- Bitcoin ETFs have been scooping up massive chunks of the available Bitcoin.

- These investment vehicles have been shaking up the trading scene, influencing overall market liquidity.

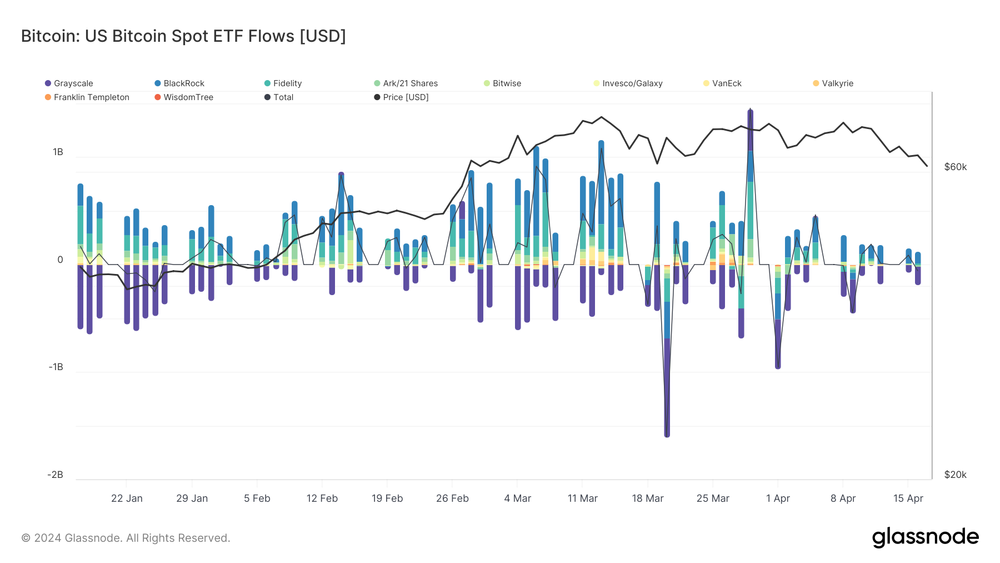

- Investor behavior through ETFs has been leaving a trail, with outflows linked to price dips.

