- Do Kwon’s Terraform Labs has filed for Chapter 11 bankruptcy with a U.S. court.

- Terraform Labs was recently granted a trial rescheduling request.

- Do Kwon is currently serving time in Montenegro, pending his extradition.

Almost two years after the collapse of stablecoin TerraUSD, efforts to hold disgraced crypto mogul Do Kwon and Terraform Labs to account have gained momentum. Following numerous hurdles and legal setbacks, the Securities and Exchange Commission (SEC) is edging closer to bringing Do Kwon and Terra to justice, securing a trial in its civil case against both parties.

As the trial date approaches, the defendants take maneuvers to address the charges and potential repercussions.

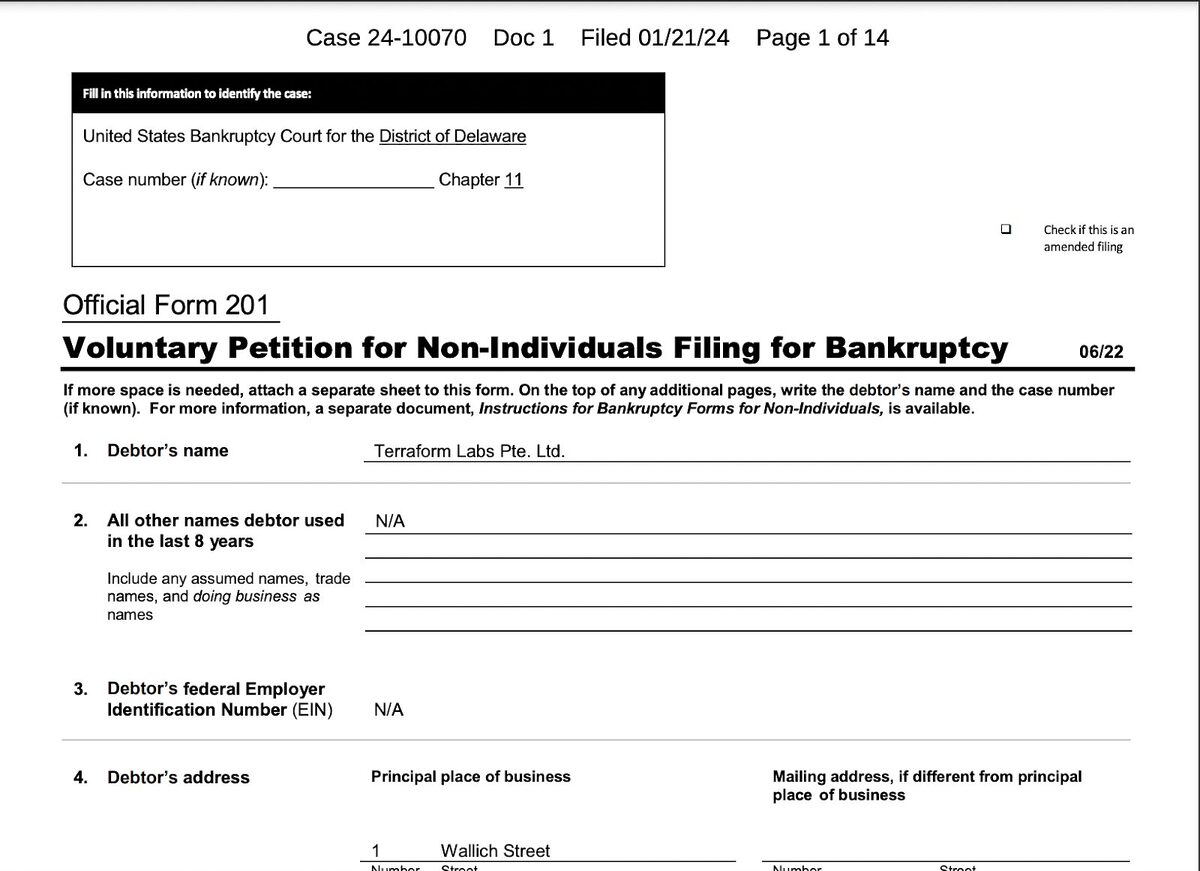

Do Kwon’s Terraform Labs Files for Bankruptcy

On January 21, Terraform Labs filed a voluntary Chapter 11 bankruptcy protection for its defunct TerraUSD in the United States Bankruptcy Court for the District of Delaware.

Sponsored

Terraform declared its assets in the filing, estimating their value to fall within $100 to $500 million. The firm acknowledged a corresponding amount in liabilities, asserting that these would be settled amid the bankruptcy proceedings without requiring additional financing.

The court document listed a 15-person creditor list, which included American software company Cloudflare and New York-based TQ Ventures. Do Kwon was listed as the 92% shareholder of Singapore-based Terraform Labs, and Daniel Shin for the remaining 8%.

In a statement, Terraform Labs CEO Chris Armani stated that the filing will allow the firm to resolve its ongoing legal challenges. “We have overcome significant challenges before and, against long odds, the ecosystem survived and even grew in new ways post-depeg; we look forward to the successful resolution of the outstanding legal proceedings,” he stated.

Sponsored

Terraform’s bankruptcy move follows the recent court approval for its proposed trial rescheduling date in the ongoing battle with the SEC.

SEC v. Terraform Labs

The Securities and Exchange Commission has recently turned up the heat on Do Kwon for his involvement in the market manipulation and the “multi-billion dollar” crypto asset securities fraud that led to the 2022 Terra collapse.

Year-long efforts to bring Kwon to justice faced obstacles due to the disgraced founder’s maneuvers, resulting in the need for extradition proceedings from Montenegro following his arrest and conviction for document forgery.

The lobby for Kwon’s extradition by his homeland South Korea and Singapore also posed additional challenges before the United States scored a win in claims that Terraform Labs sold unregistered securities, securing a trial date.

The trial date for Do Kwon, Terraform Labs, and the SEC is March 25, 2024, where alleged claims will be adjudicated in the U.S. District Court under Judge Jed Rakoff and a jury. If convicted, Kwon faces a potential sentence of 40 years behind bars.

On the Flipside

- While the bankruptcy filing by Terraform may influence the course of its legal proceedings, it does not provide immunity to the company or Do Kwon regarding potential repercussions for alleged misconduct or fraud.

- Expert predictions have raised the potential for Do Kwon to face multiple years in prison in both South Korea and the United States.

- Terraform Labs had previously attributed the collapse of UST to Citadel Securities, asserting that the depeg was not merely an algorithmic failure.

Why This Matters

The collapse of TerraUSD soiled the cryptocurrency industry, resulting in staggering losses exceeding $40 billion. As the call for accountability intensifies, Terraform Labs’ decision to file for Chapter 11 bankruptcy introduces a structured pathway for potentially recuperating investor losses.

Read more on the lawsuit against Cristiano Ronaldo for his involvement with Binance:

Here’s Why Ronaldo’s $1B Binance Lawsuit Is Getting Intense

Crypto exchange HTX suffered a time-out following a cyberattack; read more:

Justin Sun’s HTX Resumes Operations Following DDoS Attack