- Circle is cutting USDC support for Tron.

- The decision is expected to have pronounced effects on USDC holders.

- Learn how Circle’s decision impacts holders and how they can protect themselves.

Tron is the industry’s second-largest DeFi network, boasting a total value locked (TVL) of $8.5 billion. Much of Tron’s success in the DeFi space can be attributed to the rising adoption of the world’s leading stablecoins on the network, including Tether’s USDT and Circle’s USDC.

However, in recent years, particularly since 2021, USDT has been a major driver of Tron’s success in the DeFi space, with the network hosting more Tether than on any other chain, thanks to its popularity for inter-exchange fund transfers and growing use in consumer purchases.

While Tether experiences a meteoric rise on Tron, Circle, on the other hand, is pulling its stablecoin from the network.

Circle Cuts Tron Support

In a February 20 blog post, Circle announced it is cutting support for its USDC token on the Tron Network, citing that the decision aligns with its risk management framework.

Sponsored

"Our decision to discontinue support for USDC on TRON is the result of an enterprise-wide approach that involved the business organization, compliance, and other functions across our company. This action aligns with our efforts to ensure that USDC remains trusted, transparent, and safe - characteristics that make it the leading regulated digital dollar on the internet."

Effective immediately, Circle will cease minting tokens on Tron. It has advised users to look for another supported chain as it gradually exits the network.

While the exact reason for Circle’s decision remains undisclosed, Tron’s regulatory environment and legal complexities surrounding its founder, H.E. Justin Sun, could have influenced this move.

Sponsored

This isn’t the first time Circle has distanced itself from Tron. The stablecoin issuer terminated all accounts connected to Justin Sun and his companies in February 2023.

What’s Next For USDC Holders?

Circle noted that its institutional clients can transfer USDC held on Tron to other networks or redeem the tokens with it for USD until February 2025. On the other hand, retail customers can move their USDC on TRON to an exchange or distributor, where it can be transferred to a blockchain that Circle supports.

At press time, USDC supported 14 networks: Algorand, Arbitrum, Avalanche, Base, Ethereum, Flow, Hedera, NEAR, Noble, OP Mainnet, Polkadot, Polygon PoS, Solana, and Stella.

When transferring USDC to other networks, users are cautioned to exercise caution when transferring their tokens. Here’s a quick list of tips that can help you:

- Avoid clicking suspicious links and websites. Look for links that are hypertext, check slugs, and inspect buttons.

- Verify and scan all addresses, such as contract, sender, and others, before initiating transactions. Remember, everything on blockchain networks is permanent.

- Keep your wallet seed phrase private from everyone on the internet. An official will never ask for your private key.

- Ask for help from officials, and prioritize your safety and security.

The Profound Impacts of Cricle’s Exit

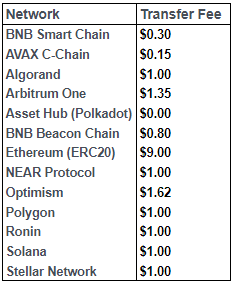

Tron stands out as a stablecoin hub thanks to its competitive low fees and quick settlement times. With transaction fees typically hovering around $1 for transferring USDC or USDT, Tron boasts some of the lowest rates in the industry, rivaled only by networks like Algorand, Near, Solana, Stellar, and Ronin.

BNB Smart Chain, Avax C-Chain, and Polkadot’s Asset Hub are the only networks with fees under $1, while Ethereum imposes the highest fee at $9 for USDC transfers.

What makes Tron an appealing choice is that users have the chance to execute fee-free transactions by staking a certain amount of TRX in their wallets.

Given Tron’s status in the DeFi industry, Circle’s latest announcement is expected to have a more pronounced impact on USDC than on individual holders or DeFi platforms on Tron, especially considering that over $335 million USDC out of its $28 billion circulation, is hosted on Tron.

Consequently, with Tron no longer supported, holders now face the challenge of selecting another network that aligns with their needs.

On the Flipside

- Circle’s distancing could be connected to its plans to go public. The stablecoin issuer filed to go public in the United States in January.

- While Circle commands a market cap of $28 billion, its rival Tether boasts a valuation of $98 billion.

Why This Matters

Circle’s decision to pull USDC from the Tron network will significantly impact Tron users and USDC holders. While Tron may experience minimal disruption in their DeFi activities, considering the popularity of USDT on the network, USDC will lose a major partner and opportunity until it finds a network that can fill Tron’s gap.

Read more about EOS’ upcoming hard fork:

Here’s What EOS’ Leap 6 Hard Fork Brings to the Network

Why is Coinbase’s crypto payment dropping Bitcoin support?

Coinbase Crypto Payment Portal Drops Bitcoin Support