- ThorChain (RUNE) surges in price and volume despite overall crypto market weakness.

- Buoyant ThorChain metrics suggest demand for truly permissionless protocols.

- Potential showdown between crypto users and regulators on the cards.

The total crypto market cap has seen a drawdown of $29 billion (-2.4%) this past week, according to data from CoinMarketCap. Nonetheless, DEX protocol ThorChain has bucked the downtrend to record 58% gains since August 9.

Many tokens have seen significant sell-offs, including GMX, Optimism, and Immutable, down 15.9%, 12.9%, and 12.2%, respectively, over the past week. Market leader, Bitcoin, held relatively steady, posting 2.2% losses over the same period.

ThorChain Price Surges

ThorChain’s RUNE token has recently experienced a significant price and daily volume surge, attracting the crypto community’s attention.

Sponsored

On August 16, RUNE posted a 17-week high of $1.6684 after going on a consecutive nine-day green close. The start of the move broke the $0.9577 resistance level, which formed having peaked at that price on August 1, then being rejected at that level the following day. This price performance equated to a 74% gain for the token.

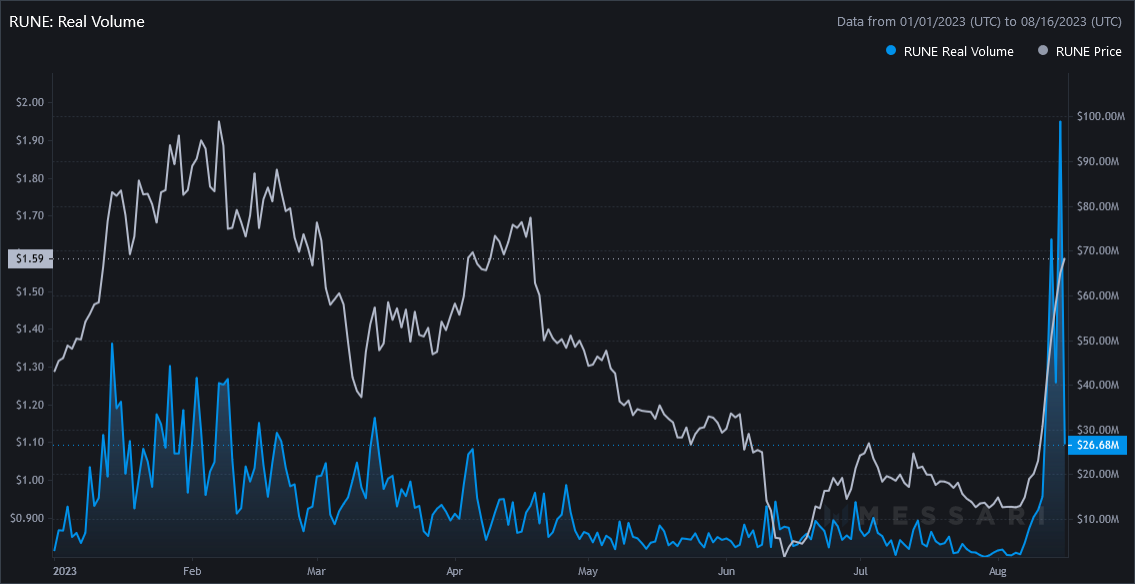

The chart below shows ThorChain had been trending downwards since posting a year-to-date high (YTD) of $1.9727 in February – leading to a local bottom of $0.7812 in June. The ensuing bounce topped out at $1.1093 by early July, leading to a period of consolidation before the recent surge.

Sponsored

Accompanying the price surge, data from Messari showed a massive 5,160% jump in volume to $98.88 million on August 15, from $1.88 million on August 4 – recording a YTD high.

It was noted that the prior YTD high in volume of $49.26 million was achieved on January 14 when RUNE was priced much higher at $1.7623.

Users Want Decentralization

According to the ThorChain website, its protocol is a cross-chain aggregator enabling swaps between Bitcoin, Ethereum, BNB Chain, Avalanche, Cosmos, Dogecoin, Bitcoin Cash, and Litecoin.

ShapeShift Founder Erik Voorhees suggested that ThorChain’s recent success was due to the growing awareness that it offers permissionless swaps between blue chip tokens – in contrast to the trend towards permissioned KYC protocols per tightening regulatory requirements.

On the Flipside

- The DEX regulatory landscape remains uncertain, with authorities determined to tackle areas of concern such as tax evasion and financial fraud.

- ThorChain has a history of exploits; the most recent saw 4,000 ETH stolen through a slippage fee bug.

Why This Matters

ThorChain’s recent success may be attributed to the growing demand for decentralized, truly permissionless protocols. If so, this situation highlights further regulatory challenges in that users are resistant to stricter rules.

Find out the latest in the SEC vs. Binance case:

Binance.US Seeks to Prevent SEC from Deposing Top Execs

Read more about the most recent ThorChain exploit here:

THORChain’s Transparency: Staying True to Themselves Despite Losses