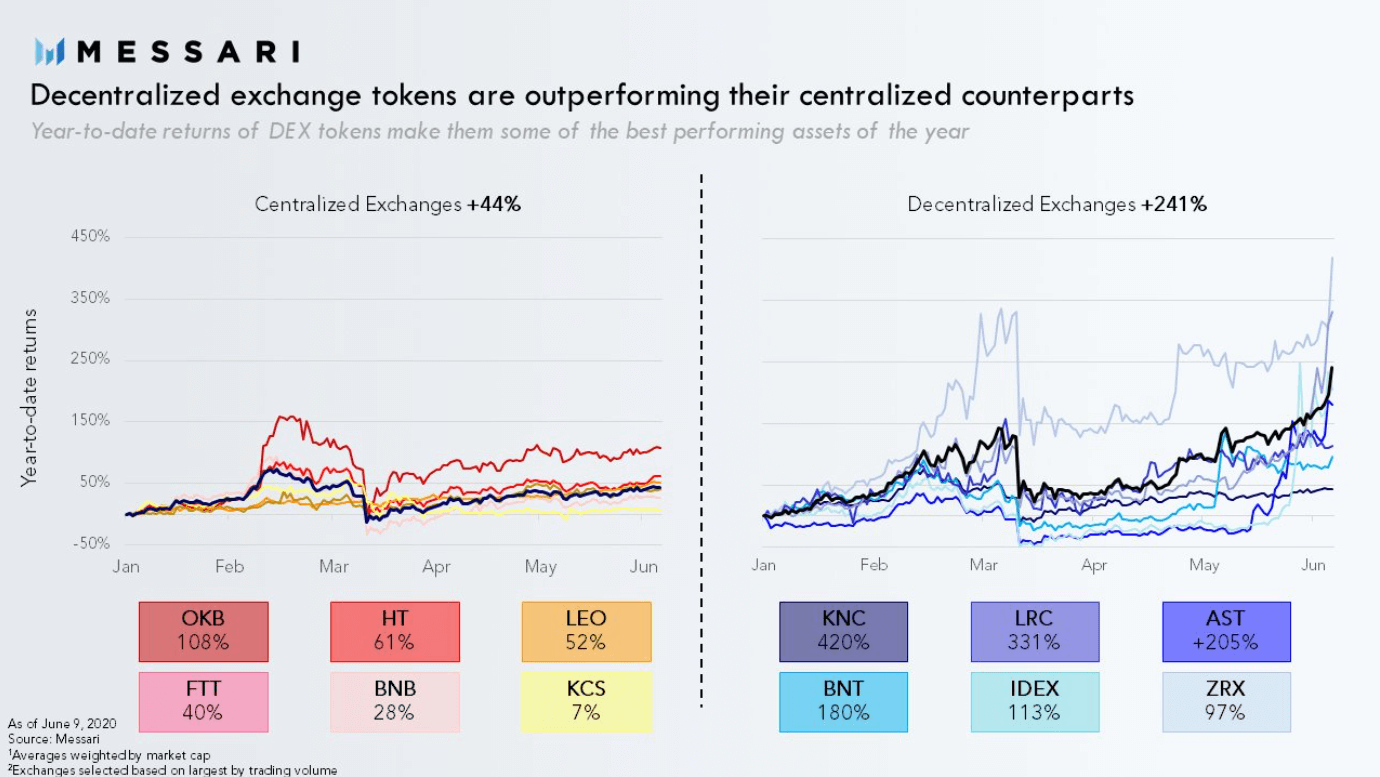

Decentralized exchanges (DEX) generate better results than their counterparts centralized exchanges, shows the latest Messari research.

The tokens of DEX might become one of the best-performing assets of the year, as their year-to-date (YTD) returns exceeded the amount of profit of centralized exchanges by more than 5 times accordingly.

The latest data from crypto analytics Messari reveal that the tokens of decentralized exchanges increased by 241% since the beginning of the year. In the meantime, their competitors – the coins of centralized exchanges generated a growth of 44%.

In the meantime, the best performing DEX token was KyberNetwork (KNC), which accomplished the 420% profit from the investments since the first day of the year. The token of Loopring (LRC) DEX came next in the line and generated over 330% growth, while AirSwap (AST) continued with a 205% increase.

Whereas the centralized exchanges generated lower results, where the best performing OKB, the native cryptocurrency token of the OKEx platform, reached 108% YTD return growth. The second in a row Huobi Token (HT) increased by 61% within the same time.

