The stablecoin market has been experiencing turbulence since the beginning of the year, and it appears to be on a downward trajectory.

Recently, Binance’s legal executive threw a curveball by mentioning the potential delisting of stablecoins when MiCA regulations are enacted in the European Union next summer.

What’s happening in the stablecoin market, and how is it preparing to address the upcoming challenges?

Stablecoins Lose Market Dominance

Stablecoins play a pivotal role in the cryptocurrency market. With their value pegged to traditional assets or currencies, they serve as a safe haven during market volatility and allow users to quickly move funds in and out of digital assets without exiting the market.

Sponsored

This is why stable-value coins make up a substantial share of trading volumes on crypto exchanges. Their increasing share on trading platforms often signals an approaching bull market, as traders tend to keep stablecoins ready to enter quickly when they anticipate a market upturn. But, it seems, not this time.

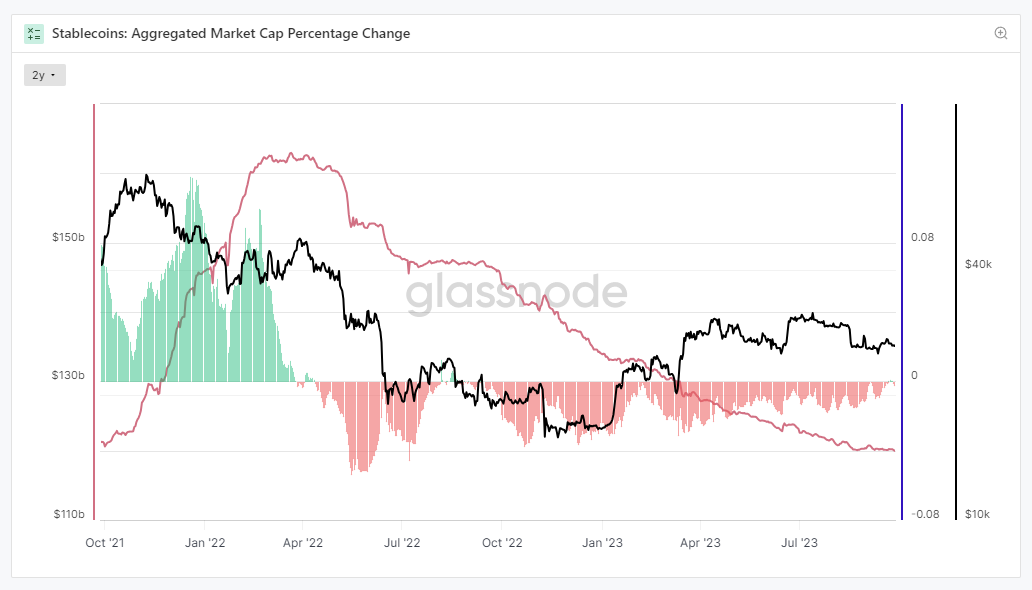

For nearly 18 consecutive months, the overall value of the stablecoin market has been steadily declining. Since April 2022, the stablecoin market capitalization has plummeted by 25%, sliding from $162 billion to slightly under $120 billion as of publication.

The market value of stablecoins on the Ethereum blockchain contracted by a staggering 28% during this period. Tron was the sole blockchain network showing upward trends, as its stablecoin market grew by 28%, according to Defillama’s data.

Sponsored

Decreasing market capitalization occurs due to the decreasing stablecoin supply in circulation, which indicates redemption. Additionally, declining market value reflects a decrease in stablecoin market dominance. This measure shows how much of a particular coin’s total cryptocurrency market occupies.

