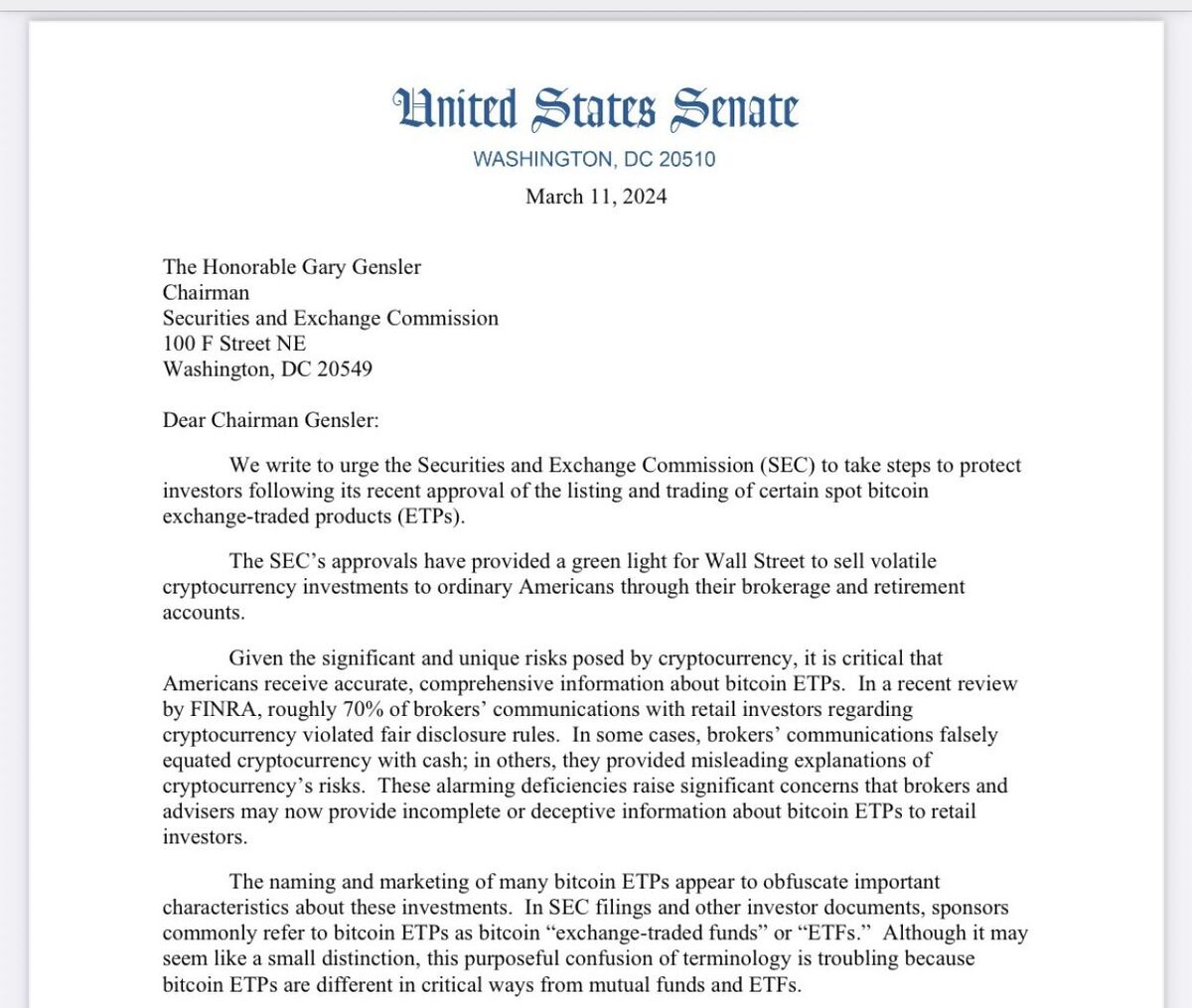

Earlier this week, U.S. senators Jack Reed and Laphonza Butler addressed a letter to SEC Chair Gary Gensler, raising concerns over the approval and launch of spot exchange-traded products (ETPs).

Sponsored

Spotlighting Bitcoin ETFs, the senators emphasized that the approval and launch of the investment has given rise to the sale of volatile crypto assets by Wall Street to “ordinary Americans,” who are denied comprehensive and accurate information regarding the products.

Reed and Butler highlighted the “deficiencies” in the offerings of Bitcoin ETFs, flagging the misrepresentation of the assets and volatile nature of the industry as threatening to investors.

“Retail investors would face enormous risks from ETs referencing thinly traded cryptocurrencies or cryptocurrencies whose prices are especially susceptible to pump-and-dump or other fraudulent schemes. The Commission is under no obligation to approve such products, and given the risk, it should not do so,” the senators stated.

The senators called on the commission to limit the precedential approach to further approvals, asserting that the asset class is susceptible to misconduct and manipulation. This aligns with the broader hardline stance of influential political figures and financial players, who continue to advocate against the industry’s progress. However, despite the trend, Bitcoin ETFs have had an impressive run since launch.

Bitcoin ETF Success Defies Detractors

Nearly two months after the SEC’s regulatory nod, Bitcoin ETFs have exceeded industry expectations by attracting hundreds of millions of dollars.

Sponsored

Leading the charge is BlackRock, which, along with other Bitcoin ETF issuers, has collectively accumulated over $28 billion since its launch, outperforming traditional investments worldwide.

Currently holding more than 167,000 Bitcoins, BlackRock’s IBIT is valued at approximately $14.4 billion.

Other Bitcoin ETFs, such as Fidelity’s WiseOrigin Bitcoin ETF and Ark Invest 21 Shares’ ARKB, have also stunned the markets with impressive performances. Each holds 105,196.9 and 34,223.4 bitcoins, valued at $6.4 billion and $2.1 billion, respectively.

The impressive numbers underscore the growing demand for the investment option, suggesting a lost opportunity for investment firms that took the hardline stance.

On the Flipside

- Coinbase legal officer Paul Grewal has fired back at the senators, asserting the potential of spot ETFs.

- The initially heightened optimism for an imminent Ethereum ETF approval has recently dampened, and the senators’ urge for caution could influence the trajectory of the SEC’s decision on the proposals.

- Investment advisor Vanguard has also taken an open stance against Bitcoin ETFs, but market predictions suggest that the firm will reconsider its decision.

Why This Matters

Following the approval of Bitcoin ETFs, SEC Chair Gary Gensler reiterated the commission’s cold and unwelcoming stance toward the asset class and broader industry. This highlights that the tense relationship between regulators and crypto still exists, and the Democrats’ advocacy against spot exchange-traded products may reinforce its stringent stance against the asset class.

Read more about SEC commissioner Peirce’s comments about the ongoing review of Ethereum ETFs

Ethereum ETF: “Let Americans Decide” SEC Commissioner Urges

Here’s how Binance’s women-focused academy is fostering gender balance. Read more:

Binance Celebrates Women’s Academy Success in IWD Redemption