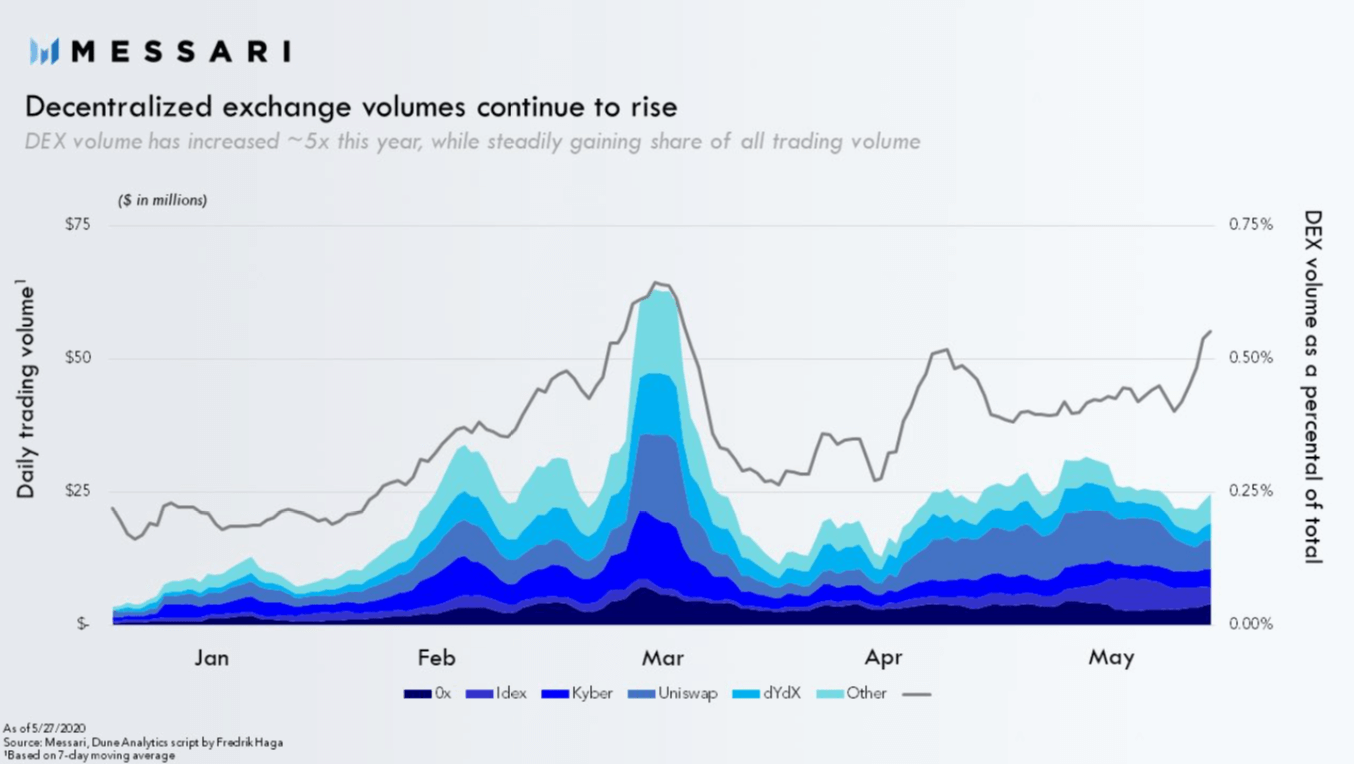

DEX volumes continue to rise

The data of Messari illustrate that the volumes of decentralized exchanges are constantly rising as well. According to statistics, the DEX average daily trading volume increased around 5 times since the beginning of the year.

Although the decentralized exchanges started the year with an average trading volume of around $5 million, the current level sits at around $25 million. Meanwhile, during the mid-March market crash, the DEX average trading volume peaked to the all-time-high and approached $60 million.

Sponsored

The growth as well has increased the share of DEX trading volume up to 0.25% in an overall trading volume.

Since DEXes are gaining a larger share of the general trading volume, Messari analytics predict that the exchanges that are run through the blockchain will be implementing major upgrades in the future in order to deprive bigger share of centralized exchanges that are run by the companies.

According to the tweet of Messari’s research analyst Jack Purdy, the critical upgrades of the protocol should include “radically altered token economics” as well as “scalability upgrades”:

Centralized exchanges are burning tokens

Despite the fact that DEXes are growing their share in overall trading volume, they still have a long way to go to reach the profits of centralized exchanges.

In the meantime, the centralized exchanges are taking record amounts of their native tokens off the circulation. As Messari’s statistics reveal, the centralized exchanges burned $127 million tokens within the first quarter of 2020. The data does not include Huobi’s token burning when approximately $700 worth of HT tokens were burned.

The token burning is mainly executed in order to reduce the total supply of coins and thus fuel the demand, which later boosts the growth of the asset price.