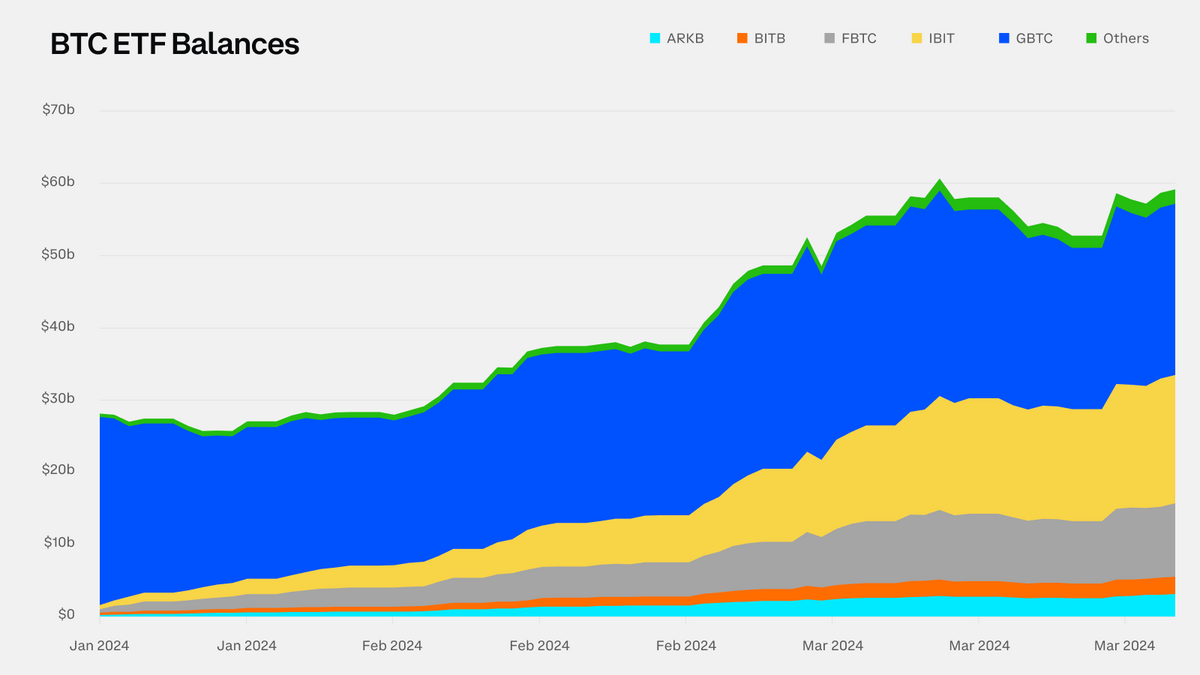

The cryptocurrency market is witnessing a surge of involvement from traditional finance, with Bitcoin exchange-traded funds (ETFs) playing a pivotal role. A recent report by Coinbase and Glassnode reveals a growing concentration of Bitcoin (BTC) holdings within ETFs, currently accounting for a significant 4.3% of the total circulating supply.

How Bitcoin ETFs Affect Supply and Demand

Beyond simply reflecting investor interest, Bitcoin ETFs are demonstrably impacting market dynamics. Their presence directly influences the supply-demand equation for Bitcoin. By holding a substantial amount of the cryptocurrency, ETFs effectively reduce its availability in the open market. This, in turn, could contribute to upward pressure on Bitcoin’s price.

Furthermore, spot Bitcoin ETFs, which directly hold the underlying cryptocurrency, are emerging as significant players in the trading arena. Their participation adds considerably to the overall spot trading volume on centralized exchanges. This increased liquidity not only benefits market efficiency but also establishes new benchmarks for trading activity.

The interplay between ETF inflows and outflows is another crucial factor to consider. The report highlights a notable correlation between significant ETF outflows and price declines. This suggests that investors utilizing these vehicles may exhibit reactive behavior during periods of market volatility.

Bitcoin ETFs Cool Down After Initial Surge

This translates to roughly 851,000 BTC under the collective management of these investment vehicles. The initial launch of Bitcoin ETFs in January 2024 was met with enthusiastic investor participation. Weekly inflows soared, reaching highs of $2.5 billion, signifying a strong appetite for exposure to the leading cryptocurrency through a familiar and regulated format.

However, this fervor appears to have moderated since late March, with inflows settling into a range between $1.2 billion and $2 billion. This shift could indicate a stabilization in investor sentiment or a potential change in their strategies.

Recognizing this pattern can be instrumental in interpreting broader market movements. The arrival of Bitcoin ETFs marked a watershed moment for the cryptocurrency space. Wall Street’s embrace of this asset class through regulated investment products signifies a fundamental shift in the market’s maturity and mainstream acceptance.

Sponsored

As ETFs continue to grow in prominence, investors are advised to remain vigilant, closely monitoring ETF activity and strategically adapting their approaches to capitalize on this evolving landscape.

On the Flipside

- While ETFs offer easy access, a large portion of Bitcoin being held in a few ETFs creates a concentration risk. If one ETF encounters issues, it could disproportionately impact the market.

- Many investors remain wary of the inherent volatility and security risks associated with Bitcoin itself, regardless of the ETF structure.

Why This Matters

The rising influence of Bitcoin ETFs goes beyond investor interest alone. By reducing available Bitcoin and increasing trading volume, they are actively shaping market dynamics. This newfound correlation between ETF activity and price movements necessitates a shift in investor strategy.

Grayscale’s GBTC and BlackRock’s IBIT are in a heated competition. IBIT has been gaining market share due to lower fees. Will IBIT overtake GBTC? Read more to find out:

Bitcoin ETF Inflows Drop Pre-Halving: IBIT Closes Gap with GBTC

Bitcoin is on the rise again after a dip caused by recent geopolitical tensions. Will Bitcoin surge after the halving, or will it continue to decline? Read what analysts have to say:

BTC Eyes $65K Rebound Post 2nd Dip In Iran-Israel Tensions