- SEC proposes fine against Ripple as year-long legal saga intensifies.

- The SEC has proposed a billion-dollar fine for Ripple as judgment bears.

- Ripple Executives have slammed the commission for its overreach under Chair Gary Gensler.

The legal tussle between Ripple Labs and the Securities and Exchange Commission (SEC) has lasted for several years, marked by debates over the alleged sales of unregistered securities and violations of US regulations. Recently, both parties outlined a structured approach to sealing and redacting court documents related to the upcoming resolution phase of the case in an effort to end the long-running battle.

However, the SEC’s recent filing of a remedies-related brief has stirred controversy.

Will Ripple Get a $2B SEC Fine?

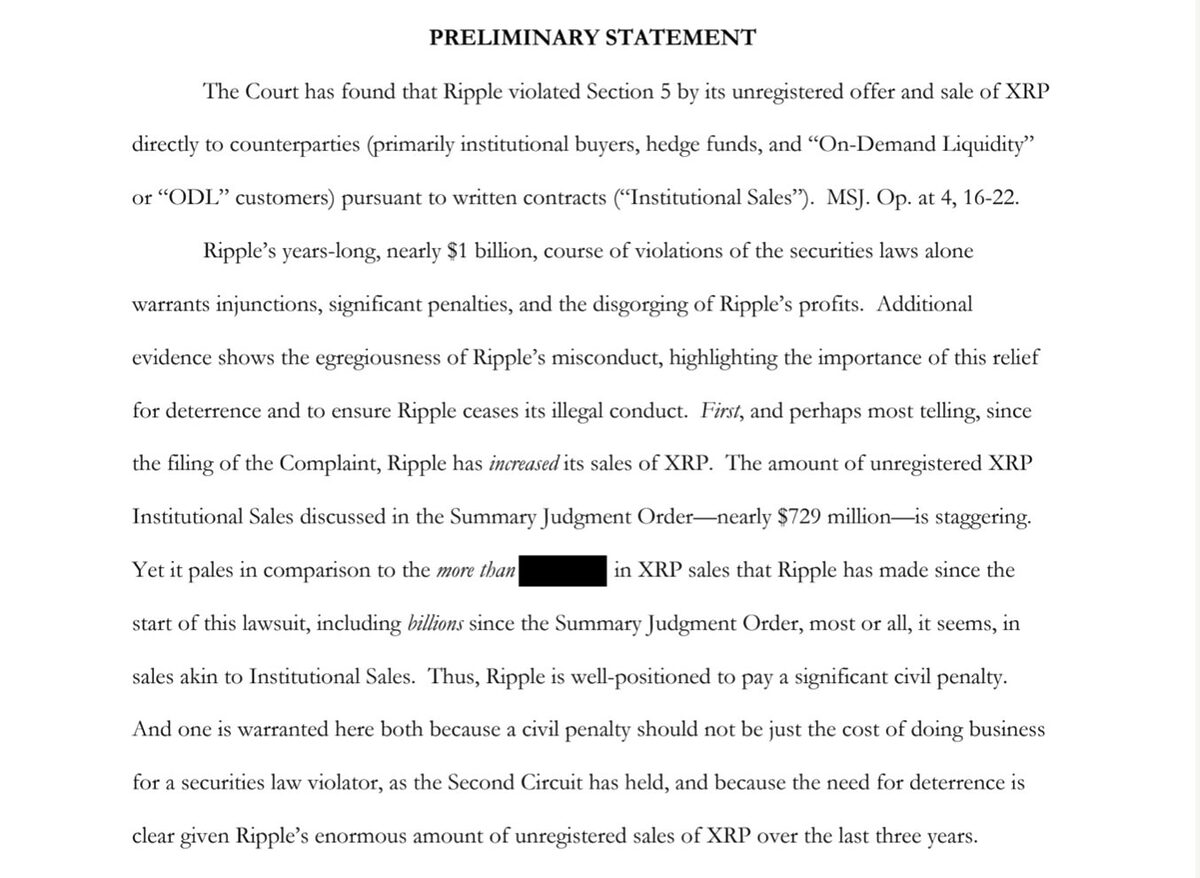

According to court documents unsealed on Tuesday, March 26, the SEC has urged US District Judge Analisa Torres to approve a proposed $2 billion fine against Ripple Labs in the ongoing legal dispute over XRP.

Sponsored

The proposed penalty comprises $876 million in disgorgement, $876 million in civil penalty, and $198 million in prejudgment interest, amounting to $1.95 billion.

Asserting the rationale behind the fine, the SEC stated that Ripple, for several years, prioritized financial gain over regulatory compliance and promoted investments to institutional investors without legal disclosure. The commission emphasized that the hefty $2 billion fine is mandatory to compel Ripple to adhere to regulations, and send a firm message to the crypto industry that similar misconduct will not be tolerated.

“Only a significant sanction from this court and the return of the ill-gotten gains Ripple made from its violations will cause Ripple to correct its conduct, either by registering its securities sales and making the disclosures required, or not selling securities,” the document read.

The SEC added that while Ripple may argue against violations in its post-complaint sales, the unchanged status and business activities of the company pose a risk for future violations, necessitating penalties to prevent reoccurrence. However, the fine has drawn the ire of Ripple executives, who condemned the commission’s actions as an overstep of authority.

Ripple CEO Slams SEC Fine

In a recent tweet, Ripple Labs CEO Brad Garlinghouse decried the commission’s proposal as an overreach, emphasizing its excessive nature in a case that “includes no allegations of fraud or recklessness.”

Sponsored

Garlinghouse asserted that the commission’s actions are “outside of the law,” with no legal precedent, and reiterated the commission’s broader questionable approach to the crypto industry.

The SEC’s recent string of errors under Chair Gray Gensler was also a focal point of argument. Emphasizing the commission’s conduct in controversial cases like DebtBox and the neglect of SBF’s fraud, the Ripple CEO asserted that the SEC’s actions have consistently reflected a lack of faithful allegiance to the law and its “gross abuse of power.”

Ripple CLO Stuart Aldertoty echoed Garlinghouse’s sentiments. Aldertoty condemned the commission’s actions as an attempt to “punish and intimidate” the firm and asserted that a response to the proposal will be filed in the coming month.

On the Flipside

- The SEC’s $2 billion proposal has drawn criticism across the crypto community as excessive and unwarranted.

- While damning, the $2 billion fine could mark the start of a resolution for both the SEC and Ripple Labs and mark an end to the legal battle.

- U.S. lawmakers have voiced criticism against SEC Chair Gensler for his unfriendly actions against the crypto industry.

Why This Matters

The whooping SEC fine proposal against Ripple mirrors the commission’s stringent stance against the crypto industry and efforts to scapegoat the firm to set a regulatory precedent. In addition, the executive’s comments signal the unwillingness to yield to the commission’s pressure, and the intensifying battle could further prolong the resolution process

To discover more about the Ripple SEC remedy stage, read here:

What to Expect in the SEC vs. Ripple Remedies Brief Battle

Read about the intensifying Binance Nigeria debacle as detained executive flees: