- Ripple will face a potential $2 billion fine if the SEC succeeds in classifying XRP as a security.

- Both parties could still choose to settle, avoiding a definitive ruling on XRP’s status.

- The court has not yet determined the verdict, and the final judgment could be significantly different.

The long-running legal battle between the Securities and Exchange Commission (SEC) and Ripple Labs appears to be nearing its conclusion. The case concerns whether XRP, Ripple’s native token, constitutes an unregistered security.

SEC Seeks $2 Billion from Ripple

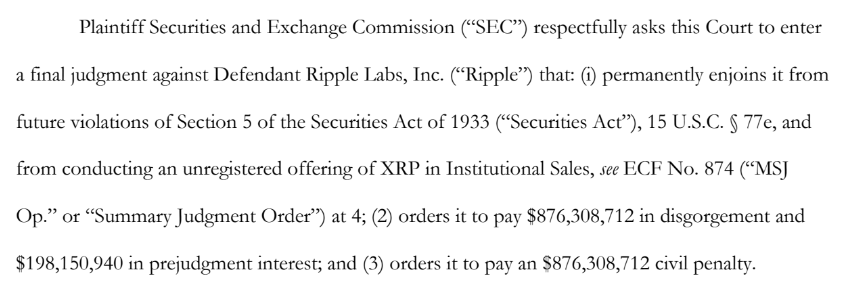

The SEC levied charges against Ripple in December 2020, alleging the company raised over $1.3 Billion through the unregistered sale of XRP tokens.

A recent filing by the SEC in the remedies stage seeking disgorgement of $876 Million, which they believe represents Ripple’s net profits from the unregistered sales along with prejudgment interest and a civil penalty, brings the total requested in remedies to nearly $2 Billion.

Ripple maintains that XRP is a utility token and not a security, and therefore, it is exempt from SEC registration. They argue that their sales to institutional investors caused no harm and that the SEC’s accusations stifle innovation in cryptocurrency.

Ripple’s CLO has stated that their response to the SEC’s filing will be submitted next month and has asserted that the SEC’s statements are false, mischaracterized, and designed to mislead.

What’s at Stake?

For Ripple, a loss in court could have significant repercussions. A hefty fine would undoubtedly impact their finances, but more importantly, a ruling classifying XRP as a security would subject Ripple to stricter regulations and potentially hinder XRP’s adoption and use case.

Sponsored

While a resolution appears imminent, the final ruling and any imposed penalties remain to be seen. The court could decide in favor of either party or even settle. Here are some possibilities:

- Ripple Wins: If the court favors Ripple, it would be a significant blow to the SEC’s efforts to regulate the cryptocurrency industry.

- SEC Wins: A win for the SEC would establish a precedent for future enforcement actions against ICOs and token sales. The $2 Billion fine could be imposed, though the final amount may be less.

- Settlement: Both parties could reach a settlement agreement, potentially involving a financial penalty but avoiding a definitive classification of XRP as a security.

The $2 billion figure being circulated represents the SEC’s claim, not a predetermined penalty by the court. The verdict is yet to be determined, and the final judgment could be significantly less or even entirely removed, depending on the court’s decision.

On the Flipside

- Even with a court decision, a lengthy appeals process could delay any final resolution for Ripple and the crypto industry.

- The $2 billion fine isn’t the final judgment for Ripple; they still need to file their response, and the judge will make the final decision.

- XRP community members argue that the SEC’s $2B damages claim appears excessive, considering Ripple’s $15B market cap loss at the time of the lawsuit’s filing. They assert the SEC should be accountable for investors’ losses due to its approach.

Why This Matters

This lawsuit sets a potential precedent for how the SEC regulates cryptocurrency tokens. A clear ruling will impact Ripple, XRP, and other companies dealing with token sales, influencing how they structure their offerings and potentially affecting the overall adoption of cryptocurrencies.

To learn more about the SEC’s reasoning behind the fine and Ripple’s defense, read this article:

Ripple CEO Blasts SEC Fine: Proposed $2B Is “Outside of Law”

Wondering what’s next in the SEC’s lawsuit against Ripple Labs? This article explores what to expect in the upcoming remedies brief battle: