- Shiba Inu (SHIB) continues the course of extended monthly deficits.

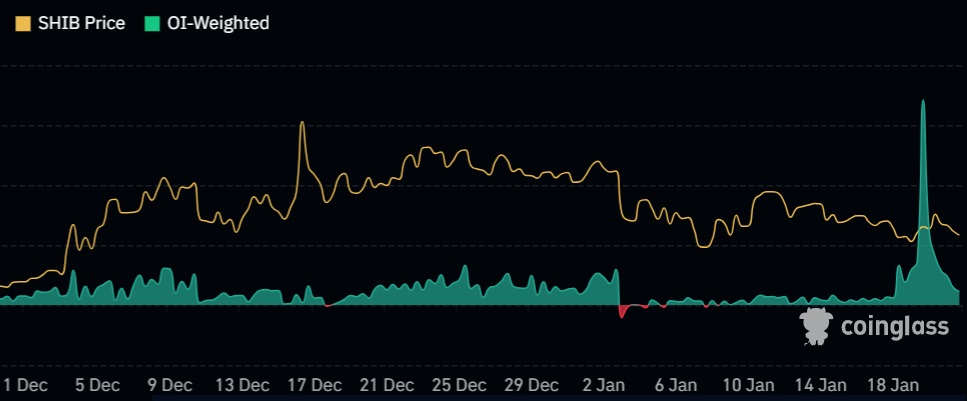

- Coinglass data shows a tremendous Open Interest (OI) spike for SHIB.

- SHIB community reacts to plummeting SHIB price with a 262% hike in burns.

Shiba Inu has made waves in the crypto derivatives sector over the weekend, as SHIB’s Open Interest (OI) hit $18 million. As a result, the Open Interest-weighted funding rate claimed a yearly high on January 20, 2024, as the canine coin hovered around the $0.00000940 price range.

According to the blockchain analytics platform Coinglass, OKX exchange takes the lion’s share of Shiba Inu Derivatives trade with $7.5M in Open Interest, while Huobi and Bitget encompass $5.04M and $3.35M, respectively. The overall long vs. short position ratio is 1.9753, while OKX customers seem even more bullish on SHIB with a 2.02 long vs. short ratio.

The hike in Shiba Inu perpetual trades on top centralized platforms has momentarily boosted SHIB’s price to $0.00000969. Still, the confluent resistance barrier rejected SHIB below the price range for the fifth time in seven days.

Bears Tighten Their Grip on Shiba Inu

The on-chain data gathered by Coinglass affirmed Shiba Inu’s status as a long-term investment to many crypto holders using centralized platforms (CeFi). However, SHIB’s latest price movement comes amid a market-wide pullback, as the global market cap lost 3.5% of its value in the last 24 hours.

Sponsored

As SHIB grapples with the key support level at $0.000009, the crypto bears have already squeezed Shiba Inu into a 19% monthly deficit. An additional 5.3% drop on Monday and a shortfall below the aforementioned price range raised concerns among investors, who sent over 50M of SHIB tokens to burning addresses over the last 24 hours. Consequently, SHIB burn tracker Shibburn reported a 262% daily upswing in SHIB burns, but with no immediate effect on the canine coin’s market value.

On The Flipside

- Shiba Inu burns in the millions rarely tend to reflect on the coin’s price.

- SHIB Derivatives trading dropped in volume by 14.56% in the last 24 hours.

Why This Matters

The Open Interest-based funding rates allude to the popularity and investor sentiment of the cryptocurrency.

Sponsored

Explore DailyCoin’s latest crypto news:

Binance Teases ‘Significant’ Multi-Chain Token Burn

BlackRock Rejects XRP ETF Noise: Focusing on Bitcoin for Now