- The SEC shocked the crypto community by revealing intentions to go after Coinbase.

- The regulator had approved Coinbase’s IPO two years prior.

- A recently unearthed letter explains why the potential enforcement is possible despite the IPO approval.

The United States Securities and Exchange Commission has ramped up its crypto enforcement actions in 2023 despite complaints over a lack of clear rules. One of the firms to land on the regulator’s naughty list is Coinbase, the largest U.S. crypto exchange by 24-hour trading volume.

In March, Coinbase confirmed the receipt of a Wells notice over several aspects of its business, including its asset listing, much to the surprise of many in the crypto space. One of the primary reasons for this surprise was that the SEC had approved Coinbase’s initial public offering just two years earlier. This is a narrative Coinbase has also adopted, arguing that its business has hardly changed since the IPO.

However, recently unearthed communications between the SEC and Coinbase may finally explain why the SEC’s planned enforcement is possible despite its approval of Coinbase’s IPO.

The SEC Warned Coinbase of the Potential of Future Enforcement During the IPO

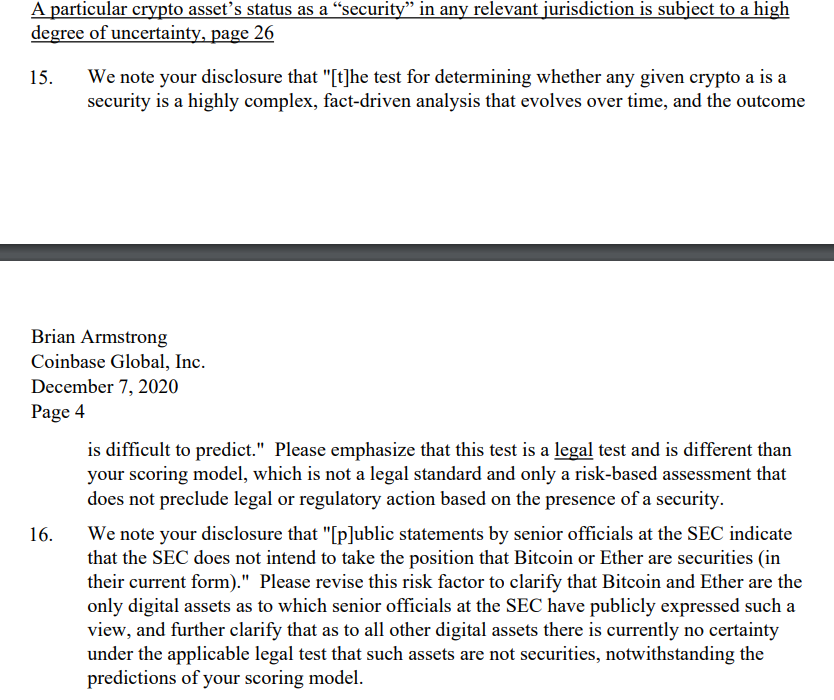

In a lengthy Twitter thread on Friday, April 28, Swan.com Chief Executive Officer Cory Klippsten argued that Coinbase was not telling the whole story, sharing details from a December 2020 letter from the SEC to Coinbase over its filing to go public.

Sponsored

In a nutshell, the SEC emphasized that its process of determining which assets qualify as securities differed from Coinbase’s methods which it described as a risk analysis. The regulator further warned that it reserved the right to pursue future enforcement action against the crypto exchange over its asset listing as uncertainty still surrounded the classification of cryptocurrencies.

Coinbase did not immediately respond to a request for comment on whether these previous warnings affected its defense should the SEC decide to proceed with enforcement.

Sponsored

The crypto exchange, however, shared its response to the SEC’s Wells notice on Thursday, April 27, again championing the narrative that its business has remained unchanged since the regulator approved its IPO.

On the Flipside

- While the letter potentially takes out Coinbase’s IPO argument, it further underscores the uncertain crypto regulatory climate in the U.S.

- Coinbase claimed to have made several attempts to reach an understanding with the regulator, only to be met with silence.

Why You Should Care

The letter clarifies why the SEC can launch enforcement action against Coinbase despite approving its IPO two years ago. It also further highlights the uncertainty surrounding the crypto regulatory climate in the U.S., as even regulators are sometimes unsure how to classify cryptocurrencies.

To learn more about the growing tensions between Coinbase and the SEC, read this:

Will Coinbase’s Lawsuit Against the SEC Affect Its Ongoing Enforcement?

Binance’s Changpeng Zhao disagrees with Bloomberg’s estimation of his wealth: