- Solana’s dog-encrusted BONK fetches 14.5% gains as Bitcoin breaches $47K.

- BONK Derivatives trading witnessed a $25.9M influx as $126K shorts got Rekt.

- Despite the upswing, pending sell orders for BONK still outweigh pending buys.

BONK, the third largest dog-themed memecoin in the crypto galaxy, seems to have awakened from a lethargic sleep. Trading in a descending parallel channel since the beginning of February, Bonk is now approaching the TOP 100 by crypto global market capitalization. Whipping up 14.5% gains in the last 24 hours, it is now at #101.

The bullish crossover for BONK comes as crypto enthusiasts are cheering for Bitcoin (BTC). The king crypto not only managed to shake off the curse of Grayscale’s investors exiting their positions but also whipped up 6% gains on Friday to scorch above $47,000, reclaiming the levels of March 2022.

Delving deeper into the mechanics behind BONK’s bull run on Friday, it’s evident that BONK has a high correlation with the parent token Solana (SOL), as the orange dog-embossed crypto was launched on Solana Layer-1 on Christmas Day 2022. However, the high price correlation isn’t the only catalyst for BONK’s breakthrough.

BONK Back in the Limelight as Open Interest Soars 140.20%

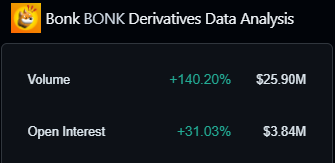

Besides the market-wide factors, the legendary Solana savior BONK embarked on a parabolic journey in Derivatives trading. While the long versus short positions remain at an almost-perfect balance of 0.9968 in the last 24 hours, the Open Interest rate (OI) skyrocketed by 140.20%, netting $25.9 million in trading volume over the past 24 hours.

This metric is crucial to understanding the speed of BONK’s adoption by major crypto exchanges and the investor sentiment dwelling around the dog-themed memecoin, according to the real-time on-chain data by crypto derivatives analysis platform CoinGlass, liquidations related to short positions summed up to $126.87K in the last 24-hour period, outweighing the liquidated long positions by nearly three times.

However, it might be too early to determine if the switch in investor sentiment holds, as memecoins tend to go through a more severe market correction than altcoins. At press time, Solana’s BONK is exchanging hands at $0.00001169, according to CoinGecko. With the 14.5% daily increase, BONK is still licking its wounds after a month of gradual market correction, highlighting a 17.8% deficit in the last 30 days.

On the Flipside

- According to the combined order book provided by CoinPaprika, pending sales for BONK still prevail over pending buys.

- This hints at mounting selling pressure, as many BONK holders attempt to take profits at the current price range.

Why This Matters

Solana’s BONK is one of the top-performing altcoins based on yearly performance, with a gigantic increase of 1253% in the last 365 days.

Sponsored

Explore DailyCoin’s trending cryptocurrency news:

Ethereum Dencun Upgrade Nears Launch, Developers Target March

Polkadot NFT Mint Breaks Records, Surpasses Solana, Polygon