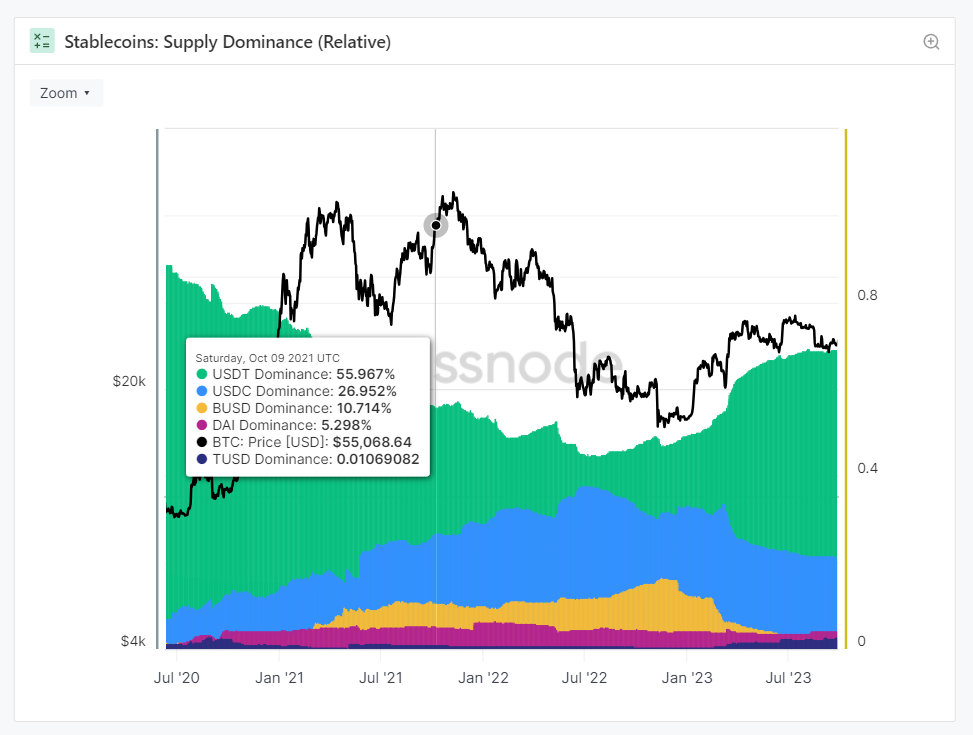

Here, we see the large stablecoins like USD Coin (USDC) and Binance USD (BUSD) consistently losing their market share.

As per Glassnode, USDC supply dominance has decreased by 14% since the beginning of summer 2022 and currently stands at 21%. Meanwhile, the influence of the Binance USD (BUSD) has dwindled from its peak of 16% last November to less than 2% today.

On the contrary, Tether’s (USDT) dominance has increased significantly by nearly 20%, reaching 68% since last summer.

New Trends and Depegs to Blame

There are various reasons why the stablecoin share within the overall crypto market is waning.

First and foremost, the general interest in digital currencies shrank during the continuous bear market. Since last April, total spot trading volumes fell by 43% on crypto exchanges. The crypto market shrunk by half, down to $1 trillion, as value has shifted away, to a large extent, to more hyped sectors like Artificial Intelligence (AI).

Besides the macro factors, internal issues also contributed to the declining dominance of stable digital coins. Major players lost their stable value at some point during the past year.

“The main rationale behind the 18-month decline can be attributed to shifts in trust toward stablecoin projects following the depegging events of a few larger stablecoins,” Jean-Baptiste Graftieaux, Global CEO of Bitstamp crypto exchange, told DailyCoin.

In the spring, dollar-pegged USDC experienced a drop to $0.87 as $3.3 billion of Circle’s cash reserves, which back the stablecoin, were frozen at Silicon Valley Bank.

Meanwhile, Tether (USDT) faced several depegging events starting in mid-June, driven by imbalances within Curve’s liquidity pool. The third-largest decentralized exchange (DEX) held significant amounts of USDT stablecoins.

Finally, another critical factor affecting stablecoin dominance is the forthcoming cryptocurrency regulation in the European Union (EU) market.

Fears of Upcoming MiCA

The Markets in Crypto-Assets Act (MiCA) is a landmark regulatory framework for crypto assets scheduled to take effect in the EU in June 2024. As part of the EU’s efforts to tighten crypto market regulation, MiCA will introduce new rules encompassing stablecoins issuers.

In other words, MiCA will prohibit algorithm-based stablecoins in the EU and require a 1:1 liquid reserve for fiat-backed stablecoins. It will also require stablecoin issuers to become regulated as Electronic Money Institutions (EMI) in the EU.

EMIs are subject to strict regulations to safeguard consumers, ensure service security, and maintain the integrity of electronic money operations, typically involving Anti-Money-Laundering (AML) and Know-Your-Customer (KYC) procedures, capital reserves, and regular audits.

Therefore, the availability of stablecoins in the EU might be significantly impacted after the MiCA regulations come into force, claims Bitstamp’s leader.

“This is going to be a hard ask for many, particularly those based outside the EU. If the issuer isn’t authorized, then crypto exchanges in the EU may need to delist stablecoins, so there is likely to be significant disruption in the EU market as a result.”

A few days ago, Binance’s Legal Executive, Marina Parthuisot, hinted that the world’s largest crypto exchange is planning to delist stablecoins for its EU customers on June 30, 2024.

As Binance clarified later, the delisting option stemmed from the fact that none of the stablecoin issuers currently have an EMI license in the EU.

“While we are confident that there will be a constructive solution in place before the mid-2024 deadline if left as is, this could have an impact on the European crypto market and the competitiveness of European crypto exchanges in a global market,” stated Binance’s official announcement.

If the worst-case scenario unfolds, it would mean that the EU market would tighten its grip on stablecoins like Tether, whose banking secrecy has raised significant concerns regarding whether the reserves backing over $83.2 billion worth of USDT are fully secured.

What to Expect from the Post-MiCA Era

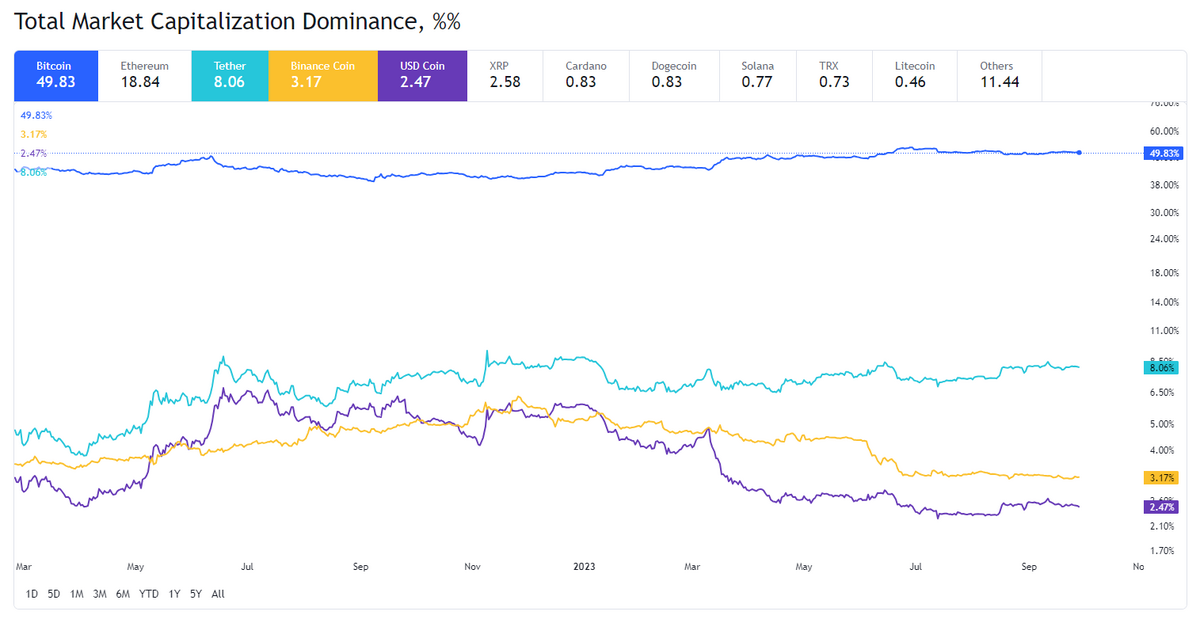

Despite decreased capitalization, stablecoins constitute approximately 15% of the crypto market today.

Meanwhile, Europe is the fifth-largest region worldwide regarding cryptocurrency users, with 31 million. Ahead of it in the rankings are Asia (260 million), North America (54 million), Africa (38 million), and South America (33 million).

While no precise figures are available, not all European countries are part of the EU, which suggests that this user count is likely even lower.

Nevertheless, in popular crypto exchanges in Europe, the distribution of stablecoins varies. For instance, KuCoin says stablecoins are involved in 19 of the top 20 most popular spot trading pairs, accounting for 56.34% of the total trading volume. USDT and USDC alone have comprised 39.74% of the exchange’s token allocation.

In the meantime, Bitstamp reports that a year-to-date average of crypto transactions involving stablecoins represents only 14%.

However, even if the regulations will affect stablecoins within the EU, it’s unlikely that the markets outside the bloc will be affected, so we will still see the market in stablecoins maintaining liquidity globally, believes Jean-Baptiste Graftieaux.

“Our prediction is that the stablecoin market as a whole will not be impacted when MiCA regulations are introduced, but there's a real possibility it could slightly move away from the EU.”

According to him, through consistent and predictable standards, MiCA will, in the end, establish a unified and well-governed cryptocurrency market encompassing stablecoins.

“This added stability will enable additional innovation in the cryptocurrency markets, consistency in regulatory approach and protect investors and market integrity.”

Find out what the crypto market needs for the bull run:

ETFs Aren’t Enough for a Crypto Bull Market. What Else Do We Need?

Learn more about EU’s MiCA regulations:

EU’s MiCA Crypto Regulations: What You Need To Know