- Tether USDT’s market cap tops close to $90 billion.

- Market participants are confident in USDT.

- Tether has been at the forefront of blockchain initiatives this year.

The crypto market is heating up after a brutal, drawn-out winter period. Despite recent shocks like the Department of Justice investigation into Binance, Bitcoin held critical support at $35.6k, trading volumes are bouncing back, and the Fear and Greed index has inched into greed territory.

Sponsored

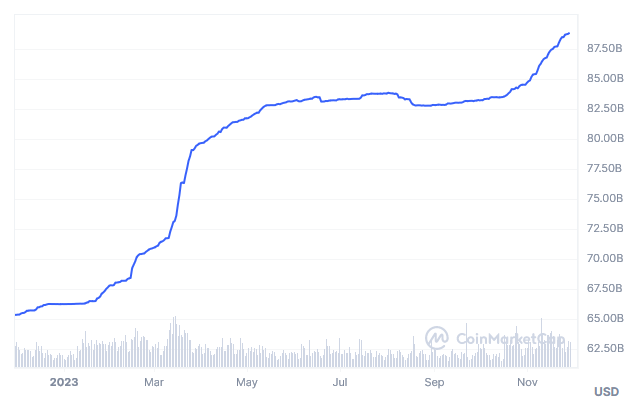

Tether’s USDT stablecoin recently achieved a new all-time high market cap of $88.9 billion, further signaling a thaw in the crypto winter, demonstrating growing confidence in the staying power of cryptocurrency and expected market movements as we head into the next cycle phase.

Tether USDT Market Cap

In a sign of growing crypto market confidence, USDT’s market cap added $860 million, moving to an all-time high of $88.9 billion over the past week. Commenting on the move, Tether CTO Paolo Ardoino tweeted the number of circulating USDT tokens at the time of the tweet with no accompanying text.

USDT has had a stellar 2023 to date. It opened the year with a market cap of $66.24 billion, which rose sharply until the March lull due to the fallout from the US banking crisis. However, USDT’s market cap began increasing by mid-August, leading to a significant uptrend by October.

Tether’s market growth can be attributed to its commitment to greater transparency. To verify its solvency, Tether continues to publish audited quarterly reserve reports. The latest Q3 report shows that Tether’s assets exceeded its liabilities by $3.2 billion. The company added Bitcoin as a treasury asset in May to diversify its reserve holdings and participate in expected price appreciation.

As well as striving to enhance transparency, Tether is at the forefront of multiple initiatives to catalyze real-world change using blockchain technology.

Driving Innovation Forward

Tether has been a key player in driving blockchain technology forward in 2023. The company has partnered with the Georgia government to develop the country as a blockchain hub. This partnership includes nurturing startups to foster innovation and technology in the region. By doing so, Tether aims to create a thriving environment for peer-to-peer technology usage.

Sponsored

Keen to engage with AI, Tether has partnered with mining firm Northern Data to support AI startups. The investment will see Northern Data rent cloud access to thousands of specialized chips to AI startups. Tether’s move into AI through Northern Data signals interest in diversifying into new sectors.

On the Flipside

- The market cap of rival stablecoin USDC has fallen $240 million since November 26.

- USDT holds approximately 70% dominance of the stablecoin market.

- Despite transparency efforts, critics contend that Tether would be unable to meet its liabilities if all USDT tokens were redeemed simultaneously.

Why This Matters

Tether’s USDT token crossing the $88.9 billion market cap threshold signals growing faith in blockchain technology. As the blockchain industry continues making inroads into the legacy system, awareness of blockchain’s vast transformative potential will spread further.

Learn more about Tether’s growing dominance of the stablecoin market here:

Tether’s Stranglehold Grows as Market Share Climbs to 72%

Find out why critics have turned on Hong Kong’s financial watchdog here:

SFC Under Fire for Inadequate Response to Hounax Scandal